In a recent tweet, a prominent crypto enthusiast, Levi highlighted a significant development in the legal battle between Ripple and the U.S. Securities and Exchange Commission (SEC).

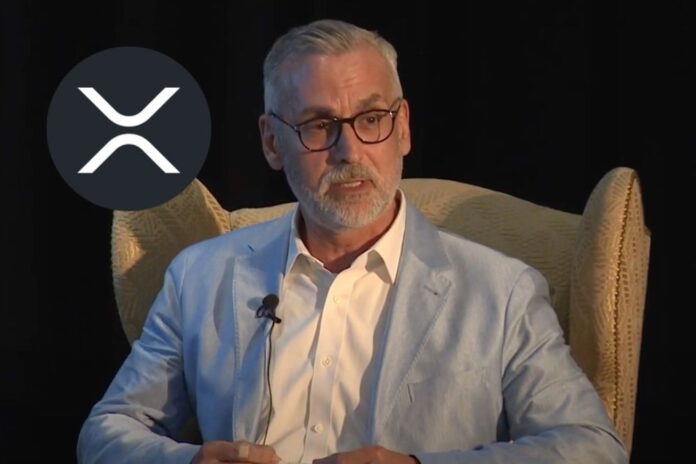

The tweet, which referenced comments made by Ripple’s Chief Legal Officer (CLO) Stuart Alderoty, captured the attention of the crypto community, further intensifying the ongoing debate over the classification of digital assets like XRP.

Alderoty’s comments were featured in a video shared by Levi, where he asserted that the SEC had suffered a substantial defeat in its efforts to prove that XRP is a security. According to Alderoty, the court’s decision has far-reaching implications for Ripple and the broader cryptocurrency industry.

SEC’s Attempt to Classify XRP as a Security

For years, the SEC has been embroiled in a high-profile lawsuit against Ripple, arguing that XRP, the digital asset associated with the company, should be classified as a security. The SEC’s position was that Ripple had conducted an unregistered securities offering by selling XRP to the public.

This case became a focal point for the entire crypto industry, as its outcome was expected to set a precedent for the classification and regulation of other digital assets.

In his remarks, Alderoty emphasized that the court’s ruling effectively dismantled the SEC’s core arguments. He stated, “This administration, with this SEC under this chair, has clearly taken an anti-crypto stance and has engaged in a war on crypto that’s playing out in the courts.”

The court’s decision, as Alderoty noted, rejected the SEC’s attempt to categorize XRP as a security, thereby providing much-needed regulatory clarity.

The Court’s Decision: XRP Is Not a Security

The court’s ruling clarified a critical distinction that has been a point of contention within the crypto industry. According to Alderoty, the court determined that a token, such as XRP, is not inherently a security. This decision echoes previous legal precedents, which have maintained that commodities like gold or other assets cannot be deemed securities on their own.

Alderoty pointed out that while commodities or virtual currencies can be packaged and sold as securities under certain conditions, they are not securities in and of themselves. He stated, “And what the court said is a token is never a security in and of itself, just like a bar of gold is never a security.” This distinction, he argued, is crucial for understanding how digital assets should be regulated.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Implications for the Crypto Industry

The court’s decision in favor of Ripple has significant implications for the broader cryptocurrency industry. By establishing that XRP is not a security, the ruling sets a legal precedent that could influence the classification of other digital assets.

This decision may limit the SEC’s ability to unilaterally classify cryptocurrencies as securities, thus offering greater legal protection and certainty to market participants.

Furthermore, the ruling may encourage innovation within the crypto space by providing companies with a clearer understanding of the regulatory landscape. Without the looming threat of being categorized as securities, digital assets like XRP can continue to operate with greater confidence in their legal status.

This clarity could also attract more institutional investment as investors seek assets with well-defined regulatory frameworks.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News