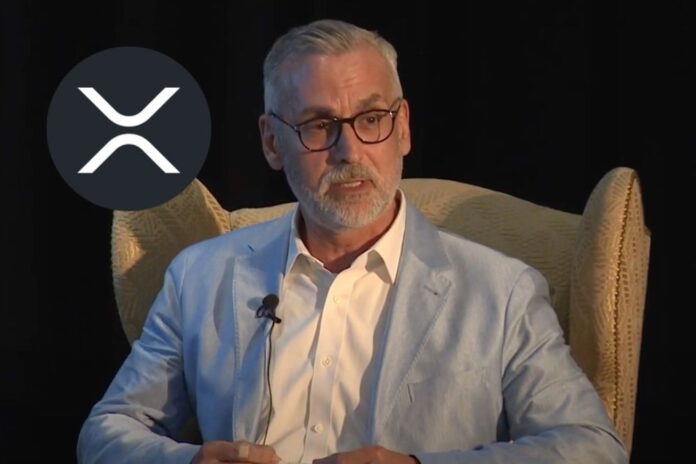

The recent victory of the SEC against TerraForm Labs has caught the attention of the crypto world. Stuart Alderoty, Ripple’s Chief Legal Officer, has voiced his observations, questioning the facts, fairness, and the foundation of the ongoing regulatory battle.

Judge Rakoff’s ruling has labeled UST and LUNA as securities, dealing a significant blow to Terra’s defense. However, the victory is overshadowed by the dismissal of the SEC’s claim of illegal security-based swaps. This leaves the situation uncertain, with Terra’s alleged fraud charges still awaiting resolution.

Read Also: Ripple CLO Reveals XRP Lawsuit Settlement Condition Offered By SEC

Alderoty’s critique adds another layer of complexity. He emphasizes the importance of having solid factual foundations in crypto rulings, suggesting that the SEC may be making accusations without fully understanding the intricacies of digital assets.

He also drew attention to the silence surrounding the Ripple verdict in Terra’s case. Despite the similarities between the two cases, the lack of clarity raises concerns about inconsistencies and potential subjectivity in the legal landscape.

Furthermore, Alderoty questions the motive behind the SEC’s crypto crusade, accusing them of pursuing political power rather than genuinely protecting investors. This accusation shifts the focus to the SEC’s true intentions, leaving investors and industry players wondering about the regulatory landscape’s future.

I have no firm view on the merits of the Terraform case, but here are a couple of thoughts on yesterday’s ruling. 1. Facts matter. 2. Judge Rakoff does not criticize, let alone even cite, Judge Torres’ Ripple ruling; 3. The SEC’s “forever” crypto ground war, fighting token by…

— Stuart Alderoty (@s_alderoty) December 29, 2023

The impact of Terra’s verdict extends beyond the crypto community. The Ripple vs. SEC saga has become a focal point for the entire industry, as its outcome could set a precedent for future regulatory actions. With the SEC emboldened by its victory against Terra, the “security” label could potentially be used to target more tokens.

Regulatory clarity is urgently needed to ensure the growth and development of digital assets. A fair and transparent regulatory framework, based on factual analysis and consistent rules, is essential for the industry to thrive and progress.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Navigating the Fallout from Terra’s Verdict

The consequences of Terra’s verdict extend beyond the legal realm, impacting the broader crypto landscape. The ruling has created uncertainties that could hinder innovation, as startups become cautious under increased regulatory scrutiny.

Exchanges, already entangled in legal battles, may face tighter regulations, potentially affecting token availability. Investors, seeking clarity, may hesitate to invest in the crypto market. Internationally, the ripple effects could lead to a fragmented regulatory landscape, hindering global adoption.

Read Also: Federal Judge Threatens To Sanction the SEC in Crypto Case, Ripple CLO Reacts

Addressing this crossroads requires collective action. Constructive dialogue between industry leaders and regulators is crucial to establish collaborative and well-informed regulation.

Self-regulation, driven by ethical practices and investor protection, can demonstrate the industry’s commitment to responsible growth. Educating policymakers and the public is essential to create a supportive regulatory environment.

The choice is clear: either retreat into uncertainty or rise to the challenge. By embracing collaboration, innovation, and resilience, the crypto industry can shape a brighter future where regulation fosters growth.

Follow us on Twitter, Facebook, Telegram, and Google News