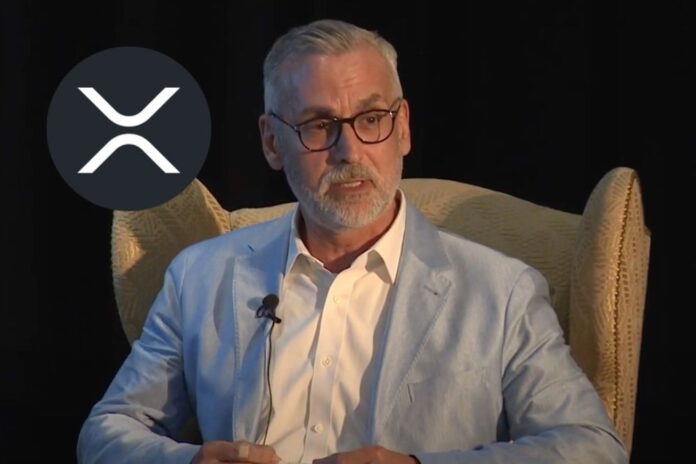

Stuart Alderoty, Chief Legal Officer at Ripple, has provided evidence that counters critics claiming that the Securities and Exchange Commission (SEC) never deemed XRP a security.

In a recent tweet, Alderoty shared a document highlighting how the SEC classified XRP as a security in its complaint against Ripple Labs. According to the document, the SEC argued that Ripple sold XRP as an investment contract.

Read Also: Ripple CTO Analyzes Court’s Rejection of Judge Torres XRP Sales Distinction; Deaton Reacts

The document stated, “At all relevant times during the offering, XRP was an investment contract and therefore a security subject to the registration requirements of the federal securities laws.”

Interestingly, Alderoty mentioned that Judge Analisa Torres ultimately dismissed the SEC’s theory.

Dismissal of Critics’ Claims

Following the SEC v. Ripple ruling last month, discussions within the cryptocurrency community focused on Judge Torres’ decision that XRP itself is not a security.

However, critics argued that Judge Torres should not have commented on the legal status of XRP, claiming that the SEC never labeled the coin as a security.

To counter these claims, Alderoty shared a portion of the SEC’s complaint, revealing how the regulatory agency described XRP as an investment contract.

Pro-XRP Lawyers React

Alderoty’s tweet sparked reactions among pro-XRP lawyers, who shared different documents that supported the SEC’s classification of XRP as a security.

Attorney Deaton responded to Alderoty’s tweet, urging critics to read the SEC’s complaint. In the shared document, the SEC stated, “The nature of XRP itself made it the common thread as Ripple, its management, and all other XRP holders.”

Deaton explained that the SEC implied that the “nature of a software code” like XRP qualifies it as a security.

Similar to Deaton, Attorney Jeremy Hogan shared another document where the SEC’s lawyer argued that XRP remains a security. Nevertheless, the lawyer contended that Section 4 provisions of the Securities Act allow individuals to sell the coin without violating federal securities laws.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Gensler Silent on XRP Ruling Appeal, Says SEC is Still Deliberating on Summary Judgment

Alderoty Criticizes a16z Crypto GC

Meanwhile, Ripple’s Chief Legal Officer criticized Miles Jennings, the General Counsel at a16z Crypto, for defending the SEC’s stance. Jennings had pointed out that the SEC clearly stated that XRP was an investment contract “during the offering.”

In response, the Ripple CLO mentioned that the offering spanned seven years, from 2013 to 2020. He emphasized that the SEC, in its filings, argued that XRP itself represented an investment contract.

Alderoty expressed his lack of surprise at Jennings’ attempt to “rewrite history,” especially considering his previous erroneous prediction that Ripple would lose its case against the SEC.

Follow us on Twitter, Facebook, Telegram, and Google News