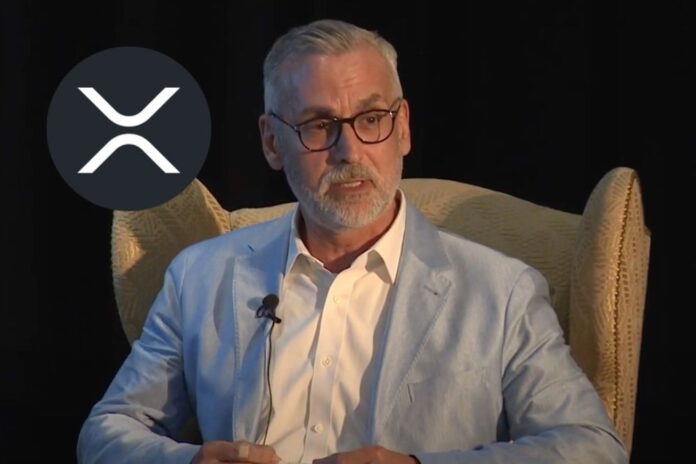

Stuart Alderoty, Ripple’s Chief Legal Officer, has offered a further analysis of the recent court ruling in the SEC vs. Coinbase legal case. In a March 27th decision, U.S. District Judge Katherine Polk Failla sided with the SEC, permitting the lawsuit to move forward into discovery.

Alderoty has expressed concerns regarding inconsistencies and potential implications stemming from the court’s reasoning.

Read Also: XRP Lawsuit Update: Judge Issues Fair Notice, Points Out SEC’s Inconsistencies

Alderoty Highlights Conflicting Definitions

A core point of contention raised by Alderoty is the court’s utilization of four distinct, and at times contradictory, definitions of the term “crypto ecosystem.” He argues that these definitions lack clarity and could potentially create legal confusion.

The Securities and Exchange Commission (SEC) narrowly defines an ecosystem as the specific coordinated ventures established by issuers and promoters of the 13 crypto assets labeled as securities in the Coinbase case (including SOL, ADA, and MATIC).

However, the court also adopts a broader definition, encompassing token issuers, exchanges, wallet providers, underlying technology, and even regulated institutions with any exposure to the token.

Alderoty characterizes these ecosystem definitions as “legal gibberish,” suggesting that the SEC’s approach could imply that any token acquisition equates to an investment in an entire ecosystem, without considering the specific context of the acquisition.

Last week’s Coinbase decision has 4 different confusing definitions of what constitutes a crypto “ecosystem.” pic.twitter.com/GZlH0l51c6

— Stuart Alderoty (@s_alderoty) April 1, 2024

Ripple Case Offers Contrasting Perspective

Alderoty draws a parallel to the ongoing Ripple case, where Judge Analisa Torres has acknowledged the SEC’s deviation from the Howey test regarding Ripple’s sales of XRP. Judge Torres ruled that programmatic XRP buyers could not have reasonably expected profits from Ripple’s efforts due to the nature of blind bid/ask transactions, underscoring a lack of common enterprise.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Legal Expert Questions SEC’s Classification

Pro-XRP legal expert Bill Morgan has also weighed in, criticizing the SEC’s strategy of dividing Ripple’s XRP sales into three categories while lacking sufficient evidence to support claims regarding the third category: “other distributions.” In Judge Torres’s ruling, no proof was found to support the allegation that Ripple used third-party XRP sales to fund its project.

Read Also: Envisioned $1,896 Per XRP After Ripple’s ISDA Membership Sets Off Community Response

Morgan speculates that the SEC may have categorized “other distributions” of XRP as part of an ecosystem while failing to establish them as investment contracts – a crucial distinction.

While the Coinbase ruling doesn’t directly impact the Ripple case, Alderoty’s analysis highlights potential concerns about the SEC’s evolving approach to crypto regulation. The inconsistent and excessively broad definitions of a “crypto ecosystem” could have implications for future legal actions in the crypto sector.

Follow us on Twitter, Facebook, Telegram, and Google News