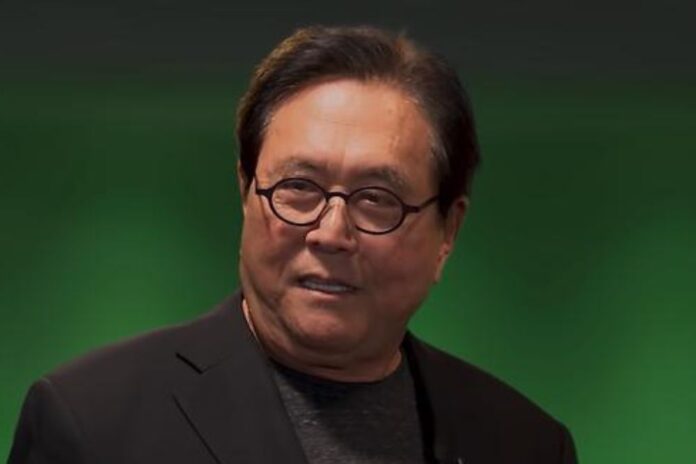

Renowned author and financial educator Robert Kiyosaki, famous for his book Rich Dad Poor Dad, is sounding the alarm bells for the stock market, painting a picture of an impending economic downturn for the United States.

Addressing his teeming followers on Twitter, Kiyosaki predicts a severe crash in the market, potentially leading to a deep depression.

Giant crash coming. Fake money-aka fist currency to die. BRUCS meeting in S. Africa August 22 to put nail in coffin of fiat…fake money. Get into real gold, silver & Bitcoin asap. Take care. End of fiat (fake) money near.

— Robert Kiyosaki (@theRealKiyosaki) July 13, 2023

Read Also: Rich Dad Poor Dad Author: I’m waiting For Bitcoin (BTC) to Test $1,100

Although Kiyosaki himself prefers to maintain control over his investments as an entrepreneur, he cautions those whose financial futures hang in the balance of stocks and bonds.

Encouraging careful consideration and possibly seeking professional advice, he expresses his anxiety over the anticipated economic conditions, stating, If your future depends on stocks and bonds, please be careful. I am afraid depression is coming.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

As a prominent advocate for Bitcoin (BTC), Kiyosaki attributes the recent surge in the stock market to the removal of the debt ceiling. Nevertheless, he remains resolute in his skepticism about the US economy’s outlook, pledging his allegiance to “real assets,” including Bitcoin (BTC), silver, and gold.

The stock market’s recent surge is a direct result of removing the ‘debt ceiling.’ This action will only cause the national debt to rise in conjunction with the stock market. As America’s wealth gap widens, the rich keep getting richer while the rest suffer. It is a disheartening reality. That is why I advocate for investments in real money and tangible assets: gold, silver, and Bitcoin.

Kiyosaki goes even further in his predictions, foreseeing a rapid devaluation of the US dollar, primarily driven by irresponsible government spending. He also highlights the intentions of BRICS, a coalition comprising Brazil, Russia, India, China, and South Africa, seeking to establish their own gold-backed currency.

According to Kiyosaki, the upcoming BRICS meeting, set to take place in South Africa on August 22, will serve as the final blow to the “fake money” or fiat currency, marking its demise.

Read Also: Microstrategy’s Michael Saylor Says One Catalyst Will Trigger Bitcoin (BTC) to Surge By 1,000%

How Will a Severe Market Crash Impact the Crypto Market

The crypto market is closely linked to the traditional financial markets, so a severe market crash could have a significant impact on cryptocurrencies. Some experts believe that cryptocurrencies could be even more vulnerable to a crash than traditional assets, as they are still a relatively new and volatile asset class.

If the stock market does crash, it is likely that investors will become more risk-averse and will sell off their riskier assets, such as cryptocurrencies. This could lead to a sharp decline in the prices of cryptocurrencies.

However, some experts believe that cryptocurrencies could also benefit from a severe market crash. They argue that cryptocurrencies could become more attractive to investors if they see the traditional financial system as being too risky. Additionally, a crash in the stock market could lead to increased demand for cryptocurrencies as a store of value.

Ultimately, it is impossible to say for sure how a severe market crash would impact the crypto market. However, it is clear that cryptocurrencies would be affected in some way. Investors should be aware of the risks and should make sure that they have a plan in place in case a crash does happen.

Follow us on Twitter, Facebook, Telegram, and Google News