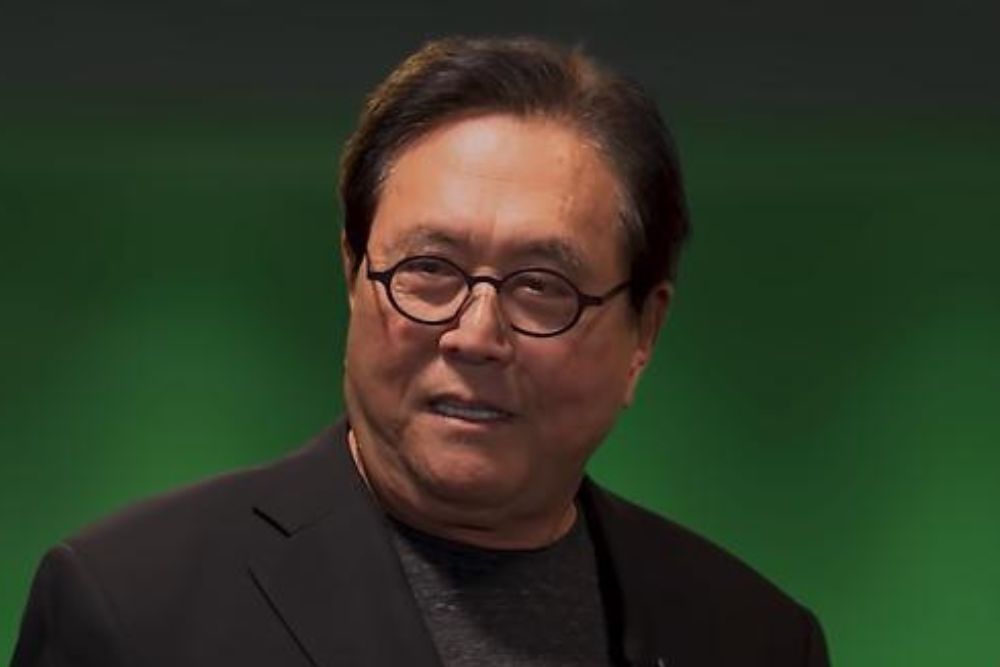

In the world of cryptocurrency, predictions can ignite heated debates. The latest comes from Robert Kiyosaki, author of “Rich Dad, Poor Dad,” who boldly forecasts that Bitcoin will hit $100,000 within the next four months.

Kiyosaki, a long-time Bitcoin advocate, sees the digital asset as a hedge against inflation and “fake money.” His $100,000 prediction echoes the 2021 “Laser-Eye” movement’s optimism, where many believed such a milestone was inevitable. However, the 2022 market crash serves as a sobering reminder of the risks involved in crypto investments.

Read Also: Rich Dad Poor Dad Author: Severe Market Crash and Likely Demise of US Dollar Incoming

Recently, Bitcoin (BTC) broke the $50,000 barrier for the first time in over two years, triggering a wave of speculation. While the approval of Bitcoin ETFs in the US played a part, it’s not the whole story. Global economic uncertainty and institutional adoption are likely significant contributors to this surge.

While individual predictions can be exciting, a holistic approach is crucial for understanding Bitcoin’s potential. This involves analyzing on-chain metrics, institutional inflows, regulatory developments, and global economic trends.

The idea of Bitcoin hitting $100,000 is thrilling, but focusing solely on price targets can be risky. It’s vital to consider Bitcoin’s broader potential, such as its role in revolutionizing finance, enabling cross-border transactions, and promoting financial decentralization.

Read Also: Rich Dad Poor Dad Author: I’m waiting For Bitcoin (BTC) to Test $1,100

It’s important to remember that Kiyosaki’s pronouncements go beyond mere price speculation. He views Bitcoin as a hedge against inflation and a “people’s money” alternative to fiat currencies. His prediction, then, can be seen as part of his broader perspective on the asset’s long-term potential, not just a short-term target.

Kiyosaki’s prediction undoubtedly stirs the pot, but approaching it with a healthy dose of skepticism is crucial. The crypto market remains inherently volatile, and external factors can significantly impact price movements. Remember to diversify your portfolio, conduct thorough research, and prioritize long-term value over short-term gains.

Follow us on Twitter, Facebook, Telegram, and Google News

When momentum kicks in, Bitcoin never disappoints. Hovering around $82,600, Bitcoin has its eyes set…

In a landmark development for the cryptocurrency market, Bitnomial, a prominent digital asset derivatives exchange,…

Shiba Inu (SHIB) is currently trading at $0.00001285, reflecting a slight price movement of 0.02839%.…

The meme coin market is as unpredictable as ever, and the latest shift in sentiment…

Yoshitaka Kitao, Chairman and CEO of SBI Holdings, reaffirmed his confidence in Ripple’s future during…

XRP has experienced notable price fluctuations in recent days, drawing increased attention from traders and…