Market analyst Bobby A has issued a statement downplaying the significance of the U.S. Securities and Exchange Commission’s (SEC) recent appeal against Ripple. He argues that the macro indicators for XRP remain bullish and believes the appeal does not indicate a prolonged price decline for the cryptocurrency.

Since the SEC filed its notice of appeal on October 2, XRP has seen its value drop by more than 8%. This correction followed Judge Analisa Torres’ initial ruling that XRP is not a security, which has faced ongoing scrutiny from the SEC.

Despite the downturn, Bobby A maintains that the bearish sentiment surrounding the SEC’s appeal does not reflect the token’s true potential. He asserts that many investors fall into the trap of selling when negative news surfaces, often missing key opportunities in the market.

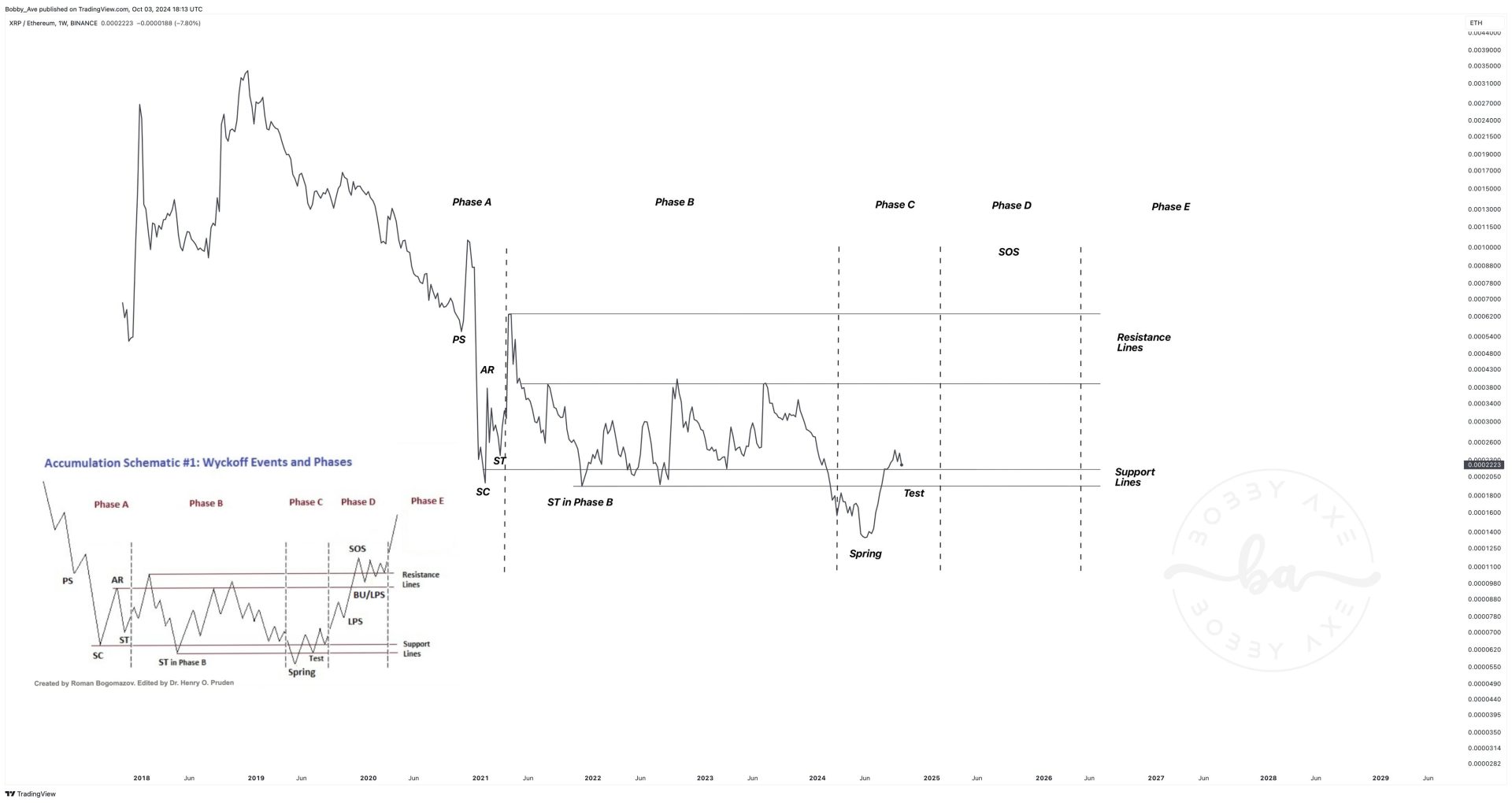

According to Bobby A, the current chart analysis does not support the idea that XRP is entering a prolonged downtrend. In a recent tweet, he stated that while the price correction has been noticeable, the overall market structure remains strong, with indicators pointing toward an impending uptrend.

XRP’s Previous Surge Despite SEC Legal Pressure

To support his viewpoint, Bobby A draws on historical data, highlighting XRP’s significant price appreciation during regulatory uncertainty. He pointed out that in 2020, despite the SEC filing a lawsuit against Ripple and classifying XRP as a security, the asset experienced an impressive rally of 1,772%, climbing from $0.11 to a peak of $1.95.

This historical context is a foundation for Bobby A’s argument that XRP is resilient, even in the face of legal challenges. He also emphasizes that the XRP/ETH and XRP/BTC trading pairs are holding steady, reinforcing that the worst news tends to emerge near market bottoms.

Technical Indicators Point to XRP Price Surge

From a technical analysis standpoint, Bobby A remains optimistic about XRP’s price trajectory. He forecasts a potential price surge of up to 695%, which would see the digital asset reach $4.23 per coin.

According to his analysis, XRP has been consolidating in a sideways pattern and forming a macro base since 2017. This long-term consolidation and certain key technical indicators suggest a significant upward movement is imminent.

Bobby A’s analysis focused on the momentum oscillator, which, according to him, has historically swung upward following Bitcoin’s halving cycles. He notes that the current market cycle bears similarities to the 2016-2017 bull run, with the token’s price showing signs of tightening around essential indicators such as the moving average and Bollinger Bands on the monthly chart. The analyst believes this technical setup is indicative of an impending breakout.

Fundamentals Support Long-Term Bullish Outlook

Beyond technical analysis, Bobby A highlights several fundamental factors that support his optimistic outlook for XRP. He believes the token now enjoys legal clarity regarding its status as a non-security, has real-world utility, and benefits from ongoing developments such as a stablecoin project and a potential exchange-traded fund (ETF).

Ripple CEO, Brad Garlinghouse, also weighed in following the SEC’s appeal notice, stating that there is no dispute over the digital asset’s status as a non-security. Garlinghouse affirmed that the SEC has not contested this point, offering further reassurance to investors.

Moreover, Garlinghouse revealed that Ripple is preparing to launch a stablecoin on the XRP Ledger within weeks, which would enhance XRP’s utility for transactional settlements.

This development, coupled with Bitwise’s recent filing for an XRP ETF, could provide additional bullish momentum for the asset. Bobby A has stated that these factors could drive XRP’s price higher by as much as 695%.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Potential Regulatory Shifts and Political Factors

In addition to the technical and fundamental analysis, Bobby A speculates that political developments in the United States could significantly influence the regulatory environment surrounding XRP.

The analyst suggests that if Donald Trump wins the upcoming presidential election, the current chair of the SEC, Gary Gensler, may resign. Bobby A believes that Gensler’s departure would shift regulatory policies and potentially lead to a more favorable environment for XRP.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News