In a dramatic turn of events that underscores the shifting tides of global finance, the U.S. stock market saw a staggering $3.25 trillion in value wiped out in a single day, while the cryptocurrency market absorbed the shock with resilience, gaining $5.4 billion. This contrasting movement between traditional finance and digital assets was first reported by Watcher.Guru in a now-viral post on X, formerly Twitter. The financial community has since been abuzz, analyzing what the divergence could mean for the future of markets—and the role of crypto within it.

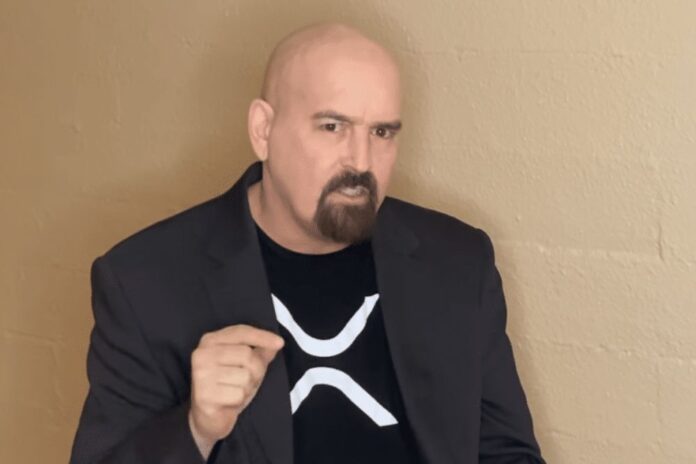

Among the earliest and most prominent voices to weigh in was pro-XRP lawyer and digital asset advocate, John Deaton. Quoting Watcher.Guru’s post, Deaton simply stated, “This is NOT insignificant,” a sharp but weighty remark that reflects the sentiment growing among crypto supporters: that traditional markets may be losing their grip as digital assets become increasingly legitimized, not just as speculative investments but as financial safe havens.

This is NOT insignificant. https://t.co/Dgd515gREi

— John E Deaton (@JohnEDeaton1) April 4, 2025

A Day of Contrasts

The concurrent decline in equities and surge in cryptocurrency capitalization may be more than just a coincidence. Investors are likely responding to growing economic uncertainties, such as rising interest rates, geopolitical tensions, and domestic policy instability. This has made digital assets, particularly Bitcoin and prominent altcoins like XRP and Ethereum, more appealing as alternative stores of value and hedges against risk.

As stocks plummeted, the cryptocurrency market experienced a modest influx of capital on the same day. While $5.4 billion may seem like a fraction compared to the trillions lost in stocks, the trend reveals a critical behavioral shift among investors increasingly parking capital in decentralized assets.

Why John Deaton’s Comment Matters

John Deaton’s reaction is not merely commentary; it carries weight because of his reputation in the crypto space, particularly his advocacy in the Ripple vs. SEC case and his broader defense of regulatory clarity for digital assets in the United States. By underscoring the significance of the market shift, Deaton highlights a moment he and others in the crypto community have long anticipated: a pivot where digital assets begin to stand not just in parallel to traditional finance, but as a viable counterweight.

His remark also resonates with the XRP community, which sees XRP not merely as another altcoin, but as a transformative financial instrument poised to revolutionize cross-border payments and liquidity provision at the enterprise level.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The Bigger Picture

The $3.25 trillion loss in traditional stocks could spur increased scrutiny of conventional market mechanisms and encourage institutional investors to diversify more aggressively into crypto. At the same time, the resilience of digital assets in this scenario adds fuel to the ongoing narrative that crypto is not going away and is increasingly being viewed as a mature and adaptive segment of global finance.

This divergence also strengthens the case for digital asset regulatory clarity, something advocates like John Deaton have been championing for years. As more people turn to decentralized options, the pressure on regulators and policymakers to offer a clear, stable, and innovation-friendly framework will only intensify.

While some may see the market’s losses and gains as an isolated event, pro-XRP lawyer John Deaton and others in the digital asset space see the deeper meaning: crypto is maturing into a serious financial alternative. With $3.25 trillion exiting the traditional space and billions entering crypto, the message is clear—confidence is shifting, and digital assets are stepping up as a significant player in the global financial ecosystem.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News