Amid the revision of key dates in its ongoing legal battle with the SEC, Ripple’s XRP seems to not be slowing down as it experienced a significant surge in its burn rate, coinciding with a price rally that propelled it above the $0.65 threshold. This bullish momentum comes as the broader cryptocurrency market shows signs of recovery

XRP Price Action, Burn Spike

XRP began March below the critical $0.60 level but steadily gained ground. As of March 1, it closed at $0.6013. This upward trajectory intensified on March 2, with XRP reaching an intraday high of $0.6501.

Read Also: Expert Proves That Increased Supply Is Not Cause of XRP Price Underperformance

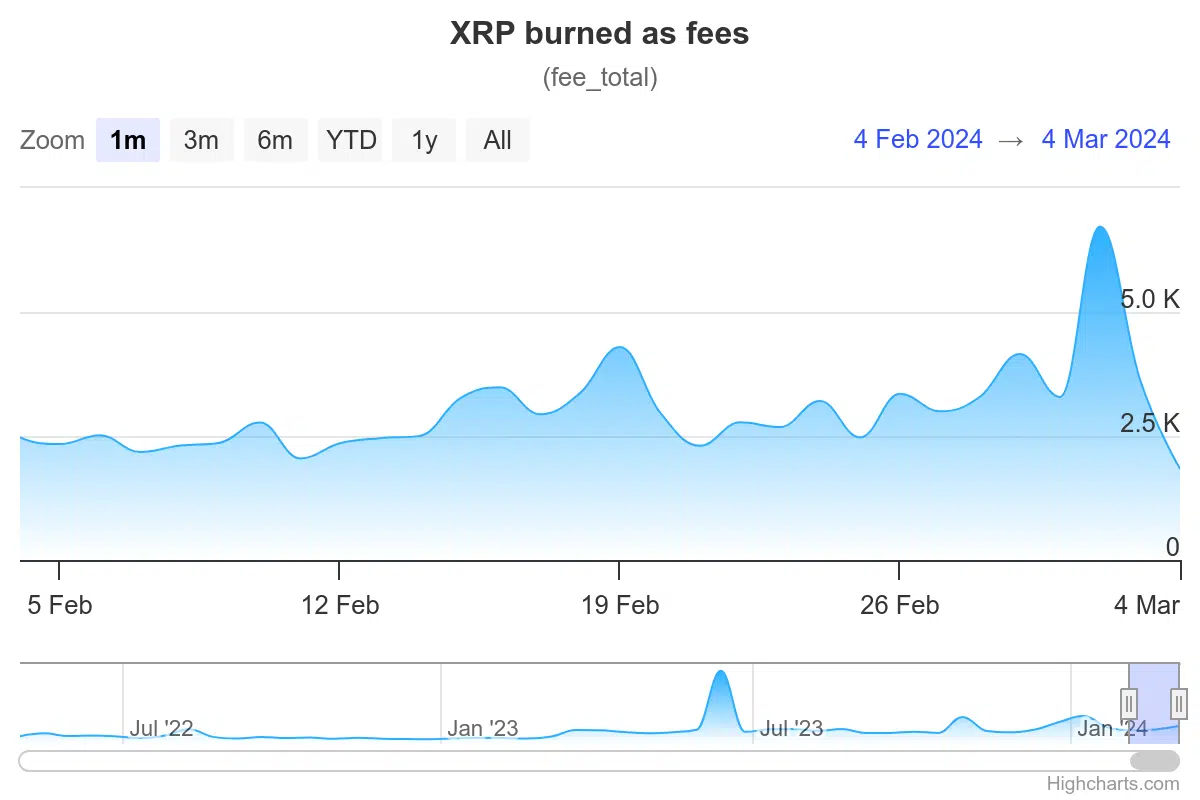

Amid this price surge, the XRP burn rate soared past the typical average of 3,000 tokens per day. Data from XRPScan indicates a burn rate of 6,721 XRP on March 2, the highest level observed in over a month.

A similar spike occurred previously on January 16, 2024, when 7,609 XRP were removed from circulation. Between December 30, 2023, and January 7, 2024, the XRP Ledger experienced multiple burn rate increases. This surge directly corresponds to the launch of the XRPL sidechain Xahau and its native token, XAH.

The demand for XAH led to a period where users consistently burned XRP tokens as part of the minting process. As a result of this activity, along with recent burns, over 16.178 million XRP tokens were removed from circulation.

Factors Driving the Burn, Market Activity, and Investor Confidence

The observed increase in burn rate aligns with heightened activity on the XRPL network. Investors have been increasingly utilizing the network for transactions. Furthermore, active addresses have also seen a notable uptick throughout 2024, reaching 18,363 on March 2.

It’s important to distinguish that network activity and trade volume are distinct metrics; XRP trade volume also saw a significant increase on March 2, peaking at $2.96 billion within 24 hours.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Inflation Debate and Price Impact

Within the XRP community, there is ongoing debate about the connection between inflation and XRP’s price trajectory. Some believe the deflationary effect caused by the burn mechanism positively influences price movements.

Built into the XRP Ledger protocol is an automated fee-burning process, currently fixed at a minimal $0.0001 per transaction, primarily designed to prevent spam transactions. While its core purpose wasn’t to drive price action, proponents argue that the burn has a supplementary effect on the digital asset’s value.

Ripple CTO David Schwartz has addressed the community, refuting the argument that the burn mechanism intentionally drives price growth, citing the example of Stellar (XLM) and its previous large-scale burn event. The cryptocurrency market remains highly volatile. Investors must conduct thorough research and consider their risk tolerance before any investment decisions.

Follow us on Twitter, Facebook, Telegram, and Google News