In a recent post on X, David Farrick, a former CEO, shared the high service fees charged by traditional banks and highlighted the need for modern payment solutions, such as those provided by Ripple using XRP.

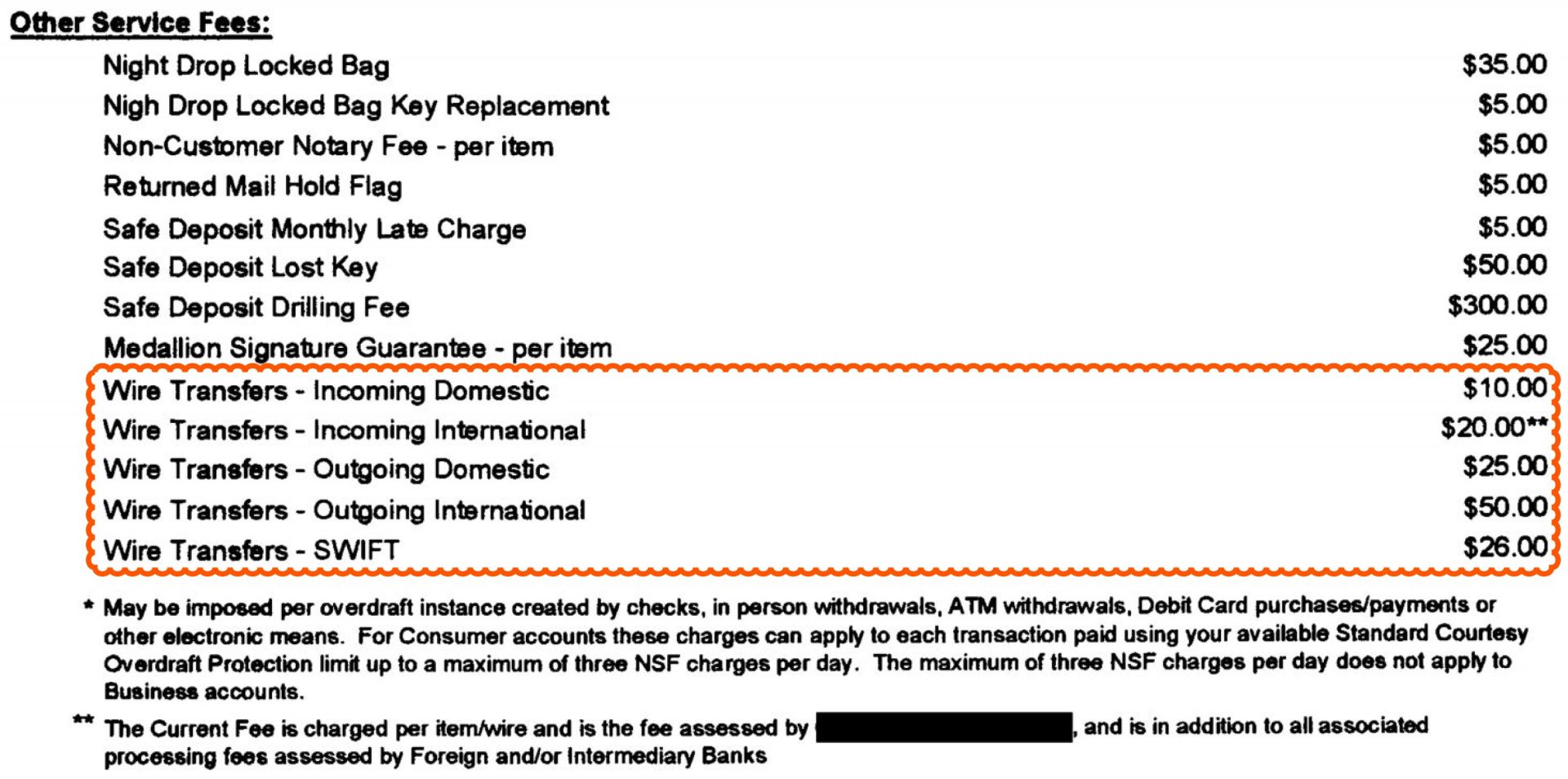

The fees detailed in the image attached to Farrick’s post are a stark reminder of the cost burden imposed on consumers by conventional banking systems. The image lists various fees banks charged him for wire transfers and other services.

Notably, the fees for the wire transfers that Farrick highlighted add up to $131. These fees reflect the cost of basic banking services, which can accumulate significantly over time. As Farrick points out, this is a clear indicator of why there is an urgent need for cost-effective payment solutions.

Community Responses

The community’s reaction to Farrick’s post sheds light on the broader sentiment towards traditional banking fees.

One user commented on the potential for banks to waive these fees for customers with substantial holdings but acknowledged that retail customers might still face high charges even with new payment infrastructures in place.

However, XRP fees are low. For reference, Michael Arrington’s firm Arrington Capital transferred $50 million for $0.3.

Banks charging fees as high as $25, which the bank charged Farrick for outgoing domestic wire transfers, would raise concerns, and questions among users.

Another user expressed frustration with the limitations imposed by banks. He stated, “How many times did I want to make a purchase and I had to call the bank to raise the limit? And I couldn’t because it was at night and the debit card department is closed.”

The consensus among users is clear: the current banking system’s high fees and operational restrictions drive the demand for alternative solutions.

One user shared his experience, revealing that he also paid $20 for a wire transfer, and noting that the fees are high.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Ripple and XRP as Solutions

Ripple, leveraging its digital currency XRP, presents a compelling alternative to traditional banking systems.

Ripple’s technology enables real-time, cross-border payments at a fraction of the cost charged by traditional banks. By eliminating intermediaries, Ripple reduces costs and significantly speeds up transaction times.

Despite these benefits, mainstream adoption of Ripple and XRP has faced hurdles. The U.S. Securities and Exchange Commission (SEC) recently added to the uncertainty surrounding XRP with its appeal of the recent ruling that ended its long-running legal battle with Ripple.

However, the XRP army is still confident that significant growth and adoption are coming, and the growing dissatisfaction with bank fees and operational constraints, as evidenced by community reactions, shows the need for such disruptive technologies.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News