Mutuum Finance (MUTM) has entered one of its most pivotal moments yet, with Presale Phase 6 now on the verge of a complete sellout and investor demand intensifying across all channels. The token’s structured price progression, fast-expanding community base, and confirmed utility roadmap have accelerated speculation around MUTM’s long-term valuation, particularly its potential price levels by 2027. As the market prepares for another rotation into high-momentum early-stage assets, MUTM’s performance in the presale has already positioned it as the best crypto to invest in.

Rapid Price Growth and Community Expansion

Presale activity continues to build in strength. MUTM has surged from its Phase 1 price of $0.01 to the current $0.035 in Phase 6, marking a 250% increase before launch. The next stage will raise the price to $0.04, while the confirmed launch value stands at $0.06. With more than $19.2 million raised and over 18,380 holders now onboarded, the remaining Phase 6 allocation is shrinking rapidly.

Meanwhile, the ongoing $100,000 giveaway has added extra momentum, drawing new buyers competing to secure their share of the reward pool while simultaneously locking in presale allocations before the next price jump for this cheapest cryptocurrency.

Long-Term Outlook and Protocol Developments

This rising confidence sets the backdrop for a clearer view of where MUTM could realistically trade by 2027. Analysts evaluating its long-term trajectory are factoring in the upcoming 2025 V1 protocol rollout, stable liquidity design, sustained holder growth, and expected expansion of lending demand across ETH and USDT markets. These elements feed directly into a near-to-mid-cycle valuation model, placing MUTM in a strong position entering 2026.

Based on these fundamentals, MUTM’s price forecast for 2027 currently spans three tiers. A conservative base case, driven by steady yet measured adoption, places MUTM between $0.45 and $0.60 within two years of launch. A stronger growth scenario, assuming accelerating user inflows and broader DeFi expansion, supports a valuation between $0.80 and $1.20. The high-conviction scenario, tied to heavy liquidity participation, strong protocol usage, and sustained burn-rate dynamics, places MUTM between $1.50 and $2.00 or higher by 2027.

Learning from Historical Market Trends

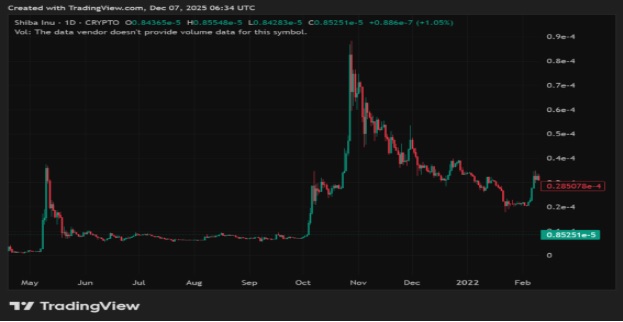

The logic behind these projections becomes more evident when viewed through the lens of historical market behavior, particularly the explosive performance of Shiba Inu (SHIB) between 2020 and 2021. SHIB launched in August 2020 at an extremely low price, around $0.000000000056, before climbing to $0.00008845 by October 2021. In just 14 months, SHIB delivered an extraordinary 1,570,000x return, one of the highest in crypto history.

While MUTM is fundamentally different, operating within DeFi rather than memecoin speculation, the comparison demonstrates a critical market reality: early-cycle tokens with strong community traction and clear narratives can undergo exponential growth far beyond initially conservative expectations.

Reinforcing the Case for MUTM’s Upside

This historical precedent reinforces the reasoning behind MUTM’s long-term upside. Just as SHIB capitalized on early liquidity rotations, peak retail interest, and rapid network participation, MUTM is benefiting from early-stage enthusiasm, rising presale inflows, and a utility roadmap that extends beyond hype.

Although no two cycles are identical, the shared underlying conditions, low entry price, expanding user base, increasing liquidity, and strong community participation, provide a rational basis for projecting a 20–30x MUTM expansion by 2027.

At today’s presale price of $0.035, these 2027 projections translate into an estimated return of 1,185% to 5,600%, depending on adoption trajectory and protocol usage. Even from the $0.06 launch price, the token maintains a projected upside between 650% and 3,200%, aligning with early-stage DeFi growth patterns from previous cycles.

Conclusion: A Compelling 2027 Narrative

Taken together, Mutuum Finance’s accelerating presale, proven demand, imminent utility rollout, and the historical market behaviors reflected in the SHIB 2020–2021 breakout all support a compelling long-range valuation narrative. With Phase 6 nearly sold out, the pathway toward MUTM’s first major market cycle appears increasingly well-defined, setting the stage for 2027 to mark a transformative milestone for early investors.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.