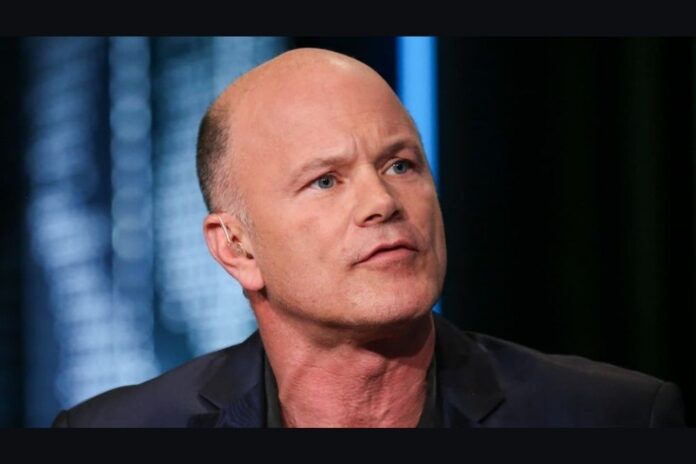

With just a few months left in 2023, Galaxy Digital CEO Mike Novogratz has provided insights into the potential approval of a Bitcoin spot ETF by the U.S. Securities and Exchange Commission (SEC) this year. His optimism stems from recent discussions between Bitcoin ETF issuers and the SEC, suggesting a promising outlook for the crypto industry.

In a new interview on Squawk Box, Novogratz stated that all the indications of dealings are heading in the right direction. He expects the approval to come soon.

"We think a #Bitcoin ETF will be approved this year in 2023. All the indications of dealing seem to be heading in the right direction," says @novogratz on #crypto. "There's a tremendous amount of pressure to do something that is rational. The American public wants this." pic.twitter.com/ozY3gOiSyi

— Squawk Box (@SquawkCNBC) October 18, 2023

The Road to SEC Approval

When asked what makes the present situation different and the approval plausible, Novogratz mentioned the SEC’s loss in court. The “most significant piece,” as Galaxy Digital CEO described it, was the court ruling that paved the way for a review of the SEC’s rejection of the Grayscale Bitcoin Trust (GBTC) application.

Novogratz stated that this loss put the SEC at a disadvantage and that SEC Chair Gary Gensler needs a win now. He added that there is pressure on the SEC to do something rational, and the approval is something the American public wants.

Novogratz also highlighted BlackRock’s commitment to the cause. BlackRock, the world’s largest asset manager, has been pushing for it publicly. Novogratz expects all these factors to move the SEC toward Bitcoin ETF approval.

Galaxy Digital CEO added that although he can’t speak on specific conversations, the dialogue with the SEC is heading in the right direction. When pressed further on this, Novogratz highlighted the public filings and the fact that the public comments on the matter have become more constructive, with people asking specific questions instead of general questions. He pointed to these as a good sign.

Another crucial indicator cited by Novogratz is the SEC’s decision not to appeal the Grayscale ruling, a development he considers significant. The SEC stayed silent about its loss in the Grayscale case since the ruling in August and recently let the deadline for an appeal pass.

Furthermore, Gensler recently shared that the SEC is actively working on multiple Bitcoin ETF filings. However, he did not state when the approvals would come and if they would all come together or one at a time.

Investors and companies eagerly await the SEC’s decision, which could mark a turning point for the cryptocurrency market and traditional finance.

Follow us on Twitter, Facebook, Telegram, and Google News