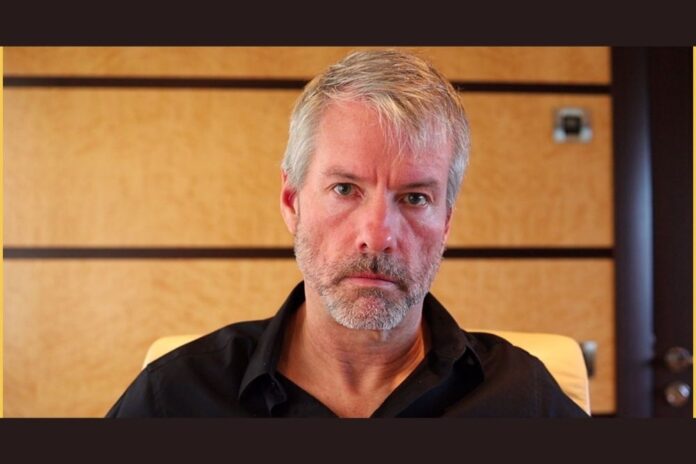

Michael Saylor, the founder and CEO of MicroStrategy, the leading business intelligence and software firm, has reiterated the ability of Bitcoin (BTC), the largest cryptocurrency by market cap, to serve as a hedge against inflation.

Saylor, the popular Bitcoin proponent, who usually seize all opportunity to promote the flagship cryptocurrency, took to Twitter a couple of hours ago to say inflation might have robbed my people, but Bitcoin is here to give back their money.

Read Also: MicroStrategy’s Michael Saylor Explains Why He Thinks Bitcoin (BTC) Will Go up Forever

Michael Saylor tweeted, “If you feel robbed by inflation, Bitcoin will give your money back.”

If you feel robbed by inflation, #bitcoin will give you your money back.

— Michael Saylor⚡️ (@saylor) March 25, 2022

As expected, the tweet gained tons of reactions from the crypto community.

Reacting to the viral tweet, Anthony Pompliano, who is also a popular Bitcoin proponent, wrote, “Bitcoin is the best savings technology.”

If you feel robbed by inflation, #bitcoin will give you your money back.

— Michael Saylor⚡️ (@saylor) March 25, 2022

It can be recalled that Michael Saylor had a few days ago explained why he keeps believing in the future prospect of Bitcoin (BTC). He also referred to the cryptocurrency as the American dream, stating that the largest crypto shouldn’t be called a commodity.

The crypto proponent further pointed out that the uniqueness of Bitcoin lies in the fact that only 21 million BTC can ever be produced, making the asset more scarce and valuable.

MicroStrategy CEO added that Bitcoin is capped. Whether it’s priced in thousands or millions of dollars changes nothing about its total supply, unlike Gold, which its production is infinite.

Read Also: Options Open Interest Says Bitcoin (BTC) Bulls Are Betting on $100,000-$200,000

Saylor has obviously been one of the proponents who have contributed to the reason why institutional and corporate investors are interested in Bitcoin.

MicroStrategy started to purchase Bitcoin (BTC) in August 2020, convincing many other firms to follow suit in order not to be left out as they fear that global inflation will linger.

At the time of press, the value of the firm’s Bitcoin holdings stands at $5.6 billion. Saylor had also once said it would have been a multi-billion mistake if he had chosen Gold over Bitcoin.

Follow us on Twitter, Facebook, Telegram, and Google News