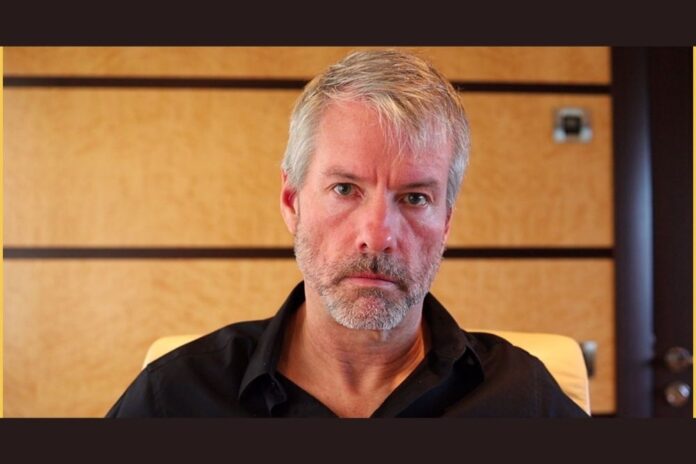

In a recent video shared by the crypto-focused Twitter account Good Morning Crypto, prominent figures Michael Saylor (Microstrategy founder) and Patrick Bet-David engaged in a wide-ranging discussion on the current state of the cryptocurrency industry, with a particular focus on Ripple, XRP, and the broader regulatory landscape.

The conversation highlighted key developments and speculations, including potential pro-crypto policies under a new U.S. administration and rumors about Ripple’s leadership meeting with former President Donald Trump.

BREAKING: 🇺🇸 MICHAEL SAYLOR & PATRICK BET-DAVID DISCUSS $XRP & RIPPLE CEO MEETING WITH TRUMP!

“The community with XRP & @Ripple, has anything changed since you and I were last together?” — @patrickbetdavid

“I think you’ll have a pro-digital assets SEC, a pro-digital assets… pic.twitter.com/yxrnc7G5lU

— Good Morning Crypto (@AbsGMCrypto) December 13, 2024

Pro-Crypto Regulatory Shift

Michael Saylor, a well-known advocate for Bitcoin and executive chairman of MicroStrategy, expressed optimism about a potential shift in U.S. policy favoring digital assets.

He predicted that by January, the U.S. could see a “pro-digital assets SEC, a pro-digital assets Treasury, a pro-digital assets White House, and a pro-digital assets House and Senate.”

Saylor emphasized the need for an ethically, technically, and economically sound regulatory framework to ensure the growth and prosperity of the cryptocurrency sector.

Saylor also critiqued the outdated financial compliance systems that hinder innovation and capital formation. He questioned the logic of imposing excessive compliance costs on smaller companies seeking to raise capital, arguing that such policies stifle economic freedom and progress.

Ripple’s Growing Influence

Saylor acknowledged Ripple’s efforts in exploring use cases beyond Bitcoin’s “digital gold” narrative, noting the proposed launch of Ripple’s RLUSD and its advancements in tokenized assets on the XRP Ledger.

These developments underscore Ripple’s commitment to expanding the functionality of blockchain technology and highlight its potential impact on the future of finance.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Broader Implications for the Crypto Industry

This discussion comes at a pivotal time for the cryptocurrency industry as regulatory clarity remains a critical factor for its long-term success. The outcome of Ripple’s legal battle with the SEC could set a precedent for how digital assets are classified and regulated in the U.S.

Furthermore, Saylor’s comments reflect a broader sentiment within the industry that a supportive regulatory environment is essential for fostering innovation and ensuring global competitiveness.

XRP Community Reactions

The crypto community has responded enthusiastically to the video, with many expressing optimism about the potential for a more favorable regulatory environment. Some view Saylor’s recognition of XRP and Ripple’s broader use cases as a significant shift, given his historical focus on Bitcoin as the dominant cryptocurrency.

The conversation also highlighted the diverse perspectives within the crypto space, from Elon Musk’s involvement with Dogecoin and Bitcoin to Ripple’s focus on cross-border payments and tokenized assets. This diversity illustrates the dynamic nature of the industry and its capacity to address various economic and technological challenges.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News