Bitcoin (BTC), the largest cryptocurrency by market cap, faces a complex market environment as it navigates global economic trends and cryptocurrency-specific developments.

As of April 2, 2024, CoinMarketCap data shows that Bitcoin’s price stands at $65,881, reflecting a 4.28% decrease in the past week. This price adjustment has brought Bitcoin’s market capitalization to $1.2 trillion.

Key Factors Influencing Bitcoin’s Price

The recent fluctuations in Bitcoin’s price can be attributed to several key factors. A strengthening US dollar has dampened demand for dollar-denominated assets like Bitcoin.

After positive US factory data, the dollar index (DXY) rose above 105, a level last seen in mid-November. This four-week gain of 2.58% has potentially decreased the appeal of BTC for investors.

Additionally, Bitcoin’s value is influenced by the impending drastic reduction in mining reward halving. This event could introduce further volatility into the cryptocurrency market.

Despite these near-term challenges, some analysts are optimistic that rapidly increasing fiscal debt might prompt the Federal Reserve to lower interest rates, potentially boosting crypto markets.

It’s worth noting the Fed’s aggressive rate hikes in 2022 and 2023 did contribute to Bitcoin’s substantial price correction in 2022.

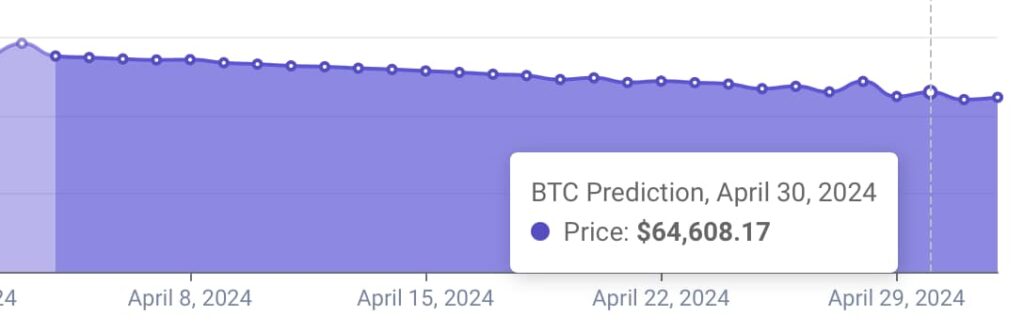

Machine Learning Model Predictions for Bitcoin

The machine learning model from PricePredictions predicts a slight downward adjustment in Bitcoin’s price by April 30, 2024, potentially reaching approximately $65,417. It’s crucial to remember that these predictions should be viewed alongside other factors influencing the market.

Market sentiment also plays a role in Bitcoin’s price movements. Data from Santiment highlights a positive reaction from the crypto community despite recent price declines. While Bitcoin and altcoins have experienced losses, overall sentiment remains bullish.

Notably, discussions about buying Bitcoin far exceed those focused on selling. This pattern has historically been seen as a ‘buy the dip’ opportunity, which often leads to larger investors accumulating assets from smaller holders.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The coming weeks will be pivotal as the Bitcoin halving event approaches, along with the release of important economic indicators. Market players will be watching closely to assess how these events ultimately shape the trajectory of Bitcoin’s price.

Please note that cryptocurrency markets are highly volatile and predictions are inherently uncertain. It’s important to conduct thorough research and consider your risk tolerance before making investment decisions.

Follow us on Twitter, Facebook, Telegram, and Google News