The XRP price has been a point of contention in the cryptocurrency market lately. While the broader market experienced a rally in March 2024, XRP showed little progress and has retraced its gains due to the ongoing legal battle between the U.S. Securities and Exchange Commission (SEC) and Ripple.

This dispute has cast a shadow of uncertainty over XRP for quite a long time, suppressing its potential for growth despite numerous attempts to break out of the damning challenge.

XRP’s Recent Performance and Key Support/Resistance Levels

At the time of writing, XRP is trading at $0.515, showing a relatively 5% increase over the past 24 hours. Although XRP has finally regained the crucial $0.5 level, it is down over 16% in the past 30 days. Despite the prolonged bearish pattern, a prominent analyst sees this “boring period” as a buying opportunity.

He advised that investors buy when the cryptocurrency is boring and showing consolidation or a downtrend. In contrast, investors should sell when it’s not boring and has experienced a breakout like the attempt from early March when XRP reached above $0.7.

The current price of XRP represents a critical juncture. The token hovers between two key technical levels: immediate support at $0.438 and potential resistance at $0.550. Breaching either of these levels could signal a significant shift in XRP’s price trajectory.

XRP’s Potential Future Prices

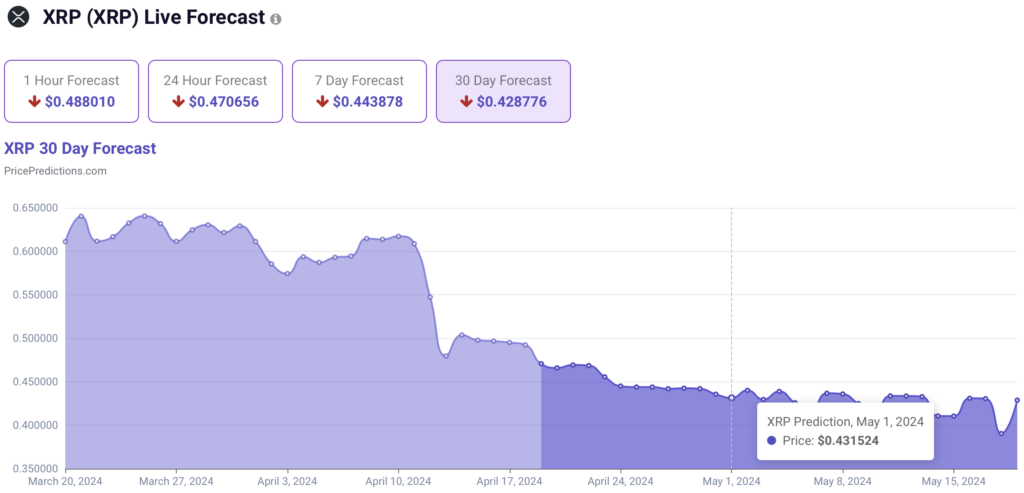

The future of XRP remains uncertain. According to predictions from the Artificial Intelligence (AI) models at PricePredictions, investors should expect a bearish trend in the long term. The AI forecasts a price decrease of around 12.55%, with a target price of $0.432 by May 1.

This will send XRP below the $0.438 resistance level and could cause prolonged bearish behavior. In the short term, however, machine learning algorithms detect a potential slight increase for XRP within the next few hours.

This contradicts the overall bearish sentiment indicated by traditional technical indicators like RSI, MACD, Bollinger Bands, and ATR. These indicators collectively suggest a sell signal, while Moving Averages (MA) and oscillators lean towards a strong sell rating for XRP across all timeframes.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Machine Learning Model Predicts Terra Classic (LUNC) Price for March 31, 2024

Interestingly, oscillators show a temporary shift to neutral when analyzing the most recent four hours of trading data at press time.

Despite the bearish outlook, an analyst recently predicted a 1,000-3,000% increase for XRP. The digital asset might end up outperforming the AI algorithm’s bearish expectations.

Follow us on Twitter, Facebook, Telegram, and Google News