With Litecoin’s foreseen third halving in view, crypto enthusiasts seem to anticipate what this expected event will mean for Litecoin, especially the coin’s market value. In this insight, TimesTabloid will analyze the effects of the customary halving event on Litecoin’s market relevance.

For Context, Litecoin is a cryptocurrency built on proof-of-work consensus, implying that the coin has a dedicated decentralized system with protection from widely distributed ecosystem miners.

Read Also: Litecoin (LTC) Price Projection: Veteran Trader Peter Brandt Foresees a 700% Surge in Value

Meanwhile, halving is a reward system in proof-of-work (PoW), affording miners opportunities to earn benefits in the form of cryptocurrencies dedicated to that particular PoW system to which a crypto user contributed significantly to its growth. Bitcoin (BTC) miners will receive rewards in the form of BTC, while Litecoin miners will amass. LTC.

Litecoin Halving: What Does This Event Hope To Achieve?

With regards to Litecoin, halving entails a decrease in LTC emission per block after every four years. On completion of the third halving event, miners’ reward will reduce to about 6.25 LTC per block, implying a 50% decrease. Judging by LTC’s current price of $101.50, owners of Litecoin mining rigs will amass approximately $634.375 every 2.5 minutes.

Litecoin (LTC) Halving Event Date

In every PoW system, halving occurs after mining a specified amount of blocks. For Bitcoin, it happens after every 210,000 blocks. For LTC, it takes place after every 840,000 blocks, implying that no designated dates for the event exist. Rather, halving depends on the block speed in a particular blockchain.

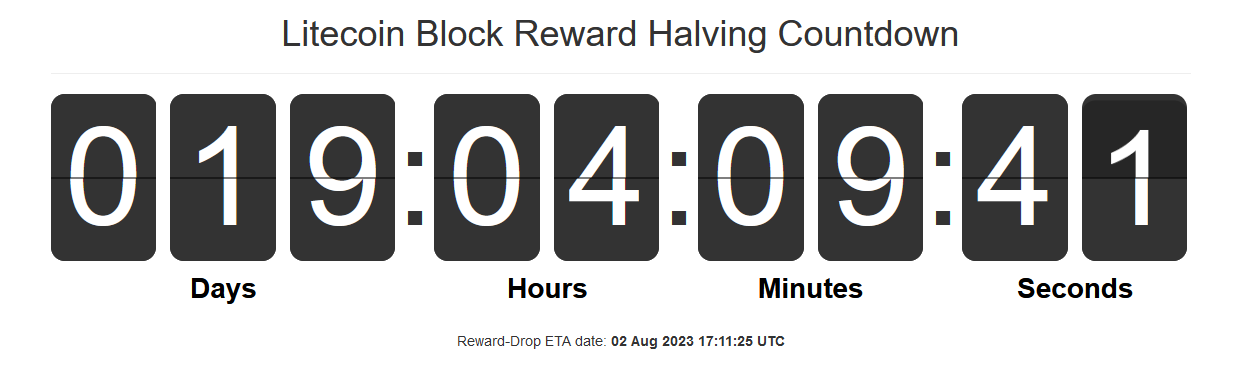

Notably, Litecoin incorporates new blocks roughly every 150 seconds. According to Litecoinblockhalf, the Litecoin Block Reward Halving Countdown portal, its third halving event is expected to play out on August 2, 2023, at 17:11:25 p.m. UTC.

Impacts Of The Halving Events On Litecoin Price Performance

Litcoin’s Halving events are not known to be accompanied by significant price changes. However, two previous rallies that played out on August 25, 2015, and August 5, 2019, were associated with massive bullish runs.

In the first post-halving phase, LTC spiked massively, ascending from $3.98 to $314 after 28 months. In addition, its crypto space capitalization massively skyrocketed from $4.8 billion to $848 billion.

In the second post-halving period, Litecoin attained an all-time high after 23 months, spiking from $95 to $354 and equalling a 273% surge. In the same vein, its market capitalization increased from $248 billion to approximately $3 trillion.

Read Also: What Is MimbleWimble Upgrade and What Does It Bring to Litecoin Network? Details

Litecoin (LTC) Halving Event: Ecosystem Impacts

LTC’s first post-halving phase saw the token trigger improved support for sidechains, opening research into lightning network payments media and other scalability solutions.

In the subsequent post-halving period, Litecoin worked on MimbleWimble feasibility via long-standing research work. It is worth noting that the MimbleWimble serves as a privacy mechanism for transaction obfuscating, implemented in the past through the Beam (BEAM) blockchain.

Bottom Line

By approximately 2142, which might be the year for the final halving event, block rewards will be no more as they must have declined to zero based on our estimated calculations. The conclusion of the last halving event implies that all 84 million LTCs must have been released into circulation.

Follow us on Twitter, Facebook, Telegram, and Google News