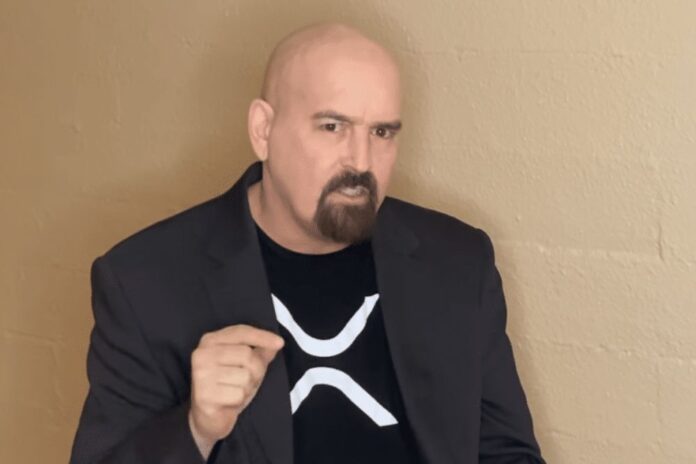

John Deaton, the amicus curiae (friend of the court) and the attorney representing over 75,000 XRP holders in the ongoing lawsuit filed against Ripple by the U.S. SEC has recently shared his predictions regarding the outcome of the crypto case.

The popular U.S.-based lawyer and the founder of Crypto Law believe that the two-year-long legal tussle will have to receive a summary judgment decision from Judge Analisa Torres, the presiding officer before a settlement occurs between both parties involved.

This he said while underlining his top projections for the crypto industry in 2023 on Thursday. Deaton wrote as his number one prediction, “the Ripple case does not settle until after we get a decision from Judge Torres”.

In response to the statement, several members of the XRP community communicated their concerns, seeking more clarity. For some users, a settlement after the Judge’s Summary Judgement ruling never occurred to them. On the other hand, another user asked how such a settlement would play out as he thinks the case is essentially over after a court ruling. “Why would the party that “won”, settle?” he asked.

Attorney John Deaton then explained, noting that a settlement could still occur after Judge Torres gives a final verdict. According to him, the essence of the out-of-court settlement is to eliminate any potential jury trial and any potential appeal.

2023 Predictions

1) The @Ripple case does not settle until AFTER we get a decision from Judge Torres;

2) An exchange (maybe more than one) is sued for selling unregistered securities;

3) investigation into SBFraud meetings uncovers bad 💩;

4) Gensler resigns before the eoy.

— John E Deaton (@JohnEDeaton1) January 12, 2023

As outlined by the defense lawyer James K. Filan, both Ripple and the SEC filed their Omnibus Motions which involved the sealing of all materials related to the Summary Judgment motions in December. Meanwhile, January 4, 2023, was set aside for unrelated third parties to file their respective motions to seal any Summary Judgment material.

Likewise, he reiterated his stance that the Gary Genler-led SEC would sue one or more exchanges for selling unregistered securities, predicting that the SEC Chair may resign as SBF’s fraud case unfolds.

Read Also: Attorney John Deaton Predicts a Court Ruling in XRP Lawsuit, States Why Settlement is Unlikely

SEC Sues Gemini and Genesis Trading

Interestingly, one of Deaton’s prognoses has played out. Per a report, the Securities and Exchange Commission filed a civil lawsuit in Manhattan federal court against two top crypto lending platforms over a $900 million crypto-lending program.

The SEC contends that both Gemini Trust Company and Genesis Global Capital violated the investor-protection laws by selling unregistered securities to customers.

According to the SEC, “both companies began marketing the program to individual investors in February 2021 and raised billions of dollars’ worth of crypto assets from hundreds of thousands of investors.”

The SEC filed its civil lawsuit in Manhattan federal court alleging that Genesis should have registered the product, which would have required providing clients with detailed financial disclosures.

Follow us on Twitter, Facebook, Telegram, and Google News