After nearly six months of consolidation, Bitcoin is poised for a potential breakout, according to several leading crypto analysts. This extended period of price stability, which began in early 2024, is identified as a re-accumulation phase that echoes patterns seen after previous halving events.

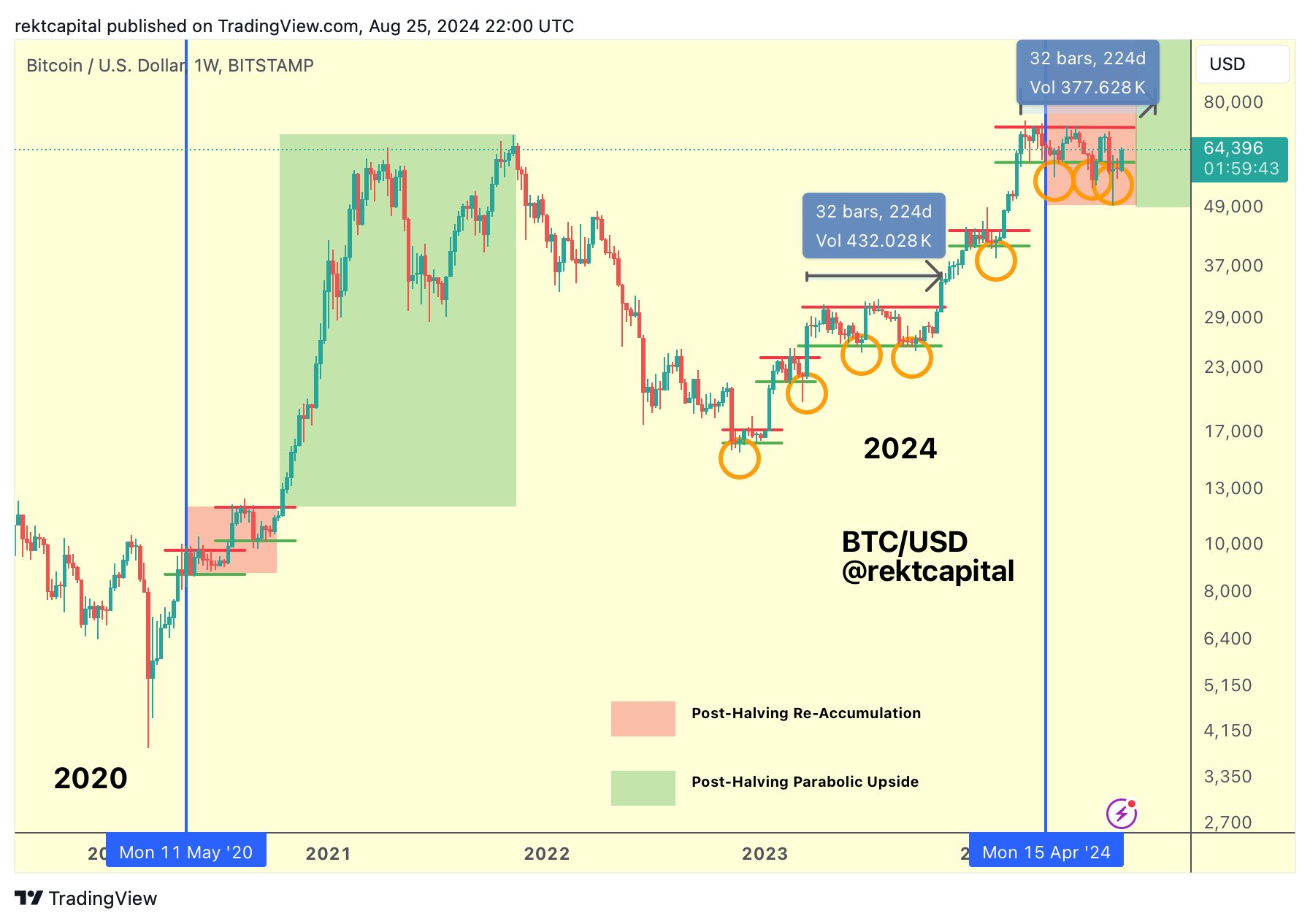

Rekt Capital (@rektcapital), a well-known crypto trader and analyst, has analyzed Bitcoin’s current market behavior, suggesting it aligns closely with the re-accumulation phase observed after the 2020 halving.

The 2024 re-accumulation phase mirrors previous ones in 2020 and 2023, marked by lengthy consolidation periods. In particular, the 2023 phase, which also lasted 224 days, preceded a dramatic rise in Bitcoin’s price, pushing it to new all-time highs.

Rekt Capital’s analysis suggests that Bitcoin’s current phase could follow a similar trajectory, potentially leading to a breakout in September or October.

Meanwhile, another prominent crypto analyst, Ali Martinez, has identified key support levels for Bitcoin by examining the buying behavior of different investor groups. Martinez’s analysis highlights four major support zones, each corresponding to distinct investor classes: new whales, Binance retail users, Bitcoin miners, and long-term holders.

New whales with holdings acquired within the last 155 days have a realized price of $63,450. Binance retail users have a realized price of $55,540. Bitcoin miners with holdings exceeding 1,000 BTC have a realized price of $44,400, and dipping below this price could affect mining activity.

Long-term holders with Bitcoin positions for over 155 days show strong support at a realized price of $25,000, a historically resilient level that has proven durable through various market cycles. With some bearish predictions flying around, analysts have to watch Bitcoin’s next moves carefully.

Adding to these analyses, crypto market analyst Mikybull Crypto (@MikybullCrypto) offers further insights into Bitcoin’s potential price movements. Mikybull, applying the Elliott Wave theory, suggests that Bitcoin may be entering its fifth and final wave, which could drive the cryptocurrency to new heights

According to this analysis, the third wave concluded with a peak at $73,000 in March 2024, and the forthcoming fifth wave could push Bitcoin’s price as high as $143,000.

Bitcoin’s ongoing consolidation is seen by many as part of a broader re-accumulation phase, and the breakout is just around the corner. If Bitcoin can follow this trajectory, we could see a new all-time high and massive surges across the market.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

Have you ever kicked yourself for not scooping up Monero when it was just pennies?…

Anticipation is building within the XRP community, as new signals point toward an exciting announcement…

Bitcoin is flashing a major bullish signal as key on-chain data points to intensified investor…

The idea of a "Great Reset" has long hovered at the edges of financial and…

After months of uncertainty, April 2025 is giving crypto investors a reason to smile again.…

Top meme coins like Shiba Inu (SHIB) and Dogecoin (DOGE) have recorded notable gains as…