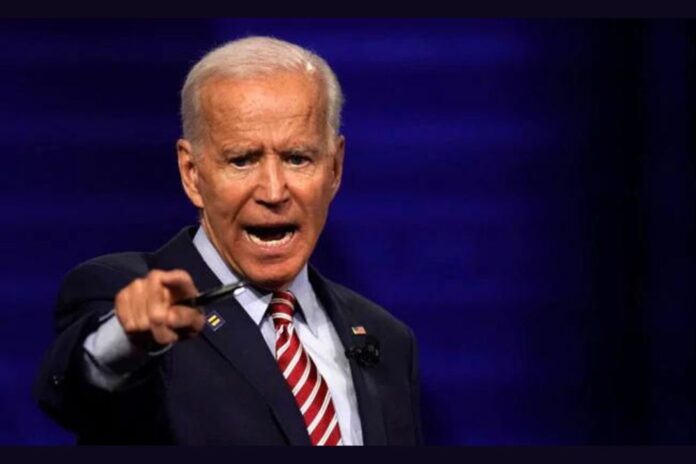

Following the high rise of cryptocurrency adoption in the United States and the globe, the Biden-Harris administration has released the first-ever comprehensive framework for the responsible and safe development of cryptocurrencies. This guiding framework also comes in response to President Biden’s Executive Order on “Ensuring Responsible Development of Digital Assets” signed in March.

To develop this framework, several agencies and diverse stakeholders across the government, academia, and civil society worked together to formulate policy recommendations that advance the six key priorities identified in the Executive Order by the U.S. President.

As seen in the recently released crypto framework, the White House is focused on ensuring the protection of consumers, investors, and businesses, fostering financial stability, promoting access to safe, affordable financial services, fighting illicit finance, advancing financial innovation, exploring the United States Central Bank Digital Currency (CBDC) and reinforcing global financial leadership and competitiveness.

More so, the release puts into consideration other sectors of the digital asset space including cryptocurrency mining. It also encourages private-sector research while stressing the need for players to observe measures useful in the mitigation of risks.

Read Also: Senator Toomey Slams SEC Chair For Classifying Most Crypto as Security

The White House Crypto Framework Focus

While cryptocurrency and blockchain technology is a beneficial digital innovation and positive contribution to the global financial system, it poses serious risks if indulged carelessly and without clear regulations. It is also worth noting that several bad actors and loss-inflicting scenarios have continuously surfaced in the crypto industry. The most recent was the Terra ecosystem collapse in May which triggered other damaging instances including the insolvency of companies like Celsius, and Three Arrows Capital (3AC) among others.

To protect investors and businesses adopting the crypto payment method as well as ensure fair play in the crypto niche, the Biden-Harris administration has consistently issued guidance and enforcement resources while keeping tabs on fraudulent players. As clearly stated in the White House framework released on Friday, the U.S. plans to step up its regulatory actions thus;

- The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) are encouraged to aggressively pursue investigations and enforcement actions against unlawful practices in the digital assets space.

- The Consumer Financial Protection Bureau (CFPB) and Federal Trade Commission (FTC) are encouraged to redouble their efforts to monitor consumer complaints and punish unfair, deceptive, or abusive practices.

- Agencies are further encouraged to issue guidance and rules to address current and emergent risks in the digital asset ecosystem. Equally, regulatory and law enforcement agencies are also urged to collaborate to address acute digital assets risks facing consumers, investors, and businesses. The release added that agencies are encouraged to share data on consumer complaints regarding digital assets — ensuring each agency’s activities are maximally effective.

- According to the publication, the Financial Literacy Education Commission (FLEC) has been tasked to lead public-awareness efforts to help consumers understand the risks involved with digital assets, identify common fraudulent practices, and learn how to report misconduct.

Related: Crypto Regulation: U.S Administrators Submit Framework to President Biden

The Biden-Harris administration holds that the digital economy should work for all Americans. Therefore, developments should be made such that digital services can be accessible to all at a low cost, especially with cross-border payments. In promoting access to safe, affordable financial services, the report read

“Agencies will encourage the adoption of instant payment systems, like FedNow, by supporting the development and use of innovative technologies by payment providers to increase access to instant payments, and using instant payment systems for their own transactions where appropriate – for example, in the context of distribution of disaster, emergency or other government-to-consumer payments.”

It added that “the National Science Foundation (NSF) will back research in technical and socio-technical disciplines and behavioral economics to ensure that digital asset ecosystems are designed to be usable, inclusive, equitable, and accessible by all.” Meanwhile, the administration is ramping up efforts to tackle illicit finance including money laundering and ransomware crimes among others.

Per the release, “the President will evaluate whether to call upon Congress to amend the Bank Secrecy Act (BSA), anti-tip-off statutes, and laws against unlicensed money transmitting to apply explicitly to digital asset service providers—including digital asset exchanges and nonfungible token (NFT) platforms.”

In addition, the plan to roll out a Central Bank Digital Currency (CBDC) is also on the sleeves of the Biden-Harris administration. On this note, it is stated that “the leadership of the Federal Reserve, the National Economic Council, the National Security Council, the Office of Science and Technology Policy, and the Treasury Department will meet regularly to discuss the working group’s progress and share updates on and share updates on CDBC and other payments innovations.”

Follow us on Twitter, Facebook, Telegram, and Google News