A recent survey conducted by EY-Parthenon revealed an increase in institutional investor interest in XRP. Over 20% of the surveyed decision-makers disclosed holding XRP in their portfolios, a substantial uptick from previous years.

This development, highlighted by XRP community pundit WrathofKahneman, underscores a growing trend toward diversification within the cryptocurrency market.

The survey, conducted in early March 2024, involved 277 institutional investors from around the globe, including CEOs, COOs, and portfolio managers.

Respondents represented a diverse range of financial institutions, such as wealth managers, family offices, traditional asset managers, hedge funds, and asset owners. The data provides a comprehensive snapshot of the current landscape of institutional investment in cryptocurrencies.

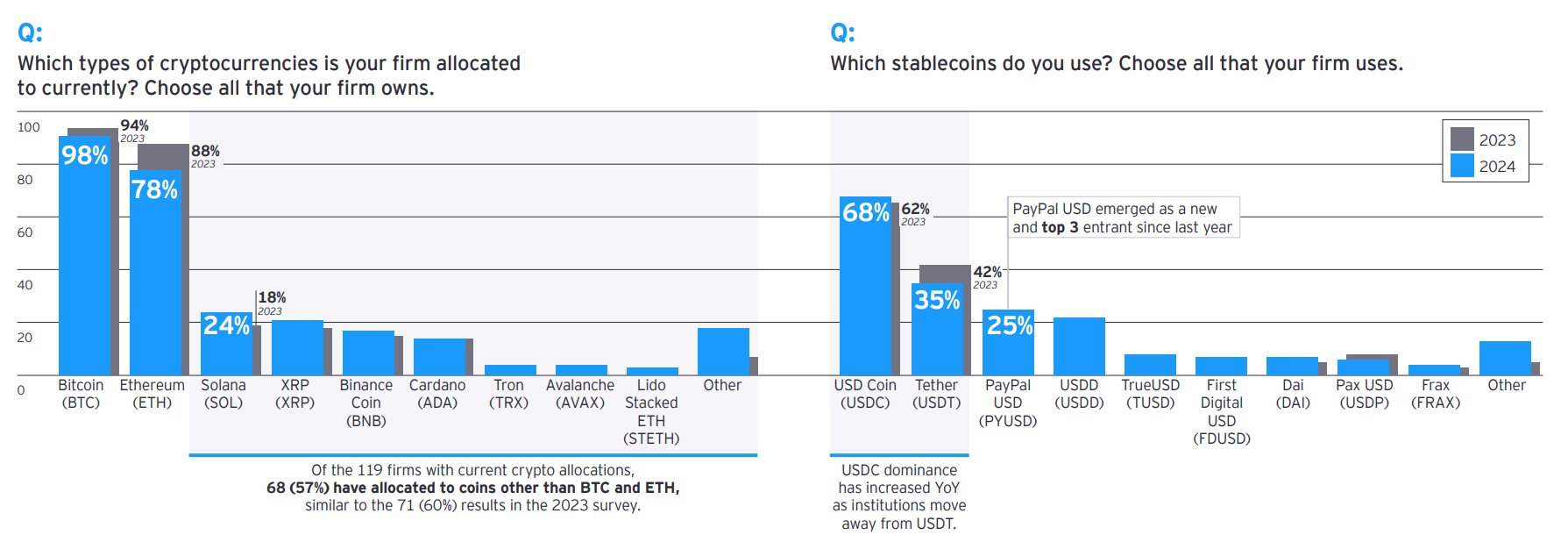

The survey uncovered a notable shift in investor preferences. While Bitcoin and Ethereum continue to dominate the market, a significant proportion of respondents have allocated funds to alternative cryptocurrencies, including XRP.

In particular, 57% of respondents have invested in coins beyond the top two, and family offices were even more likely to favor alternative options, with 68% expressing a preference for XRP. This suggests a growing recognition of the potential benefits of diversifying cryptocurrency portfolios beyond the traditional leaders.

Despite the growing interest in alternative cryptocurrencies, Bitcoin and Ethereum remain the most popular choices among institutional investors. 98% of respondents reported holding Bitcoin, and 78% disclosed an allocation to Ethereum.

This reflects the established market position and perceived security of these two cryptocurrencies. Solana and XRP followed, with 24% and 20% respectively, indicating a growing interest in these emerging projects.

The survey also shed light on the evolving stablecoin market. USDC has gained significant traction among institutional investors, surpassing Tether in terms of market share.

This shift can be attributed to factors such as increased regulatory scrutiny of Tether and the growing preference for USDC’s transparency and backing. PayPal USD emerged as another prominent player in the stablecoin space, offering a convenient and accessible option for institutional investors.

The survey indicated that institutional investors plan to maintain their current allocation levels to digital assets in the short term. However, a significant increase in allocation is anticipated over the next three years. This suggests a growing confidence in the long-term prospects of the cryptocurrency market.

The EY-Parthenon survey highlights a growing trend among institutional investors towards diversification and willingness to explore alternative cryptocurrencies like XRP. We will likely see further adoption of digital assets by traditional financial institutions.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

Crypto analyst Egrag Crypto has shared a detailed Elliott Wave analysis of XRP, predicting significant…

A financial expert has argued that institutions would expand their crypto investment strategies beyond Bitcoin…

Bitcoin rose by 2% to $81,830.3 on Wednesday, offering only a brief reprieve as traders…

Discussions are ongoing between the U.S. Securities and Exchange Commission (SEC) and Ripple regarding a…

The winds of change are blowing through the crypto market, and those paying attention know…

The crypto industry has proven to be a lucrative venture that can turn small investments…