Grayscale Investments, the world’s largest asset management firm, has recently updated its Crypto Sector framework, shedding light on the evolving cryptocurrency landscape and drawing attention to the distinctions between digital assets and traditional fiat currencies. Notably, the absence of Ethereum (ETH) in Grayscale’s framework has raised eyebrows within the industry.

Grayscale’s framework update emphasizes the core difference between cryptocurrencies and fiat currencies – the absence of government control over digital assets.

Read Also: Return of XRP Digital Large Fund: Next Grayscale Likely Grand Move after Victory Against SEC

Unlike fiat currencies, which are subject to central banks’ influence through monetary policy and interest rate adjustments, cryptocurrencies operate independently, driven by their inherent protocols and decentralized networks.

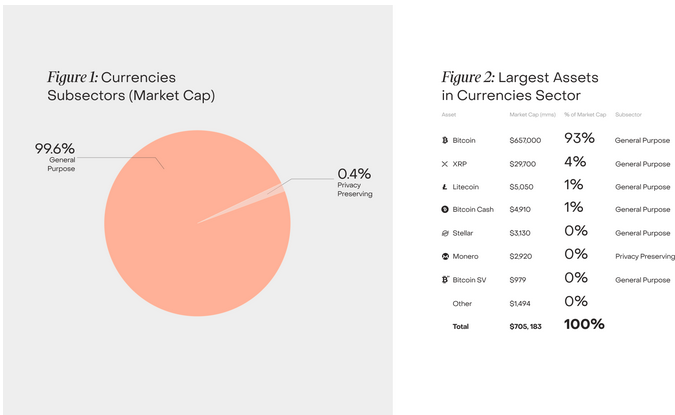

Grayscale’s update puts a spotlight on the potential of XRP as a compelling alternative to the traditional SWIFT system for cross-border payments. The report recognizes XRP’s ability to facilitate fast and cost-effective international transactions, positioning it as a competitive contender in the global payments arena.

In the report, Grayscale noted, “XRP aims to offer fast cross-border payments at lower transaction costs than competitors”

The exclusion of Ethereum from Grayscale’s Crypto Sector framework has sparked discussions within the crypto community.

Ethereum (ETH), the second-largest cryptocurrency by market cap, plays a vital role in the decentralized finance (DeFi) ecosystem. Grayscale’s decision to exclude Ethereum has left many wondering about the firm’s reasoning behind this choice.

Grayscale’s renewed recognition of XRP’s potential has reignited speculation about the firm’s stance on the digital asset. It is worth noting that Grayscale previously held XRP in its GDLC product and XRP Trust but discontinued support for the asset in January 2021 following the SEC’s lawsuit against Ripple.

Although Grayscale has not explicitly indicated a change in its stance on XRP, the recent report highlighting its strengths as a cross-border payment solution suggests a possible shift in sentiment. Moreover, the exclusion of Ethereum from its framework adds weight to the notion that Grayscale may be reevaluating its portfolio holdings.

Read Also: Jeremy Hogan Makes Clear Clarification Over Fake BlackRock “XRP ETF” Trust

Grayscale’s latest Crypto Sector framework update demonstrates the firm’s commitment to providing investors with comprehensive insights into the evolving crypto landscape.

The report’s emphasis on XRP’s potential as a cross-border payment solution and the exclusion of Ethereum have sparked discussions within the crypto community, fueling speculation about Grayscale’s potential reconsideration of its stance on these digital assets.

As the crypto industry continues to mature, Grayscale’s position as a leading investment firm will undoubtedly influence investor sentiment and shape the trajectory of the crypto space.

Follow us on Twitter, Facebook, Telegram, and Google News

Anticipation is building within the XRP community, as new signals point toward an exciting announcement…

Bitcoin is flashing a major bullish signal as key on-chain data points to intensified investor…

The idea of a "Great Reset" has long hovered at the edges of financial and…

After months of uncertainty, April 2025 is giving crypto investors a reason to smile again.…

Top meme coins like Shiba Inu (SHIB) and Dogecoin (DOGE) have recorded notable gains as…

A bold new forecast is shaking the crypto community. According to a recent post by…