The evolving relationship between the BRICS nations (Brazil, Russia, India, China, and South Africa) and the U.S. dollar has drawn the attention of financial analysts and crypto enthusiasts.

Recent discussions about BRICS countries potentially reducing their reliance on the U.S. dollar for international trade have sparked significant debate on the future of global finance.

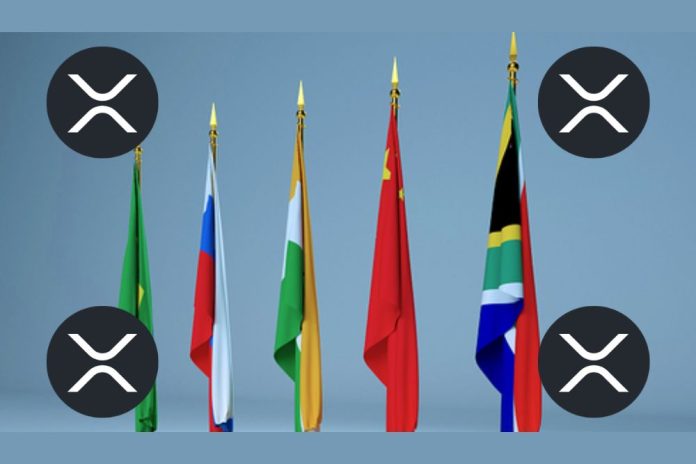

One notable voice in the cryptocurrency community, Amelie (@_Crypto_Barbie), a prominent pundit on X, recently posted on X about the implications this shift might have for XRP, Ripple’s digital currency. She suggested that if BRICS adopts a digital currency for cross-border transactions, XRP could emerge as a strong contender.

Amelie posted a video with comments from U.S. Representative Marjorie Taylor Greene, who raised concerns about the BRICS nations’ potential to disrupt the global dominance of the dollar.

WOW! 💥

„The BRICS nations have an agreement, they‘re going to stop trading in the Dollar!

Wait until all of these countries stop trading in the Dollar – Inflation will be out of control!“#XRP would be in the top contenders' list if BRICS countries choose a digital currency… pic.twitter.com/0VcckpLoWa

— 𝓐𝓶𝓮𝓵𝓲𝓮 (@_Crypto_Barbie) October 13, 2024

Greene’s warning that this shift could lead to uncontrolled inflation in the U.S. was accompanied by speculation that BRICS may develop an alternative currency for international trade.

While Greene focused on the economic threats to the U.S., Amelie highlighted an opportunity for XRP and its role in the evolving financial landscape.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Will BRICS Adopt XRP?

XRP has long been touted as a solution for fast, low-cost international payments, addressing inefficiencies in the current financial system. Ripple, the company behind XRP, has developed partnerships with financial institutions globally, advocating for XRP as a bridge currency in cross-border transactions.

Amelie’s post suggests that if BRICS adopts a digital currency for a new payment system, XRP could be an ideal candidate due to its established infrastructure and ability to facilitate swift and secure transactions.

One of XRP’s key advantages is its scalability and the efficiency of its ledger. Transactions on the XRP Ledger can be settled in seconds, making it highly competitive compared to traditional payment systems. Additionally, its low transaction costs are appealing to both financial institutions and businesses that need to send money across borders frequently.

Should BRICS explore alternatives to the U.S. dollar, XRP’s potential as a bridge currency could help streamline transactions between the member countries’ diverse currencies. Many in the community are confident that BRICS will adopt XRP, and a prominent crypto CEO recently predicted that this would happen by 2025.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News