The Ethereum price surged to $2,720 this week as $224 million worth of assets exited exchanges, the largest outflow in two years. SEC delays on ETH ETF approvals have pushed institutional focus toward emerging opportunities.

Strategists believe this capital shift could spotlight hybrid platforms like DTX Exchange (DTX), which has raised $13.7 million in its presale stage. With Ethereum’s regulatory hurdles stalling short-term momentum, insiders consider DTX’s potential no KYC requirements and 1000x leverage on stocks, crypto, and ETFs a compelling alternative. As traditional finance merges with decentralized tools, early investors see potential in its unified approach to global markets.

Ethereum Price Surge Sparks Bullish Momentum for ETH ETF Approval

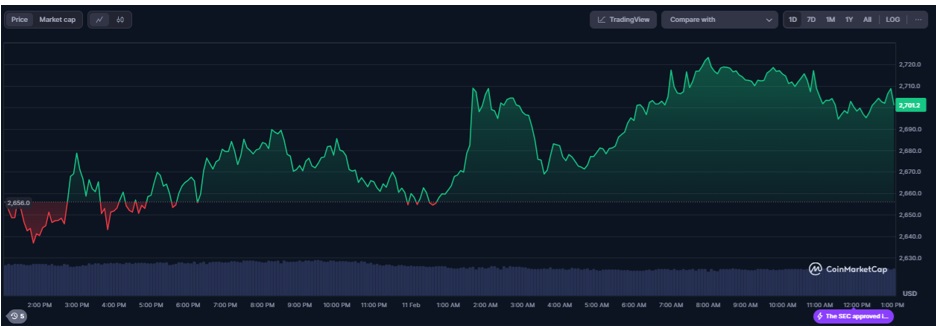

Ethereum price trends have reenergized debates regarding possible decisions to approve an Ethereum ETF. The Ethereum market fell below $2,710 throughout the week, which led to a minimal 2.50% decline while market prices shifted. Reviewers believe this trend in Ethereum price changes could strengthen the case for regulatory approval as institutions increasingly view Ethereum’s stability as a positive signal.

Source: Ethereum price, CoinMarketCap

The U.S. Securities and Exchange Commission (SEC) recently extended its review period for ETH ETF options until April 2025, citing the need for deeper analysis. While this delay might seem discouraging, experts believe there is growing institutional interest in Ethereum’s ecosystem. This growth is evidenced by $224 million in Ethereum withdrawn from exchanges, which could pressure regulators to greenlight the ETH ETF sooner.

An approved ETH ETF would likely attract significant capital, mirroring the success seen in Bitcoin ETF launches earlier this year. Market observers note that Ethereum’s network upgrades, such as reduced gas fees and improved scalability, further bolster its case.

With transaction costs at a five-year low, Ethereum is becoming more accessible for everyday users and large-scale applications alike. These developments lend credence to the idea that an ETH ETF could act as a bridge between traditional finance and decentralized technologies.

Solana Investors Explore Alternatives as Market Sentiment Shifts

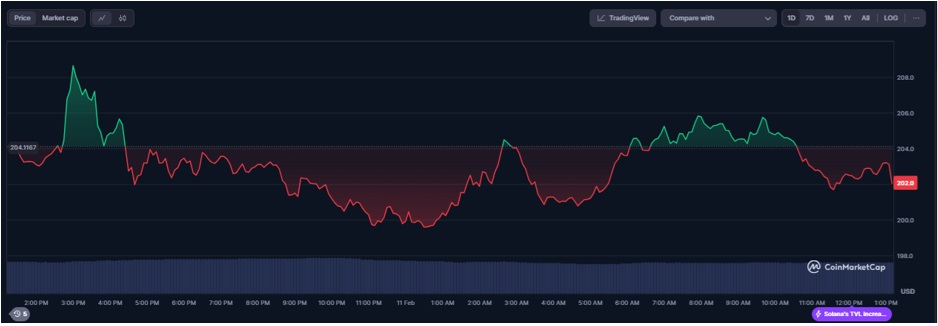

Some investors are now reevaluating their investment in Solana (SOL) due to its price swings. SOL declined to below $200 during the first part of January before it faced difficulties in recovering strength, as it currently trades at $202. Stakeholders have started looking for alternative solutions that merge swift operations with dependable systems because of network delays alongside high validator costs.

Source: SOL price, CoinMarketCap

One such option gaining attention is DTX Exchange. While Solana remains a leader in decentralized applications, its recent technical challenges highlight the risks of relying solely on single-blockchain ecosystems. Industry analysts are betting on platforms that merge centralized efficiency with decentralized security, a niche where DTX’s hybrid infrastructure could excel.

Solana’s 30-day performance, down 19%, contrasts sharply with DTX’s presale growth, which has surged 700% since January. This divergence underscores a transition in investor priorities. Projects offering real-world utility and cross-market accessibility are increasingly favored over those limited to niche crypto sectors.

DTX could avoid Solana’s scalability issues by leveraging distributed liquidity pools and 1000x leverage capabilities. For traders seeking stability during market swings, this could position the altcoin as the best option compared to volatile Layer-1 tokens.

DTX Exchange Presale Gains Traction With Hybrid Trading Innovations

The DTX Exchange presale could likely become one of 2025’s standout crypto events, raising $13.7 million ahead of its official launch. Costing $0.16 per token, the project’s distinctive value proposition is its hybrid model, which has the potential to integrate conventional assets, such as stocks and ETFs, with cryptocurrencies within one platform.

The main features that could generate interest include non-custodial wallets, no KYC obligations, and the availability of institutional-level liquidity. These elements will address common pain points in both decentralized and centralized exchanges, offering a seamless experience for retail and professional traders.

Researchers think the platform’s upcoming tokenized ETF trading could disrupt traditional finance by democratizing access to high-value markets. Comparisons to Solana and Ethereum are inevitable, but DTX could differentiate itself through speed and versatility.

The project’s VulcanX blockchain could process 200,000 transactions per second, outpacing Ethereum’s 15–45 TPS and Solana’s theoretical 65,000 TPS. Such technical advantages, combined with a $0.20 listing price target, suggest DTX could deliver returns that rival even the most optimistic ETH ETF projections.

Conclusion

While Ethereum price movements and the ETH ETF delays dominate headlines, forward-looking traders are eyeing platforms that blend innovation with accessibility. With presale tokens still available at $0.16 and hybrid features that could redefine trading, strategists believe early participation could unlock significant advantages post-launch.

For those weighing Ethereum’s regulatory uncertainties against actionable opportunities, exploring DTX’s model might offer clarity.

Learn more:

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.