Aave Labs just became one of the first DeFi giants to crack Europe’s MiCA regulation, unlocking zero-fee stablecoin conversions across the continent. Coinbase is fighting back against banking groups trying to ban stablecoin rewards, calling the move un-American, while Bitfarms stock tanked 18% after ditching Bitcoin mining for AI.

And DeepSnitch AI is already at the helm. The presale has raised over $527K at $0.02289, with 51% gains from $0.01510. Its SnitchFeed agent is now live and catching whale moves in real time, with 100x potential backed by operational tools, not illusions or false promises.

DeFi gets regulated, miners abandon Bitcoin

Aave’s Push service can now convert euros to crypto with zero fees after securing MiCA approval from Ireland’s Central Bank. That’s a direct shot at traditional exchanges charging merchants billions annually.

Meanwhile, US banking lobbyists asked regulators to ban cashback tied to stablecoin payments, worried that widespread adoption could drain over $6 trillion from traditional banking. Coinbase called it protectionism disguised as regulation.

And Bitfarms announced its shuttering of Bitcoin operations over the next two years to pivot entirely into AI compute. The company posted a $46 million Q3 loss, and its stock dropped 18% on the news.

DeepSnitch AI 100x potential, Ethereum and Chainlink outlooks

-

DeepSnitch AI 100x potential and tools shipping already

Although still in the early days of its presale, with plenty of room to run, DeepSnitch AI is already operational. One of its snitches, or AI agents designed by on-chain experts to source crucial information for retail traders, SnitchFeed is streaming live alerts in the internal environment, catching whale moves and sentiment shifts before they cascade through Twitter.

The DSNT growth outlook holds so much promise with this utility-driven, working infrastructure. Its rare and sophisticated AI-based market prediction capability gives traders a sharp edge, one they’ve needed for a long time to contend with elite intelligence until now only accessible to whales and institutions.

The presale raised over $527K and delivered 51% gains at $0.02289 while most competitors are still in testnet at this stage. Its AI-based market prediction infrastructure is audited, operational, and shipping features early enough to prove its trustworthiness beyond a shadow of a doubt.

November launches crypto’s historically best six months. DeepSnitch AI holds AI-based market prediction capabilities that retail needs in a market littered with scams. This is its holding power, and at this early stage in the presale, it’s a clear mark of a moonshot in the making.

2. Ethereum: Network activity declines amid ETF competition

Priced at around $3,170 in mid-November, ETH has declined substantially since earlier in the month, and even more so since October. The network saw transactions drop 23% over 30 days while active addresses fell 3%.

Network fees also collapsed 88% from their late-2024 peak of $70 million per week, hammering staking yields. The Ethereum price prediction for 2026 will be contingent on whether the Fusaka upgrade delivers clarity on how ETH holders benefit from layer-2 scaling solutions.

Traders are questioning whether Ethereum’s dominance in total value locked will translate into higher DApp revenues. With XRP, BNB, and Cardano launching ETFs, Ethereum faces intensifying competition for institutional capital.

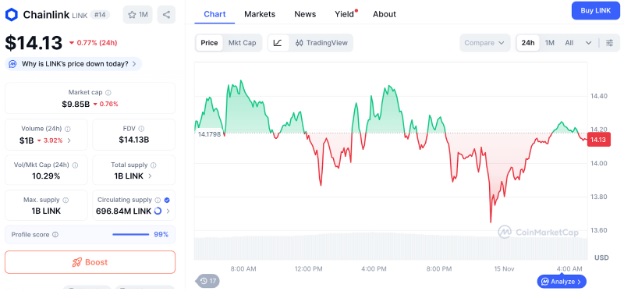

3. Chainlink: Oracle infrastructure eyes ETF and institutional growth

Trading at approximately $14.2 on November 14, Chainlink has been maintaining its position as the industry-standard oracle network.

Recent momentum includes potential for a Chainlink ETF and integrations with institutions like the US Department of Commerce and S&P Dow Jones.

The protocol has secured tens of trillions in transaction value since launch and actively secures the majority of DeFi protocols across blockchains. And mainstream organizations like Swift, J.P. Morgan, Mastercard, and Euroclear have partnered with Chainlink to build tokenization infrastructure.

But whether Chainlink maintains oracle dominance as competitors emerge remains to be seen. And with a market cap approaching $10B, explosive gains are far easier found elsewhere, especially among utility-based presales with all the room in the world still to run.

Last reflections

Aave unlocked zero-fee euro-to-crypto conversions. Coinbase is battling banks over stablecoin rewards, and Bitfarms abandoned mining for AI.

At the centre of this infrastructure change, DeepSnitch AI has 100x potential and is backed by operational tools, not speculation, and no smoke and mirrors.

At $0.02289 with 51% gains delivered and over $527K raised, the DSNT growth outlook offers asymmetry that mature coins can’t match. With AI-based market prediction infrastructure already deployed and the presale launching during November’s historically strong crypto period, DeepSnitch AI offers infrastructure in a sector projected to hit $1.5 trillion in AI spending by year’s end.

Visit the website for more info or to buy into the presale, or keep up with X and Telegram for official updates.

FAQs

Does DeepSnitch AI have 100x potential?

With working AI agents, live staking, 51% presale gains, and a $0.02289 entry price, there’s plenty of reason to believe in DeepSnitch AI’s 100x potential as the platform scales and institutional AI spending accelerates toward $1.5 trillion.

What is the DSNT growth outlook for 2026?

The DSNT growth outlook is supported by its operational tools, over 10.9 million tokens already staked, regulatory compliance through audits, and positioning as infrastructure in the AI x crypto sector during typically strong market months.

Is AI-based market prediction accurate through DeepSnitch AI?

AI-based market prediction through DeepSnitch AI uses live data feeds, sentiment analysis, whale tracking, and contract scanning to provide real-time intelligence, giving traders an edge through information asymmetry rather than speculation.

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.