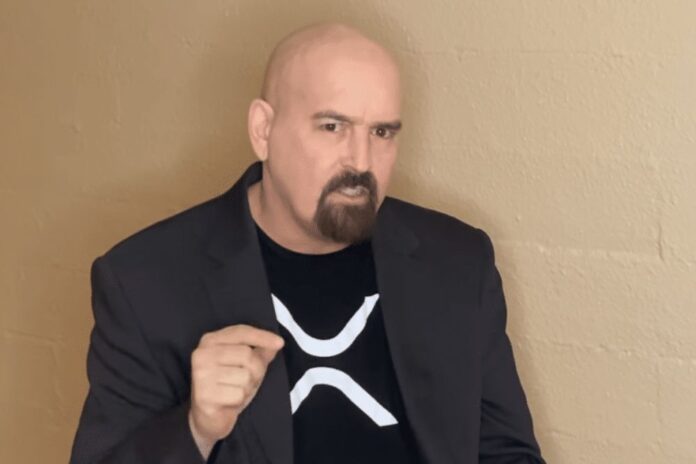

Prominent crypto lawyer and XRP enthusiast John Deaton has made a significant change in his cryptocurrency portfolio. Breaking away from his previous inclination towards Ethereum (ETH), Deaton has now shifted his investment focus to XRP, allocating a larger portion of his holdings to the digital asset designed for cross-border payment.

This decision is driven by his strong belief in the long-term potential of XRP and ability to disrupt the global payments landscape.

Read Also: Pro-XRP John Deaton Shares Likely Timeline For Ripple-SEC Case Final Judgement

Deaton’s Momentous Shift in Investment Choice

Once favoring Bitcoin and Ethereum, Deaton has now redirected his attention towards XRP, increasing his holdings in the digital asset. This strategic move is underpinned by Deaton’s unwavering conviction in the long-term prospects of XRP, despite the prevailing market sentiment.

To people’s surprise, back then, I owned 10X more in #BTC than #XRP and 3-4X more in #ETH than #XRP.

Today, I still own more in #BTC than #XRP but now I own significantly more in #XRP than I do #ETH.

— John E Deaton (@JohnEDeaton1) November 8, 2023

XRP vs. Ethereum: A Paradigm Shift in Deaton’s Portfolio Allocation

Deaton’s decision to prioritize XRP over Ethereum marks a significant departure from conventional wisdom within the crypto realm.

Ethereum, the second-largest cryptocurrency by market capitalization, has long been hailed as a leader in the smart contracts space. However, Deaton’s conviction in XRP’s potential to revolutionize cross-border payments has prompted him to reallocate his investments.

XRP: The Chosen Contender in Cross-Border Payments

Deaton’s unwavering belief in XRP’s potential stems from its suitability for cross-border payments. He cites the staggering volume of cross-border transactions, which exceeded $2.8 trillion in 2021 alone, as evidence of the immense opportunity for disruption and innovation in this market.

XRP’s speed, scalability, and cost-effectiveness make it an ideal solution for facilitating seamless cross-border transactions, with settlement times measured in seconds and transaction fees significantly lower than traditional methods.

Read Also: Pro-XRP Lawyer John Deaton Predicts Another Notable Defeat for the SEC

XRP’s Long-Term Value Appreciation: Deaton’s Optimistic Outlook

Deaton envisions a bright future for XRP, as the cross-border payments market is projected to reach a staggering $290 trillion by 2030. He firmly believes that XRP has the potential to capture a significant share of this market, despite its current lethargic growth.

Just how big has the cross-border payments market been in 2023?

USD: $190 trillion

Global payments are expected to skyrocket from USD $190 trillion in 2023 to a staggering USD $290 trillion by 2030.

– FXC Intelligence, Cross-border payments market sizing data.Oct 31, 2023.

— John E Deaton (@JohnEDeaton1) November 8, 2023

While Deaton does not align himself with the most overly optimistic price predictions for XRP, his optimism about its long-term prospects remains steadfast.

Deaton’s Bold Investment Strategy: Challenging Conventional Wisdom

Deaton’s investment strategy, which defies conventional wisdom, is a bold and calculated move. By prioritizing XRP over Ethereum, he is betting on the digital asset’s ability to capitalize on the growth of the cross-border payments market.

Additionally, Deaton maintains unwavering confidence that XRP will emerge victorious from the ongoing legal battle with the SEC, further bolstering its prospects in the eyes of investors.

Follow us on Twitter, Facebook, Telegram, and Google News