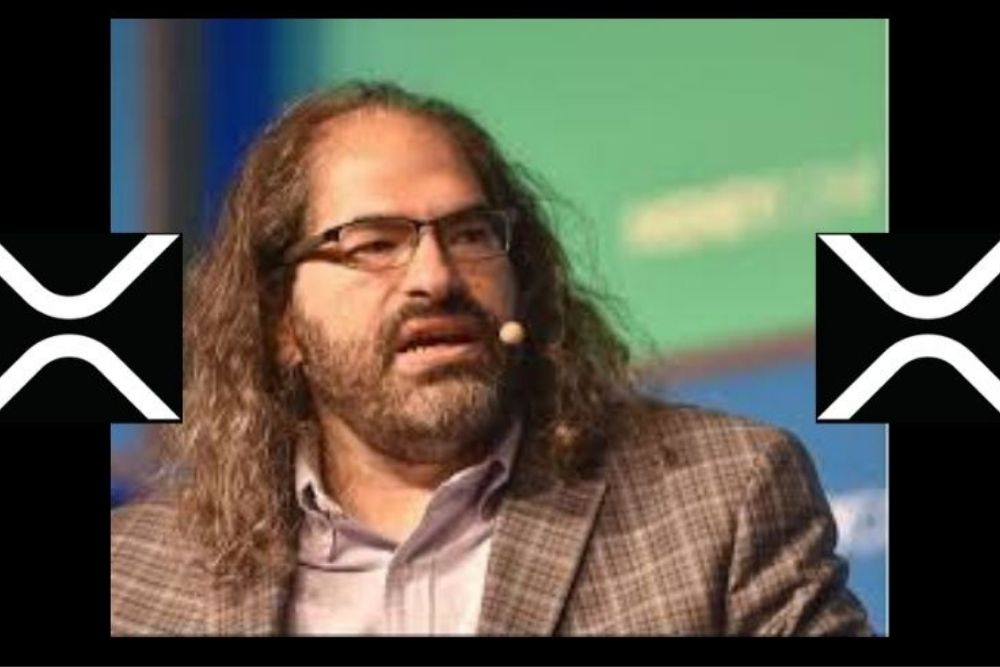

In a recent discussion on X, David Schwartz, Ripple’s Chief Technology Officer (CTO), addressed accusations regarding Ripple’s XRP sales and transparency. The discussion stemmed from concerns about the state of the XRP Ledger (XRPL) and its support for infrastructure providers.

A community member expressed dissatisfaction with the current state of the XRPL. He argued that Ripple’s actions have led the XRPL to evolve into an ecosystem lacking sufficient financial and on-chain support for entities maintaining the network’s infrastructure.

Read Also: Ripple CTO Responds to Allegations that Ripple Paid Six Exchanges $1M – $5M to List XRP

These comments followed the decision by XPUNKS, an XRP Ledger-based Non-Fungible Token (NFT) project, to migrate to the Solana blockchain. The creators of the Onledger project echoed these sentiments, placing some of the blame for the XRPL’s situation on Ripple.

Onledger further alleged that Ripple poses the biggest threat to the XRPL. They claimed that Ripple intends to use a proposed Ethereum Virtual Machine (EVM) sidechain to obfuscate future XRP sales. For context, Ripple partnered with Peersyst Technology to develop an EVM sidechain for the XRPL.

Onledger contends that the blockchain payments firm seeks the EVM sidechain’s implementation to wrap XRP tokens, enabling them to sell these assets discreetly. This theory is presented despite Ripple’s cautious approach with Hooks, a solution that would introduce smart contract functionalities directly to the XRPL.

Unlike several established blockchains, the XRP Ledger lacks smart contract capabilities. Onledger suggests that Ripple’s opposition to smart contracts stems from a desire to maintain the ability to sell XRP tokens without public scrutiny.

Responding to these claims, Schwartz emphasized that Ripple does not need such elaborate schemes to conceal XRP sales. He clarified that the company could easily sell XRP on exchanges with fewer transparency requirements, bypassing on-chain transactions.

Onledger countered this argument, suggesting that Ripple wouldn’t achieve anonymity through exchange transactions. While Schwartz acknowledged that exchanges would be aware of Ripple’s involvement, he maintained that the public wouldn’t necessarily be privy to this information.

Read Also: Ex-SEC Official States Key Factor That Could Ignite SEC’s Interest in XRP Lawsuit Settlement

Historically, Ripple’s XRP sales have been publicly accessible. On-chain data provides a record of most transactions involving Ripple’s XRP holdings. Previously, the company even published quarterly reports detailing XRP sales.

The debate surrounding Ripple’s XRP sales and transparency highlights the importance of clear communication within the XRP ecosystem. These problems extend to other areas, as some in the community believe that Ripple’s sales practices, particularly those involving bots and institutional investors, contribute to XRP’s price suppression. However, many industry experts strongly refute this claim. Additionally, Schwartz confirmed that Ripple has discontinued these institutional sales.

Follow us on Twitter, Facebook, Telegram, and Google News

What’s the next big thing in crypto? With thousands of digital assets out there, only…

Meme coins have grown into a force to be reckoned with in the cryptocurrency world.…

Traders in the crypto arena recognize the importance of timing and sentiment when seeking the…

In the evolving landscape of digital finance, XRP, the native cryptocurrency of the Ripple network,…

CryptoBull, a well-known crypto analyst, recently posted about XRP’s price action, highlighting its prolonged consolidation…

The next big development in Ripple’s ongoing battle with the SEC may not just be…