Recent revelations in the ongoing Ripple vs. SEC lawsuit have brought scrutiny to the company’s use of market maker GSR for programmatic XRP sales.

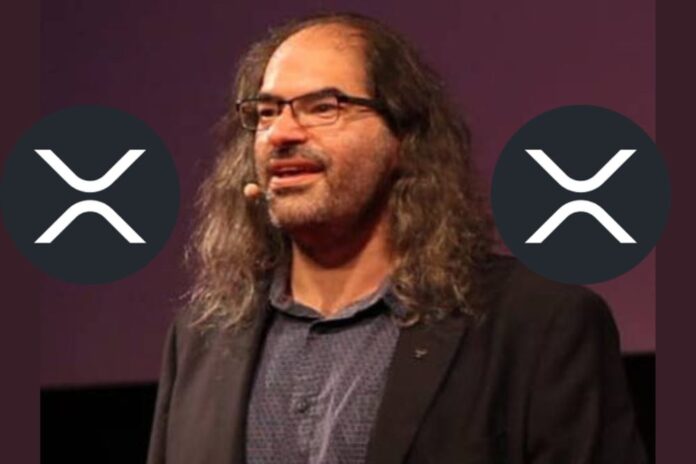

Emails suggest a decision to halt these sales in 2017, followed by a surge in XRP’s price, leading some to speculate about intentional price suppression. David Schwartz, Ripple CTO, has stepped forward for clarification.

Read Also: BitMEX’s Arthur Hayes: It’s Time To Get Back On Solana (SOL) Train

Shifting the Lens: Beyond Speculation

In a post on X, Schwartz acknowledges limited knowledge of the specific GSR email conversation but offers insights into possible motivations behind using a third party. He emphasizes that Ripple’s primary concern was avoiding accusations of price manipulation, a risk they might have faced if they directly sold the tokens.

Direct sales could have fueled claims of using insider information to influence XRP’s price. By delegating to GSR, Ripple aimed to distance itself from such allegations. They instructed GSR to execute sales to minimize market impact, avoiding large-scale, rapid offloads.

Schwartz underlines that this delegation wasn’t micromanagement; Ripple didn’t control GSR’s specific trading strategies. The email exchange reflected GSR’s proposed approach to minimizing price impact.

When the government tries to prove something, they get documents from everyone even remotely connected to the thing they're trying to prove. They take the most damning statement they can find anywhere and show it as if it was typical of every conversation on the topic.

One of…

— David "JoelKatz" Schwartz (@JoelKatz) February 20, 2024

Absence of Charges: Does it Indicate Innocence?

Schwartz further highlights the absence of price manipulation charges in the SEC’s lawsuit against Ripple. He argues that if evidence truly existed, the SEC, known for exhaustive investigations, would have included such accusations.

The current lawsuit solely focuses on unregistered securities sales, suggesting the email correspondence might not hold the weight some attribute to it.

An X user and Crypto enthusiast, @XRPJulian, thanked Schwartz for the explanation. He said, “David Schwartz is Ripple and XRP’s biggest asset. It is wonderful that he engaged in this quite rough thread, and sometimes rough talk is constructive for both sides. Thank you to both of you.”

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Shiba Inu Lead Developer Addresses Major Concerning Issue Within The Community

Clarity Through Context: Understanding the Complexities

While Schwartz’s explanations shed light on potential motivations, it’s crucial to remember the ongoing legal battle and the complexities involved. Definitive conclusions are difficult to draw at this stage.

It’s essential to consider all perspectives, including potential emerging counterarguments. Remember, the legal system thrives on robust debate and thorough examination of evidence.

Ultimately, time and the legal process will reveal the whole picture. Until then, responsible investors should approach all information critically, researching and avoiding decisions based solely on speculation.

Follow us on Twitter, Facebook, Telegram, and Google News.