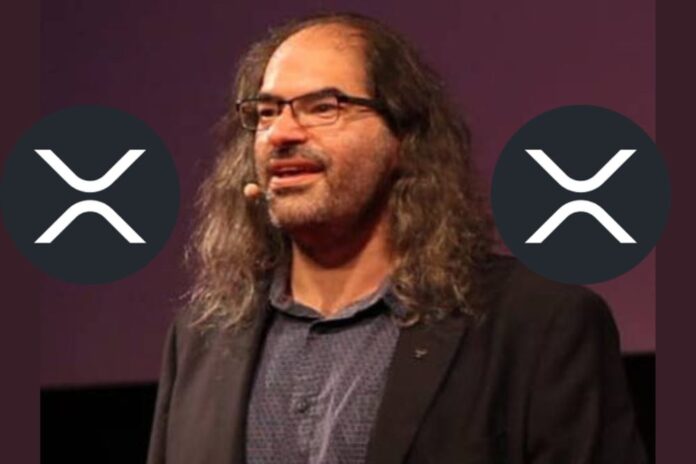

A community member recently expressed concern over interpretations of Ripple Chief Technology Officer (CTO) David Schwartz’s past statements. Some community figures believed Schwartz previously implied that XRP didn’t require a high price for efficient payments.

Schwartz addressed two key topics: XRP’s ideal price point for payment functionality and the potential classification of Ethereum as a security. The CTO sought to dispel a lingering misconception regarding Ripple’s stance on XRP’s price for payment processing. He emphasized the illogical nature of the argument suggesting Ripple prefers a lower XRP price.

Read Also: SEC Says Battle On XRP Classification Remains On The Table As Penalty Phase Knocks

Clarifying his position on XRP’s price, Schwartz acknowledged a 2017 statement where he pointed out XRP’s utility in payments renders it unsuitable for being “dirt cheap.”

It *can't* be dirt cheap. That doesn't make any sense. If XRP costs $1, they'd need a million XRP which would cost $1 million. If XRP cost a million dollars, they'd need one XRP which would, again, cost $1 million. 1/2

— David "JoelKatz" Schwartz (@JoelKatz) November 20, 2017

Ripple CTO reiterated his belief that a higher XRP price strengthens its practicality in facilitating payments and acting as an intermediary asset.

Schwartz elaborated that his past comments aimed to counter misconceptions held by some XRP holders. These individuals believed Ripple desired a low XRP price for efficient transactions. Some even harbored theories of Ripple manipulating the price through trading bots. Schwartz dismissed these claims and tagged them entirely illogical.

Schwartz explained that a higher XRP price translates to faster transaction settlement times and lower fees within the RippleNet network. This efficiency becomes increasingly crucial as transaction volume scales.

Ethereum’s Potential Security Classification

Schwartz’s comments on XRP pricing were part of a broader conversation regarding cryptocurrency regulations. A key point of discussion was the potential classification of Ethereum as a security by the U.S. Securities and Exchange Commission (SEC).

Molly Elmore, Chief Marketing Officer at Valhill Capital, began the discussion with speculations surrounding potential maneuvers by Ethereum founders. She focused on the implications of a security classification for Ethereum, particularly concerning staking.

Elmore presented a hypothetical scenario involving Ethereum’s transition to a Proof-of-Stake (PoS) validation mechanism. She then connected this to the recent launch of BlackRock’s first tokenized fund on the Ethereum network, BUIDL.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: European Corporate Governance Institute Acknowledges XRP Non-Security Status

Elmore suggested a strategic link between these two events, which occurred nearly two years apart. She theorized that Ethereum insiders and BlackRock might be attempting to push institutional investors towards Ethereum by classifying ETH staking as a security offering. This, in turn, would restrict participation to accredited investors and institutions.

With the SEC potentially going after Ethereum, Ripple CEO Brad Garlinghouse recently asserted that the regulator will lose that fight. Schwartz weighed in on the conversation, expressing his bewilderment regarding the notion of staking as a security. He separated the concept of the token itself from the act of staking, emphasizing that staking is a service provided by the system, not a securities transaction.

Follow us on Twitter, Facebook, Telegram, and Google News