A recent post on X by prominent crypto personality Chad Steingraber has reignited discussions surrounding XRP’s prospects. Steingraber discussed the public supply of XRP and its potential influence on price. He highlighted a key distinction between the total supply of XRP (100 billion) and the readily available public supply on the open market.

XRP’s total supply is capped at 100 billion tokens. However, a significant portion, currently just under 40 billion XRP, is held in escrow accounts managed by Ripple. These escrows release XRP at a predetermined rate, ensuring a controlled influx into the public market. This mechanism aims to maintain predictability and stability within the XRP ecosystem.

Read Also: Market Strategist Predicts 50,558% XRP Rally to $250. Here’s Timeline

Public perception often equates total supply with readily available supply. Steingraber emphasizes the difference, suggesting the actual amount of XRP accessible for trading is considerably lower than the total figure.

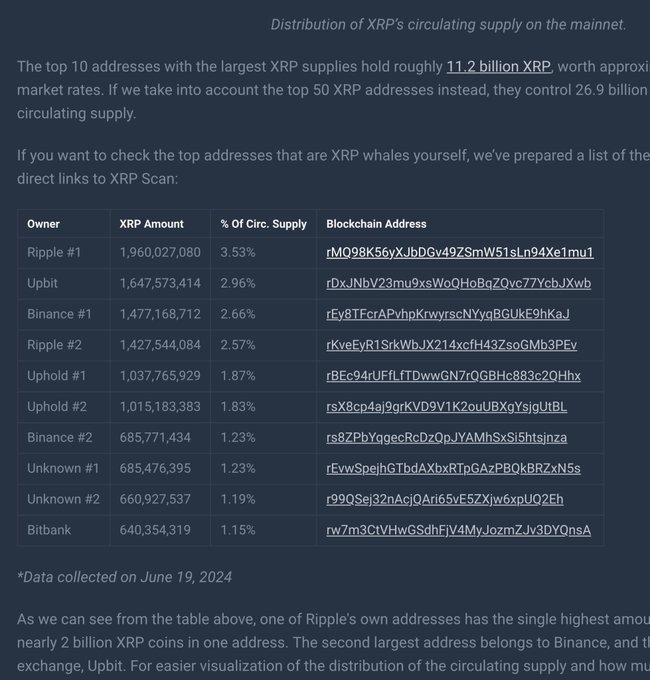

Steingraber further strengthens his argument by referencing the distribution of XRP within the public market. Analysis of wallet holdings reveals a concentration of XRP tokens amongst a limited number of whales.

The top 10 wallets reportedly control 11.2 billion XRP, representing 11.2% of the total supply, and the top 50 wallets hold 26.9 billion XRP, 26.9% of the total supply.

This concentration of ownership raises questions about the influence of retail investors on price movements. Traditionally, retail investors, comprising a larger group of individual buyers and sellers, play a significant role in determining an asset’s price through collective buying and selling activity.

Steingraber suggests that the growing dominance of whales, coupled with a limited public supply due to escrow, could create an environment of scarcity for XRP. Steingraber pointed out that retail investors determine the price of an asset, and believes that as the tokens available to retail investors reduce, the price will increase. He referenced an older post asking what XRP’s price would be if only 1 billion XRP were in circulation.

Read Also: Top Crypto Proponent Discusses What Could Happen If XRP ETF Is Approved

Steingraber’s analysis sheds light on an important factor that could significantly boost XRP’s price. Ripple, XRP’s parent company, is currently involved in a legal dispute with the U.S. Securities and Exchange Commission (SEC), which has lowered institutional investment in the token.

The end of the lawsuit could bring an influx of institutional investment, increasing the number of whales in the ecosystem. This would lower the amount of XRP available to retail investors, potentially raising the price significantly as Steingraber predicts.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News

Ali Martinez (@ali_charts), a well-known crypto analyst on X, recently shared an updated technical view…

Crypto enthusiast WrathofKahneman (@WKahneman) recently commented on a possible shift in XRP’s price behavior, following…

Versan Aljarrah, co-founder of Black Swan Capitalist, has emphasized the long-standing complementary relationship between XRP…

Prominent pro-crypto attorney John E. Deaton has published a detailed response to Coinbase Institutional’s recent…

John Squire, a social media influencer with a growing presence in the digital asset space,…

Crypto analyst Egrag Crypto has shared a detailed technical analysis predicting that XRP could reach…