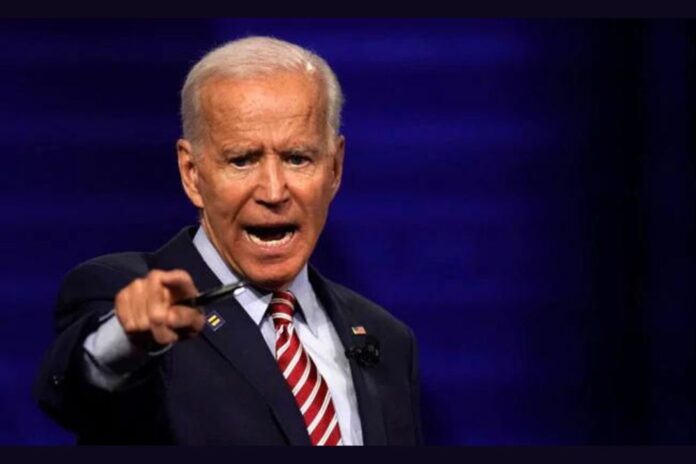

In response to the President’s Executive Order on ensuring responsible development of digital assets, U.S regulators have collaborated to develop a framework for international crypto regulation which was presented to President Joe Biden on July 7.

Framework for International Crypto Regulation

Per a report, a framework for international crypto regulation was drafted and submitted to the President of the United States on July 7.

We Are On Twitter: Follow Us

The document crafted by several agencies summarizes all approaches the United States administrators intend to employ in maintaining high regulatory standards and a level playing ground in the digital assets industry.

As revealed in the fact sheet, this crypto regulatory framework seeks to primarily address the risks as well as harness the potential benefits of cryptocurrency and blockchain technology.

Also, it is directed at enhancing the adoption of global principles and standards in the cryptocurrency space.

More so, approaches laid out in the framework are intended to ensure that “the nation’s core democratic values are respected; consumers, investors, and businesses are protected; appropriate global financial system connectivity and platform, as well as architecture interoperability, are preserved.”

Meanwhile, the safety and soundness of the global financial system and international monetary system have also been put into consideration.

Other core objectives of the framework as stated in the document include the protection of the United States and global financial stability as well as, the mitigation of illicit finance and national security risks posed by the misuse of digital assets.

The press release further disclosed that U.S. regulators have set out to support technological advances that promote responsible development and use of digital assets by advancing research and relationships that increase shared learning.

Above all, protecting consumers, investors, and businesses in the United States and globally by promoting technology and regulatory standards that reflect U.S. values is a top objective.

To achieve these planned goals, U.S. administrators noted that the United States must continue to engage and partner with the G7, G20, IMF, Financial Stability Board, Financial Action Task Force (FATF), the Egmont Group of Financial Intelligence Units (FIUs), Organization for Economic Cooperation and Development (OECD), the World Bank and other standard-setting bodies.

Part of the fact sheet said;

“The United States must continue to work with international partners on standards for the development of digital payment architectures and CBDCs to reduce payment inefficiencies and ensure that any new payment systems are consistent with U.S. values and legal requirements.

Such international work should continue to address the full spectrum of issues and challenges raised by digital assets, including financial stability; consumer and investor protection, business risks; money laundering, terrorist financing, proliferation financing, sanctions evasion, and other illicit activities.”

Notably, the submitted blueprint was developed in accordance with the President’s Executive Order, by the United States Department of the Treasury, in consultation with other administrators of bureaus like the U.S. Agency for International Development (USAID), the Secretary of State, the Secretary of Commerce, and the heads of other relevant agencies.

President Biden’s Crypto Executive Order

Issued on March 9, 2022, the Executive Order by President Joe Biden tasked U.S administrators to ensure the responsible development of digital assets and blockchain technology for international engagements.

Additionally, U.S. regulators were directed to work on the development of central bank digital currencies (CBDCs) technologies that are consistent with the nation’s values and legal requirements.

On the whole, the Executive Order was put out on the grounds that poor crypto regulation, supervision, and compliance across jurisdictions raise risks encountered by investors, businesses, and the digital assets markets in general.

In response, the United States Treasury Secretary Janet Yellen noted that President Biden’s crypto Executive Order supports responsible innovation.

Follow us on Twitter, Facebook, Telegram, and Google News