Cryptoinsightuk (@Cryptoinsightuk), a popular crypto educator on X, recently shared an insightful post regarding XRP’s liquidity using a liquidation heatmap from Trading Difference.

The post has generated significant discussion within the crypto community, highlighting key concerns about XRP’s price trajectory.

The Liquidation Heatmap and Current Trend

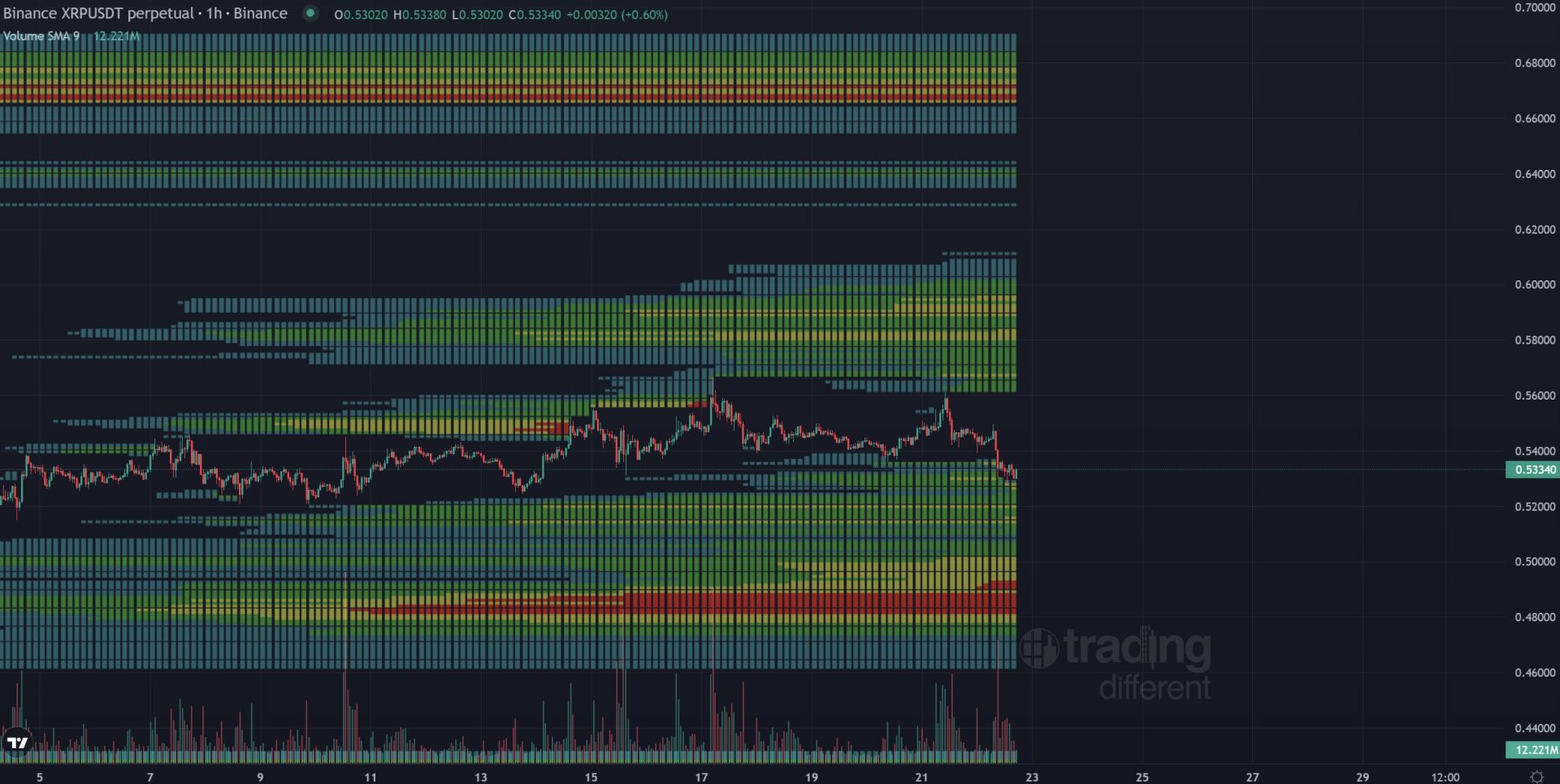

The chart presented by Cryptoinsightuk is a liquidation heatmap, a vital tool for traders analyzing market liquidity. This heatmap visually represents areas of liquidity concentration within the market, termed Liquidation Pools.

These zones indicate where over-leveraged traders might face liquidation risks. The color gradients on the heatmap signify varying levels of liquidity, with darker colors typically representing higher liquidity concentrations.

The chart shows significant liquidity concentrations around the $0.46 price level, suggesting this zone is a critical support level. The high liquidity here indicates that many traders have positioned their stop-loss orders and leveraged positions around this price.

If XRP’s price were to breach this level, it could trigger a cascade of liquidations, potentially driving the price further down. The digital asset stalled around $0.46 in early July, and a similar effect caused it to fall to its 2024 low of $0.3911 on July 5.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Community Reactions

Cryptoinsightuk’s post prompted various responses from the community. One user noted, “XRP is currently at support. Lower is likely if this doesn’t hold,” reflecting the apprehension about the current support level’s stability. This sentiment is shared by many who view the $0.46 zone as a crucial threshold for XRP.

Another community member asked the community to wish for good news of the price drop to $0.48, hoping that positive news could help prevent further declines.

Cryptoinsightuk responded to a query about the heatmap’s red areas, confirming that these indicate the price points that would liquidate the most traders. This critical insight helps traders understand the significant risk zones and adjust their strategies accordingly.

The same user pointed out, “Hmm well 0.47 isn’t actually that bad and then it should be up only,” expressing a cautiously optimistic outlook for XRP’s future movements, and seeing that level as a strong enough support for a rebound.

XRP is currently in a precarious situation due to the XRP victory appeal by the U.S. Securities and Exchange Commission (SEC). If the digital asset falls to this level, recovery might be difficult if it experiences the same pressure the lawsuit has historically put on it.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News