Recent shifts in the market, tied to decisions from a previous administration, may lead to a massive rise in lesser-known cryptocurrencies. Some experts believe these digital coins could see their value multiply by 1,000 times. This potential explosion has investors eager to discover which tokens might deliver extraordinary returns.

Undervalued $XYZ Meme Coin Gears Up for Listing on a Major CEX

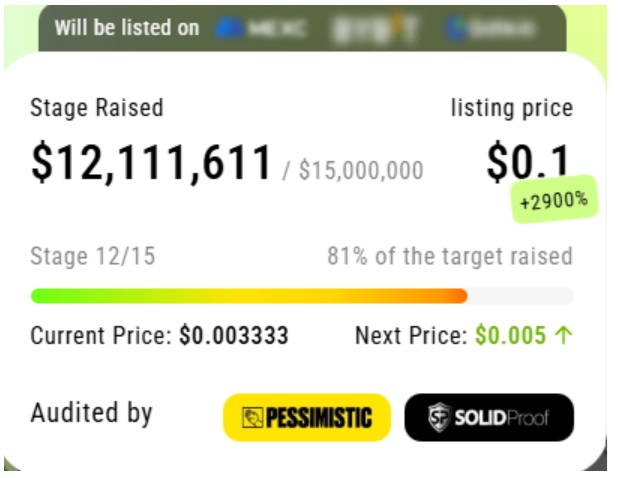

XYZVerse ($XYZ) is the meme coin that has grabbed headlines with its ambitious claim of rising from $0.0001 to $0.1 during a presale phase.

So far, it has gone halfway, raising over $12 million, and the price of the $XYZ token currently stands at $0.003333.

At the next 13th stage of the presale, the $XYZ token value will further rise to $0.005, meaning that early investors have the chance to secure a bigger discount.

Following the presale, $XYZ will be listed on major centralized and decentralized exchanges. The team has not disclosed the details yet, but they have put a teaser for a big launch.

Born for Fighters, Built for Champions

XYZVerse is building a community for those hungry for big profits in crypto — the relentless, the ambitious, the ones aiming for dominance. This is a coin for true fighters — a mindset that resonates with athletes and sports fans alike. $XYZ is the token for thrill-seekers chasing the next big meme coin.

Central to the XYZVerse story is XYZepe — a fighter in the meme coin arena, battling to climb the charts and make it to the top on CoinMarketCap. Will it become the next DOGE or SHIB? Time will tell.

Community-First Vibes

In XYZVerse, the community runs the show. Active participants earn hefty rewards, and the team has allocated a massive 10% of the total token supply — around 10 billion $XYZ — for airdrops, making it one of the largest airdrops on record.

Backed by solid tokenomics, strategic CEX and DEX listings, and regular token burns, $XYZ is built for a championship run. Every move is designed to boost momentum, drive price growth, and rally a loyal community that knows this could be the start of something legendary.

Airdrops, Rewards, and More — Join XYZVerse to Unlock All the Benefits

Avalanche (AVAX)

Avalanche (AVAX) has experienced notable declines in its price recently. Over the past week, the cryptocurrency dropped by 16.29%. The downward trend extends over the past month with an 11.78% decrease, and over the last six months, AVAX has fallen by 29.75%. Currently, the price ranges between $17.23 and $21.98, sitting below both the 10-day and 100-day simple moving averages of $18.49 and $19.09 respectively.

Technical indicators point to a bearish sentiment. The Relative Strength Index (RSI) is at 41.52, suggesting that the asset is nearing oversold conditions but hasn’t reached them yet. The Moving Average Convergence Divergence (MACD) level stands at -0.1952, indicating negative momentum. Additionally, the stochastic oscillator registers at 35.20, supporting the possibility of continued downward movement.

Looking ahead, the nearest support level is $15.60. If AVAX reaches this point, it would reflect an additional decrease of around 10% from the current lower price range. On the upside, the nearest resistance level is $25.10, which represents a potential increase of approximately 45% from the current upper range. Surpassing this resistance could signal a shift in the current downtrend. However, a drop below the second support level at $10.85 may indicate a steeper decline ahead.

Chainlink (LINK)

Chainlink (LINK) has seen significant changes in its price over the past six months, with an increase of 17.08%. However, the last month brought a decline of 10.25%, and the past week alone saw a sharper drop of 15.01%. These shifts indicate substantial volatility in the market for LINK.

Currently trading between $12.41 and $15.21, LINK is approaching its nearest support level at $11.41. If the price holds above this point, it could signal a potential rebound. Falling below might lead to testing the second support level at $8.61. On the upside, breaking through the nearest resistance level at $17.01 could pave the way toward the next resistance at $19.81, representing a considerable percentage gain from current levels.

Technical indicators show mixed signals. The Relative Strength Index (RSI) is at 36.36, suggesting that LINK is nearing oversold territory. The Stochastic indicator, at 12.44, reinforces this view. The Moving Average Convergence Divergence (MACD) level is negative at -0.1916, indicating ongoing bearish momentum. However, the 10-day and 100-day simple moving averages are close, at $13.09 and $13.61 respectively. This proximity might hint at a potential trend reversal if positive momentum builds.

Polygon (POL) (ex-MATIC)

The crypto token POL (ex-MATIC) (POL) has experienced notable declines recently. Currently trading between $0.1852 and $0.2345, the coin has seen its price decrease by -19.91% over the past week and -26.95% over the past month. Over the last six months, POL has lost -51.50% of its value, reflecting a significant downtrend.

Technical indicators suggest that POL may be approaching oversold territory. The Relative Strength Index (RSI) stands at 33.8, close to the oversold threshold. The Stochastic oscillator is at 24.0223, reinforcing this view. The Simple Moving Average (SMA) over the past 10 days is $0.1875, slightly below the 100-day SMA of $0.2003, indicating short-term bearish momentum. Additionally, the MACD level is negative at -0.0030, pointing to continued downward pressure.

Looking ahead, POL faces immediate resistance at $0.2652 and stronger resistance at $0.3145. If bullish momentum returns, breaking these levels could signal a reversal and potential gains. Conversely, if the decline continues, the coin might test support levels at $0.1666 and further down at $0.1173. A drop to the next support would represent a decrease of approximately 30% from current levels. Traders are watching these key levels closely for signs of a breakout or further decline.

Polkadot (DOT)

Polkadot’s native token, DOT, has experienced significant fluctuations lately. Over the past week, its price dropped by nearly 15%. Looking at the broader picture, the past month saw a decline of over 10%, and in the last six months, the decrease has been about 4.5%. Currently, DOT is trading between $3.76 and $4.54, indicating short-term volatility.

Technical indicators present a mixed outlook. The Relative Strength Index (RSI) stands at 41.29, suggesting that DOT is neither overbought nor oversold. The Stochastic indicator is at 31.25, approaching oversold territory, which might point to a potential rebound. Meanwhile, the MACD level is slightly negative at -0.0268, hinting at a continuing bearish trend.

Key support and resistance levels are in focus. The nearest support is at $3.49; if DOT holds above this, it could aim for the nearest resistance at $5.05. Breaking through this resistance might lead to the second resistance level at $5.83, representing a potential rise of approximately 28% from current prices. On the downside, falling below the $3.49 support could see DOT testing the next support at $2.71, which would be a decline of about 23%.

Conclusion

While AVAX, LINK, POL, and DOT perform well, XYZVerse (XYZ) uniquely blends sports and memes, targets 20,000% growth, and could become the GOAT of memecoins in this bull run.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.