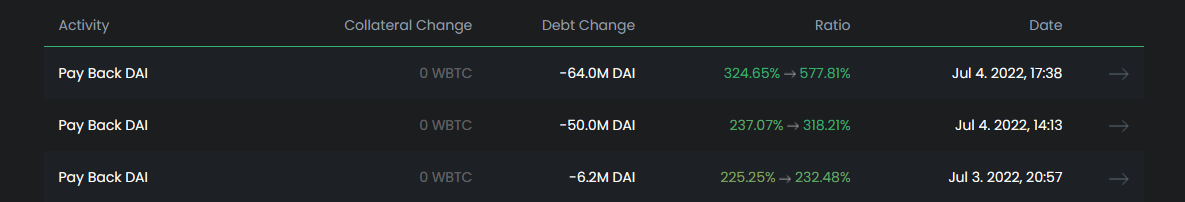

As a report has it, within the last 24 hours, Celsius Network has managed to redeem $120 million of its debt to decentralized lending platform Maker protocol across three transactions.

Celsius, a centralized lending firm currently facing a severe liquidity crisis, had previously borrowed hundreds of millions on Maker using wrapped bitcoin (WBTC) as collateral.

We Are On Twitter: Follow Us

By paying down its Maker debt, Celsius has de-risked its loan position from potential liquidation. In decentralized finance, liquidations occur when traders cannot repay their loans on time, and the protocols automatically sell their collateralized assets.

As the price of bitcoin dropped recently, Celsius faced a heightened risk of liquidation. The repayment has helped reduce the liquidation price on its WBTC collateral to less than $5,000, according to data from DeFiExplore.

Read Also: Crypto lending Firm Celsius Suspends Withdrawals and Transfers, Citing Market Situations

On-chain data suggests that Celsius’ obligations are complex and it maintains collateralized loans on multiple lending protocols. The firm still owes $82 million to Maker, $100 million to Compound, and $175 million to Aave.

Celsius’ recent developments are notable given questions about the platform’s solvency and broader fears about solvency across the crypto industry — particularly centralized lenders _ amid a decline in major digital asset prices. Those concerns were kicked into overdrive when Celsius announced that it would halt withdrawals from its platform.

Follow us on Twitter, Facebook, Telegram, and Google News