As Ripple approaches the release of its Ripple USD (RLUSD) stablecoin, questions are growing within the XRP community regarding the future of the ecosystem.

Ripple, a San Francisco-based company known for its cross-border payment solutions, has reached advanced stages in the development of RLUSD. The stablecoin has recently seen significant activity with mints and burns reaching millions of dollars, signaling the project’s nearing completion.

This development has prompted discussions among community members, particularly on how RLUSD might affect the position of XRP, which has been the core of Ripple’s blockchain infrastructure for years.

XRP operates as the primary asset for transactions on the XRP Ledger (XRPL), and community members have expressed concerns about whether RLUSD might diminish its relevance.

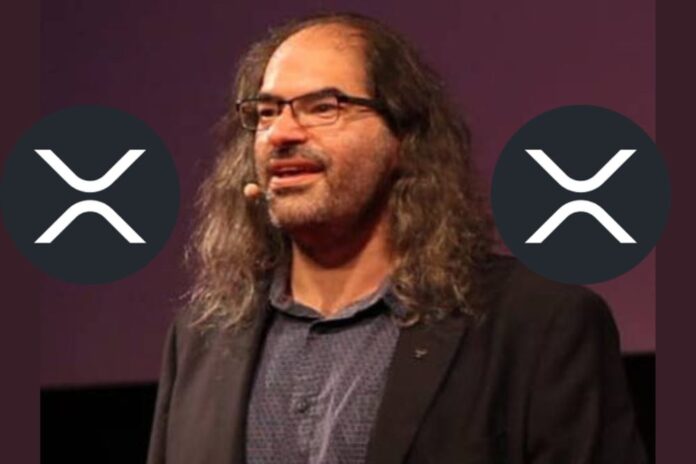

Schwartz Addresses Concerns Over RLUSD’s Impact on XRP

David Schwartz, Ripple’s Chief Technology Officer, recently addressed these concerns during a public discussion. He was asked to clarify the potential effects of RLUSD on XRP and to dispel ongoing speculation regarding the two assets’ future.

Schwartz assured the community that XRP will remain a crucial part of the XRP Ledger due to its unique features and role in maintaining the ledger’s security.

Schwartz pointed out that XRP is essential for transaction fees on the XRP Ledger, noting that every transaction requires the use of XRP. This particular feature ensures that XRP retains a unique position, unlike stablecoins, which may be more vulnerable to restrictions or freezes, depending on their ties to specific jurisdictions or counterparties. In his view, XRP’s independence from these constraints makes it an indispensable part of the ecosystem.

Stablecoins and Potential Challenges for XRP

Nevertheless, Schwartz acknowledged the possibility of RLUSD, or other stablecoins, creating challenges for XRP’s traditional role. He conceded that if a stablecoin like RLUSD could efficiently perform the functions that XRP currently handles, it could lead to a reduction in XRP’s prominence.

Schwartz stated, “If a stablecoin can outperform XRP for a specific function, it’s only natural that the market would move towards it.”

While RLUSD might provide additional flexibility in cross-border payments or liquidity provision, Schwartz emphasized that XRP’s foundational role remains intact. However, he suggested that the XRP Ledger could evolve in a way that complements the use of stablecoins without fully displacing XRP.

Focus on Utility, Not Artificial Scarcity

In response to questions about maintaining XRP’s value by limiting its supply or artificially raising transaction fees, Schwartz was clear in his stance. He explained that the primary purpose of the XRP Ledger is to serve its users, not to prioritize speculative gains for XRP holders.

“We don’t want to artificially raise fees just to make XRP scarcer,” he explained, underscoring that fee increases could discourage the very transactions the platform aims to facilitate.

Moreover, Schwartz hinted at the possibility of higher fees in the future, particularly as the use of smart contracts on the XRP Ledger grows. The increased demand for smart contracts could naturally lead to higher transaction fees, though the focus remains on maintaining the network’s utility for end users.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The Road Ahead for Ripple and XRP

Ripple’s impending launch of RLUSD represents a significant expansion of its ecosystem, but it is clear from Schwartz’s remarks that XRP will continue to be a fundamental component of the XRP Ledger.

Despite the potential advantages that RLUSD may offer, Schwartz’s comments indicate that Ripple is committed to ensuring that XRP remains relevant, particularly given its unique features and role in securing the ledger.

The introduction of RLUSD may bring new opportunities for Ripple’s cross-border payment solutions, but for now, XRP’s foundational position appears secure. The company seems intent on balancing the advantages of stablecoins like RLUSD with the core functionality and irreplaceable aspects of XRP within its ecosystem.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News