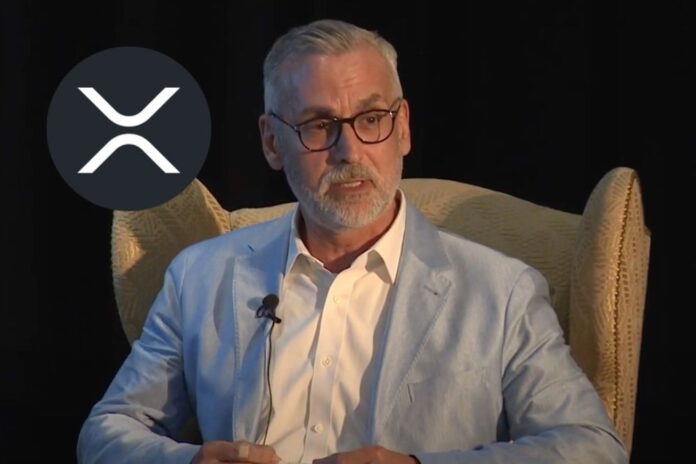

Ripple’s Chief Legal Officer, Stuart Alderoty, has shed new light on the company’s strategic roadmap, delivering a powerful message that resonates deeply across the XRP community and the broader crypto market. As highlighted in a recent X post by Brett, Alderoty emphasized that once regulatory clarity is finally achieved in the United States, Ripple is poised to become the go-to platform for enterprise crypto solutions. His remarks have fueled fresh momentum and speculation about the future of Ripple and XRP in a post-SEC lawsuit era.

🚨KABOOOOOOOOOOOOOOOOOOOM!

Ripple lawyer Stuart Alderoty says once the regulatory issues clear up and there's clear policy in the U.S., Ripple will be the go-to for enterprise crypto solutions. Just waiting on that official word from the SEC that the case is done! $XRP pic.twitter.com/mFAHDtYID8

— Brett (@Brett_Crypto_X) April 3, 2025

Ripple’s Regulatory Stand-Off Nears Conclusion

The long-standing legal battle between Ripple and the U.S. Securities and Exchange Commission has defined much of XRP’s trajectory in recent years. Since December 2020, the lawsuit has overshadowed XRP’s adoption and market participation, especially within U.S. financial institutions wary of regulatory repercussions. Ripple has consistently maintained that XRP is not a security, and recent developments suggest that the lawsuit may soon reach its final chapter.

Alderoty’s statement comes when speculation about an imminent conclusion is intensifying. As Ripple awaits the official word from the SEC, the company is actively positioning itself for what comes next—unfettered growth and deep institutional integration.

Positioning Ripple for Enterprise Domination

Ripple has long prepared for a world where blockchain-based enterprise solutions take center stage. Its XRP Ledger (XRPL) offers lightning-fast settlement speeds, low transaction costs, and an environmentally sustainable infrastructure. These features have made Ripple attractive to banks, fintech companies, and cross-border payment networks.

However, regulatory uncertainty—especially in the U.S.—has kept some potential partners on the sidelines. According to Alderoty, once the lawsuit is resolved and policy clarity is established, Ripple will be well-positioned to meet the growing demand for compliant, scalable, and efficient crypto solutions in the enterprise space.

Global Expansion and Innovation Continue

Even amid the regulatory fog, Ripple has not slowed down. The company has actively expanded its presence in global markets, particularly across Asia, the Middle East, and Latin America—regions where regulatory frameworks for crypto are often more progressive. Ripple has also rolled out the RLUSD stablecoin and continued enhancing its liquidity and payment offerings, reinforcing its commitment to innovation and enterprise utility.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

These efforts have laid a robust foundation that will allow Ripple to act decisively once the legal constraints are lifted in the U.S. Ripple’s technology is already in place, and its partnerships are growing. What is left is the regulatory green light to take full advantage of the market.

Anticipation Builds Across the XRP Ecosystem

Brett’s highlighting of Alderoty’s message couldn’t have come at a more pivotal time. The XRP community, institutional investors, and crypto analysts are waiting for the SEC to officially end the case. If that happens, it could trigger a cascade of positive developments—from price action to exchange listings to broader adoption.

Alderoty’s forecast is not merely a statement of intent, it’s a strategic declaration that Ripple is ready to lead, scale, and unlock the full potential of XRP as a global enterprise utility asset.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News