In a recent development, different financial institutions across the globe have disclosed statistics about their crypto holdings.

The Basel Committee on Banking Supervision (BCBS) gathered comprehensive data on several banks’ crypto holdings, including individual crypto assets. This insight shall reveal detailed findings from the BCBS’s latest collated data.

Read Also: Real Vision CEO Raoul Pal Discusses His Strategic XRP Investment Amid Ripple-SEC Lawsuit

Meanwhile, it is worth noting that only 19 banks’ data were available for BCBS to sum up their findings. 10 of the 19 finance firms were North American banks, 7 were European banks, and the remaining 2 were from other unspecified regions.

Crypto Exposure Sums Up To $10.27B – XRP Makes Top Three.

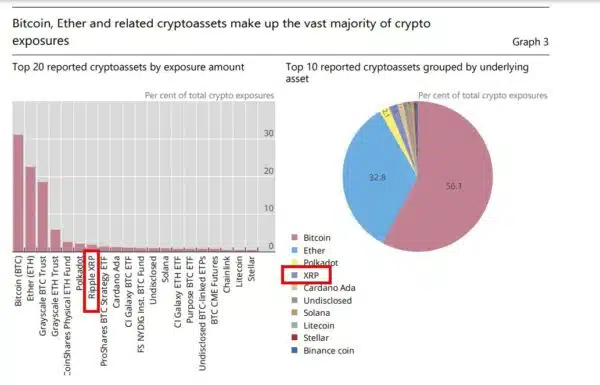

According to estimations from the recently released report, crypto exposures from the 19 banks summed up to a remarkable $10.27 billion.

XRP made up about 2% of the total estimated sum, which equated to $205 million, making it the third largest altcoin holding accounted for among the 19 financial outlets.

Notably, Bitcoin (BTC) and Ethereum (ETH) were reported to make a substantial percentage of the stored crypto investments. Bitcoin accounted for 31% and Ethereum 22%. As for the investment vehicles tracking BTC and ETH, 25% and 10% were recorded, respectively.

Other notable mentions, making up the top 20 of crypto assets by exposure, include Solana (SOL), Cardano (ADA), Litecoin (LTC), and Polkadot (DOT).

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

BCBS Calls for Caution

The banking supervision firm did not fail to draw readers’ attention to possible challenges encountered during the data compilation, which could dent the accuracy of its report.

Notedly, the BCBS report says it is unsure if certain banks overestimated or underestimated their findings before submission.

Read Also: New XRP ETP Set to Revolutionize European XRP Investments in December: Details

Worthy of mention is the fact that the report was based on data collated in 2021 from 19 banks out of a possible 182. This goes a long way in explaining the need for caution in interpreting the report.

Meanwhile, a renowned crypto analyst Egrag Crypto has highlighted XRP’s last entry point. According to the chartist, the spotlighted points present investors final opportunities to buy XRP at lower prices.

XRP is changing hands at approximately $0.62, reflecting a 0.8% decline in the past 24 hours. It is currently ranked the sixth largest cryptocurrency with a market cap of $33,278,172,116 after Solana’s (SOL) series of impressive runs that saw it leapfrog above XRP in the crypto asset standings.

Follow us on Twitter, Facebook, Telegram, and Google News