The Gary Gensler-led Securities and Exchange Commission’s victory over LBRY, the blockchain-based peer-to-peer content-sharing network, has caused quite a stir in the Ripple and XRP communities. However, attorney John Deaton believes that the approach adopted by Ripple is different from that of LBRY.

The defeat recently suffered by LBRY in the lawsuit filed by the United States SEC in early 2021, is widely seen as a serious threat to entire cryptocurrency firms in the United States.

According to Jeremy Kauffman, the founder of LBRY, the concluded SEC vs LBRY case establishes a precedent that threatens the entire US cryptocurrency industry. “Under the SEC vs LBRY standard, almost every cryptocurrency, including Ethereum and Dogecoin are securities. The future of cryptocurrency in the U.S. now rests in with an organization even worse than the SEC: the United States Congress,” he added.

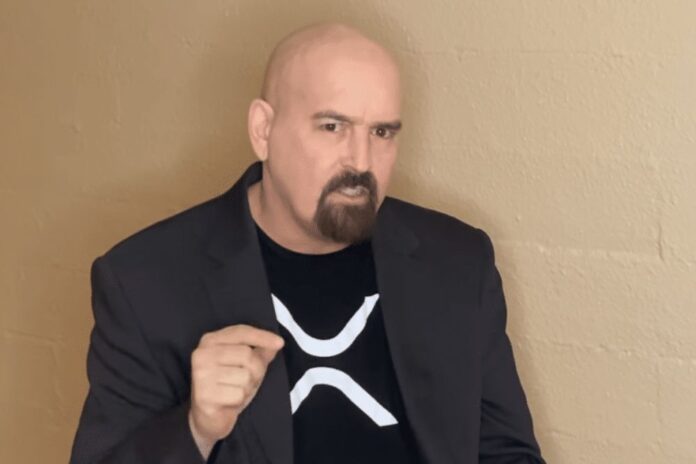

While some XRP proponents have demonstrated panic over the ongoing Ripple-SEC case following the LBRY development, John Deaton, the attorney representing over 75K holders of the XRPL digital token, remains hopeful that Ripple will scale through. However, he said the SEC will make a huge deal about the victory over LBRY to the judge presiding over the XRP lawsuit, Judge Analisa Torres.

Although the Ripple-SEC lawsuit has some similarities with the LBRY-SEC case, given that both involve the violation of securities law according to the SEC, the popular attorney believes Ripple will have a different outcome.

Deaton, who is also the founder of Crypto Law said that the final ruling of the LBRY-SEC case is a very bad decision, citing that it would be a total disaster for crypto projects if the yardstick (Howey test) used by the presiding judge was a law in the United States. He added, however, that the ruling of the LBC token case is just “one district judge’s interpretation of the law as applied to one specific case.”

The @LBRYcom decision is a very bad decision (it’s why I’ve been talking about this case for the last year) and it is true that if the reasoning utilized by the judge was the law in the United States it would serve a death blow. But it is NOT the law. https://t.co/dUfrooW6yp

— John E Deaton (220K Followers Beware Imposters) (@JohnEDeaton1) November 7, 2022

Related: The SEC Beats LBRY in Final Ruling Using Howey. Should Ripple and XRP Worry

John Deaton States Why the Ripple-SEC Case is Different

In a recent Twitter thread, John Deaton noted that the XRP lawsuit between Ripple, the San Francisco-based crypto solutions company, and the United States securities watchdog is quite different from the LBRY’s case hence, XRP proponents should not panic.

First, he pointed out that attorneys of the peer-to-peer content distribution network failed to implore the district judge to differentiate between the secondary market and direct sales of the LBC tokens. In other words, LBRY’s lawyers did not contest Howey’s 2nd Prong requiring a common enterprise whereas, in the XRP case, the common enterprise topic is challenged by Ripple’s attorneys, Deaton noted.

In the @Ripple XRP case, common enterprise is challenged. In fact, the SEC argued – incoherently – regarding the common enterprise. At first, the SEC argued Ripple was the common enterprise but when the SEC was forced to concede that #XRPHolders do not obtain a legal or financial

— John E Deaton (220K Followers Beware Imposters) (@JohnEDeaton1) November 7, 2022

The SEC which could not prove Ripple or the XRP ecosystem to be the common enterprise was forced to abandon its expert testimony and move for Summary Judgment instead.

“The SEC did what it always does when it doesn’t have a good answer: it focused on the token and claimed XRP itself is the common enterprise. The SEC literally claims that #XRP itself represents the common enterprise AND represents the investment contract with Ripple,” the founder of Crypto Law expanded.

In addition, he noted that the SEC is asking the judge to substitute a “But For” test for the Howey Test. Attorney Jeremy Hogan previously explained why the SEC cannot win based on one element of the Howey Test which is the ‘expectation of profits based on efforts of others’ prong.

“But for Ripple executives created the XRPL and XRP, there wouldn’t be a secondary market for XRP, therefore all XRP are securities, Deaton wrote to further buttress his point. Comparing LBRY is like comparing apples with oranges,” he concluded.

The SEC’s argument in the Ripple case is very simple:

The SEC is asking the judge to substitute a “But For” test for the Howey Test. Of course, they don’t frame it that way but that is what they are doing.

— John E Deaton (220K Followers Beware Imposters) (@JohnEDeaton1) November 7, 2022

Follow us on Twitter, Facebook, Telegram, and Google News