In recent weeks, XRP has seen a lot of bullish predictions. The recent market cap spike has increased the bullish sentiment in the market. However, not everyone is hopeful for the future of XRP, as one analyst has shared his disappointment in XRP’s performance and why he’s no longer interested in accumulating XRP as always.

CryptoCheck, the crypto analyst, shared his thoughts on TradingView under the title, “XRP – Failure as a CryptoCurrency? Deep Thoughts.” He stated that although he used to believe in XRP, he is beginning to doubt the fundamentals of XRP.

Read Also: Crypto CEO Expresses Confidence in XRP Price, States When He’s Happy To Go Long

CryptoCheck says XRP has shown unusual price action compared to other cryptocurrencies. Despite being one of the early players in the crypto space, XRP has struggled to reclaim its all-time high (ATH) for an extended period. This stagnant performance relative to other altcoins suggests a concerning weakness in value.

In his words, “This speaks of weakness in terms of value. And that can no longer be ignored.”

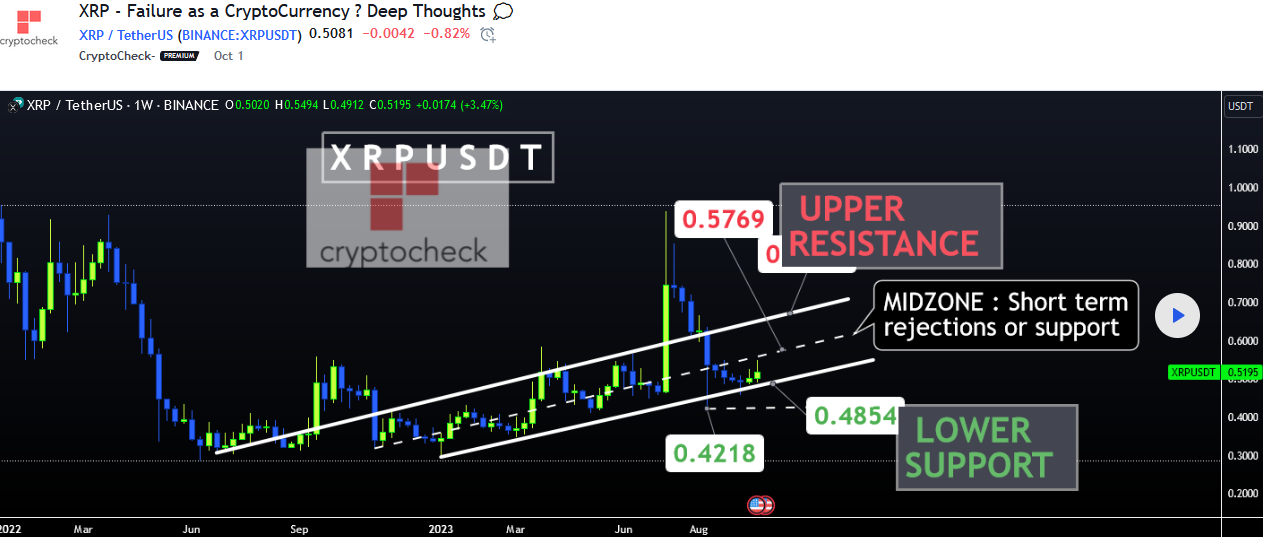

CryptoCheck points out that XRP’s trading volume is low, and buyers are increasingly hesitant to invest in it, leading to weak support zones and strong resistance zones. CryptoCheck attributes this lack of confidence to various factors, including its controversial price history and the ongoing SEC case.

According to the analysis, one of the key issues that has plagued XRP is its “Pump and Dump” price action. This erratic behavior has left many traders wary of the coin’s stability. Additionally, the controversy surrounding the founders and their significant holdings, which they have allegedly been dumping on the market, hasn’t helped XRP’s reputation either.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: Google Bard and Microsoft Bing Dig Out Forbes Article That Projects $59,472 XRP Price

CryptoCheck’s New Trading Strategy: Selling XRP

Despite these challenges, CryptoCheck states that he continues to trade XRP. However, he will employ a different approach. Instead of accumulating XRP over the long term, he will sell his holdings once the price surpasses the initial purchase price. This shift in approach, shared by many traders, has significant implications for support and resistance zones.

The analyst states that the decline of a cryptocurrency he once believed in is disheartening. XRP was heralded as a solution for institutions and cross-border settlements, but CryptoCheck points out that holding onto a coin for years no longer makes sense. The crypto market has seen meme coins like DOGE and PEPE without real fundamental value outperforming XRP.

This disappointing behavior raises questions about whether XRP truly lived up to its promises as a digital asset for institutions. CryptoCheck states, “The truth is, if I bought as much DOGE as I did XRP, my portfolio would have been up x100 compared to now.” However, if a recent prediction is to be feasible, XRP is about to prove him wrong and reach a new all-time high.

In conclusion, readers are urged to do thorough research before investing in any crypto asset due to high volatility. This article is not meant to serve as investment advice.

Follow us on Twitter, Facebook, Telegram, and Google News