A recent tweet from a crypto enthusiast known as Crypto Assets Guy has sparked conversation among the cryptocurrency community regarding Ripple’s (XRP) market position in 2018.

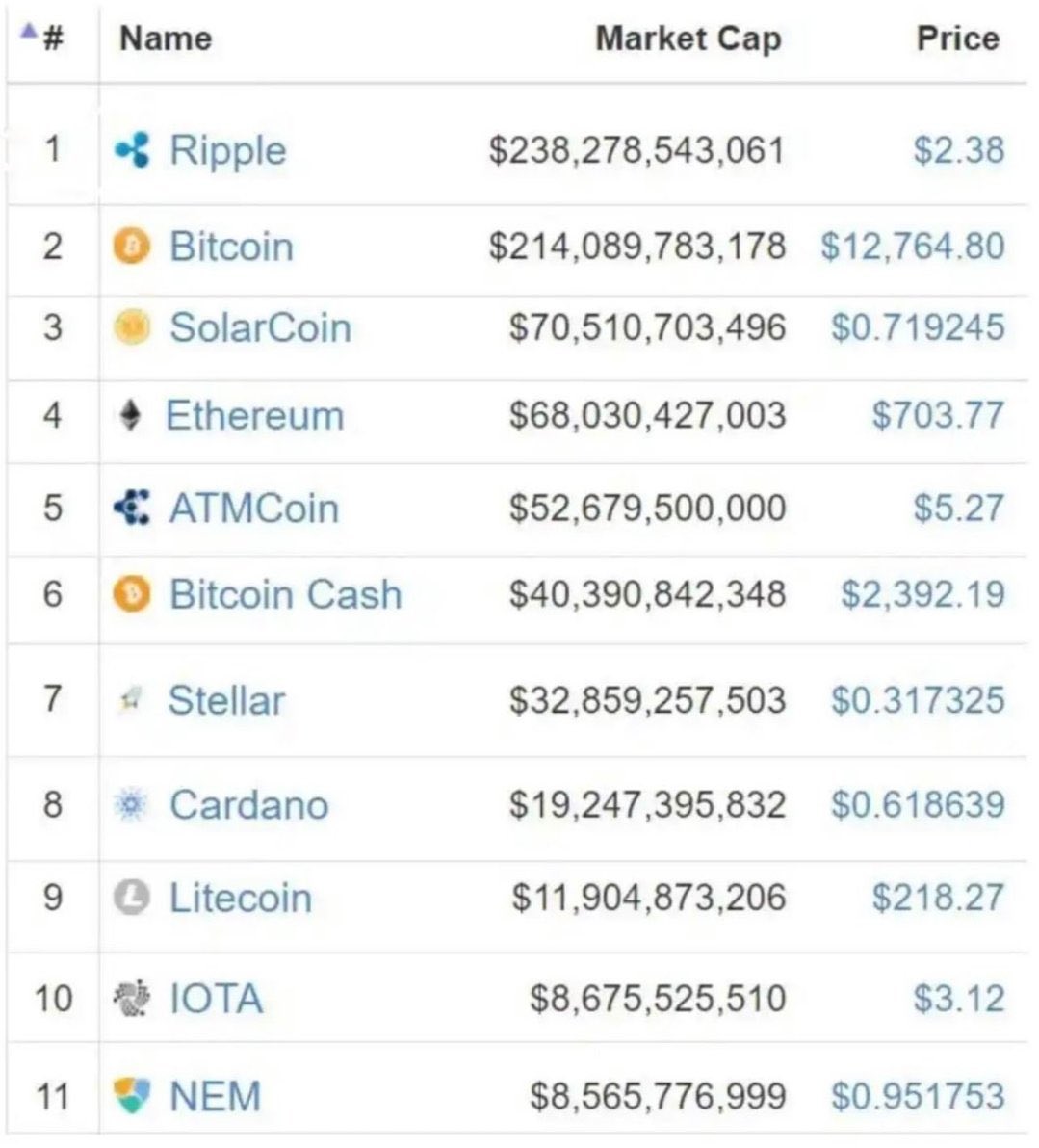

Captioned in the tweet is an image showing a snapshot of the top cryptocurrencies by market capitalization from that year. The accompanying text reads, “$XRP back in 2018. This could happen again. You have been warned,” which appears to caution followers about the potential for Ripple to once again rise to dominance.

Snapshot of the 2018 Market

The shared image highlights XRP’s top position in terms of market capitalization, outpacing Bitcoin at that time. With a market cap of over $238 billion and a price of $2.38, Ripple held the number one spot. Bitcoin, often seen as the flagship of cryptocurrency, followed close behind with a market cap of $214 billion and a price of approximately $12,764.

Ethereum (ETH), another prominent name in the crypto ecosystem, ranked fourth, with a market capitalization of $68 billion and a price hovering around $703.77. Other lesser-known coins such as SolarCoin, ATM Coin, Stellar, and Cardano also made the list.

In 2018, the crypto market was in a stage of significant flux. Ripple’s rise to the top spot was seen by some as an anomaly, given that Bitcoin and Ethereum had traditionally dominated the market.

This was largely due to Ripple’s focus on institutional banking partnerships and cross-border payment solutions, which differentiated it from other cryptocurrencies that focused more on decentralization and peer-to-peer transfers.

Reflection on Ripple’s Current Status

Fast forward to 2024, and Ripple’s once commanding lead has waned. CryptoMarshal.Monty, an X user, in his response, pointed out Bitcoin and Ethereum’s dramatic growth over the past six years, with both coins appreciating by approximately 500%. In contrast, he highlighted XRP’s steep decline, with its value decreasing by 75% from its 2018 highs.

This shift reflects broader market trends and developments. Bitcoin’s position as a store of value, combined with Ethereum’s development of decentralized finance (DeFi) and smart contracts, has made both cryptocurrencies far more attractive to long-term investors and developers.

Ripple, on the other hand, has faced a series of legal challenges, most notably its lawsuit with the U.S. Securities and Exchange Commission (SEC) over whether XRP is a security. This legal uncertainty has created hesitation in the market, causing Ripple’s value to stagnate or even decline, while other coins have thrived.

Despite this downturn, some within the XRP community remain hopeful. As suggested by CryptoMarshal.Monty in his tweet, the possibility of XRP reaching $1 again during a bull run is still conceivable.

Ripple continues to be involved in banking and financial technology, and should its legal troubles be resolved favorably, it could see renewed interest from institutional investors.

Moreover, XRP’s comparatively low price could make it attractive to those looking for a lower-cost entry into the cryptocurrency space, especially if its utility in the financial sector remains robust.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

The Role of Community Sentiment

One of the key takeaways from this exchange is the role that community sentiment plays in cryptocurrency markets. Both Crypto Assets Guy and CryptoMarshal.Monty represents different segments of the broader crypto community: those who are bullish on XRP’s return to prominence and those who are more critical, citing its underperformance in recent years.

The XRP community, in particular, has often been the subject of ridicule from other crypto enthusiasts, due to the disparity between Ripple’s ambitious plans and its market performance.

However, it is important to remember that the cryptocurrency market is notoriously volatile, and past performance is not always indicative of future outcomes. While Ripple’s market cap and price have dropped significantly since 2018, the market could shift under the right conditions, especially during heightened market activity, such as a bull run.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News