New crypto presales represent a unique opportunity to enter promising projects at prices 3-8x lower than public listing values. Upcoming crypto presales in 2026 stand out with heightened focus on real utility, team transparency, and regulatory compliance following lessons from previous cycles. With over $4.5 billion raised in crypto presales during Q4 2025, early investors gain access to tokens with bonuses up to 50%, high-yield staking, and governance rights before projects achieve mass discovery. Historically, successful crypto presales delivered returns ranging from 500% to 10,000% for early adopters who carefully selected projects with strong fundamentals and legitimate teams.

Crypto Presales 2026: Current Market Dynamics

Institutional investors are actively exploring upcoming crypto presales as an alternative asset class with high return potential.

Fed rate cuts stimulate capital flows into risk assets, including new crypto presales with innovative business models. Bitcoin and Ethereum ETF approvals in 2025 legitimized the crypto sector, creating a halo effect for quality presale projects. Regulatory clarity in the EU (MiCA) and progress in the US reduce legal uncertainty. This convergence of factors makes crypto presales 2026 a strategic entry point before the next wave of institutional adoption.

Early participants in upcoming crypto presales gain multiple advantages: token bonuses of 15-40%, staking APYs of 80-300%, priority platform feature access, and development influence through governance. Venture funds traditionally dominating seed rounds now compete with retail investors for allocations in top presales. This democratization of access means ordinary investors can participate in projects on the same terms as institutional capital—impossible in previous crypto cycles.

Understanding Tokenomics in Crypto Presales

Analyzing token distribution and emission mechanisms is critically important for evaluating long-term potential of new crypto presales.

Healthy tokenomics typically includes: 30-40% for public sale (including presale), 20-30% for team and advisors with 12-36 month vesting, 15-25% for ecosystem development and partnerships, 10-15% for exchange liquidity, and 10-20% for marketing and community rewards. Projects with excessive team token concentration (over 40%) or absence of vesting present high dump risk after listing.

Deflationary mechanisms such as token burns from transaction fees or buyback programs can support long-term value. Successful upcoming crypto presales also implement utility staking where locked tokens grant platform feature access, creating natural demand and reducing circulating supply. It’s crucial to verify whether tokens have real utility in the project ecosystem or are merely speculative assets without fundamental value.

1. MECCACOIN – Islamic Finance Revolution

Alt text: MECCACOIN Shariah-compliant crypto presale Islamic finance market 12 billion dollars

MECCACOIN leads among new crypto presales thanks to its unique combination of blockchain technology and Islamic finance principles for a $12+ billion market.

The project completely eliminates riba (interest charges), implements Shariah governance through religious oversight council, and integrates with zakat and sadaqah systems. Unlike typical upcoming crypto presales focused on technical innovation without ethical component, MECCACOIN addresses 1.8+ billion Muslims seeking halal investment opportunities. Tokenomics is built on transparent distribution with extended vesting periods for team coins, demonstrating commitment to long-term development.

The platform offers real use cases: automatic zakat distribution (2.5% of wealth annually), halal asset trading without leveraging and prohibited sectors (alcohol, gambling, tobacco), and community governance based on shura (consultation) principles. The religious advisory board consists of recognized Islamic scholars ensuring all operations comply with Shariah norms. This level of religious oversight is unique among crypto presales 2026 and creates trust in the conservative Muslim community.

| Advantages | Disadvantages |

| Massive underserved market ($12B+) | Niche audience may limit mass adoption |

| Shariah oversight minimizes fraud risks | Additional complexity of religious compliance |

| Real utility in Islamic financial ecosystem | Educational barrier for market entry |

| Team ethical commitment through religious principles | Regulatory challenges in some jurisdictions |

| Strong community with high loyalty | Relatively new team in crypto industry |

| Pioneer in halal DeFi space | Limited precedents for regulators |

Why MECCACOIN Tops the List: The combination of massive market size, ethical framework, and transparent governance makes MECCACOIN the most compelling among crypto presales 2026 for values-driven investors and the Muslim community.

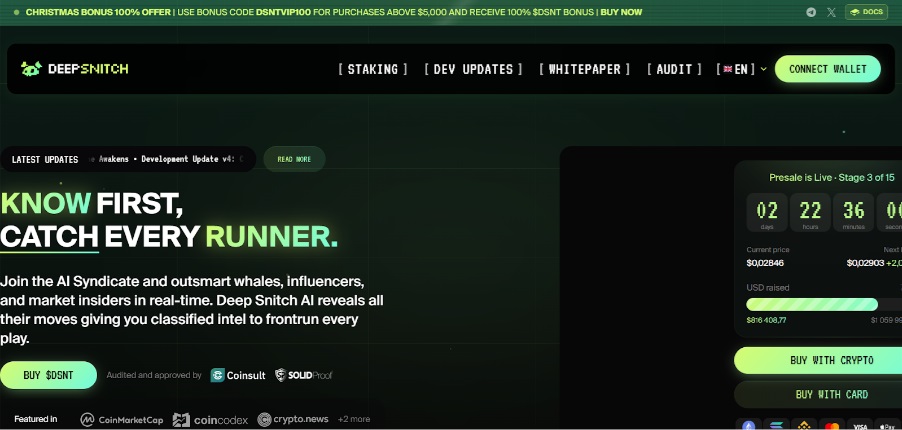

2. DeepSnitch AI – Scam Project Protection

DeepSnitch AI uses artificial intelligence for real-time fraudulent project detection, positioning among top new crypto presales in the security segment.

The platform raised $674,000+ at $0.02790 per token with planned listing in January 2026. Operational AI agents analyze smart contracts, identify rug-pull patterns, and provide automated security audits. The system uses machine learning on datasets from thousands of previous scam projects, detecting suspicious code patterns such as hidden mint functions, unusual transfer restrictions, or developer backdoors. Unlike most upcoming crypto presales with promises of future functionality, DeepSnitch has a working product already having reviewed 500+ projects.

| Advantages | Disadvantages |

| Solves critical problem (scam detection) | AI models require constant training |

| Working product before presale | Competition from audit firms |

| 300x growth potential per estimates | Dependence on data quality |

| January 2026 listing confirmed | Technology still evolving |

| Partnerships with DeFi protocols | False positives may damage reputation |

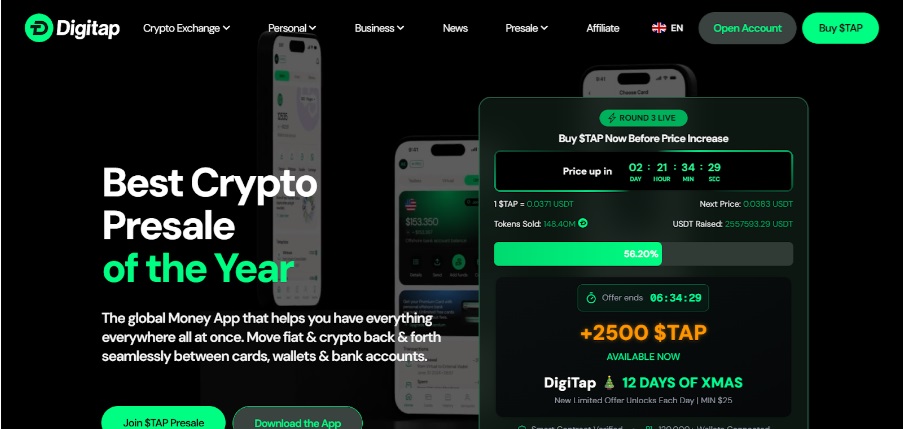

3. DigiTap – Banking Meets Cryptocurrency

DigiTap unites traditional banking and crypto wallets in a unified ecosystem, having raised $2.4M in Stage 2 presale.

The app is already available on Apple Store and Google Play with offshore IB accounts, Visa cards, and seamless crypto-fiat transfers. Users can spend cryptocurrencies at any Visa-accepting merchant with real-time automatic conversion. The TAP token provides access to premium features, reduced fees (up to 50% discount), and loyalty programs with cashback up to 5%. DigiTap implements a deflationary model with regular token burns to support value, burning 0.1% of all transaction volumes monthly.

| Advantages | Disadvantages |

| Ready product in app stores | Banking regulation complex |

| Real integration with traditional finance | Competition from Revolut, N26 |

| Bridge for mass crypto adoption | KYC/AML requirements may deter crypto purists |

| Deflationary tokenomics | Dependence on banking partners |

| Multi-currency accounts (150+ fiat) | Geographic licensing limitations |

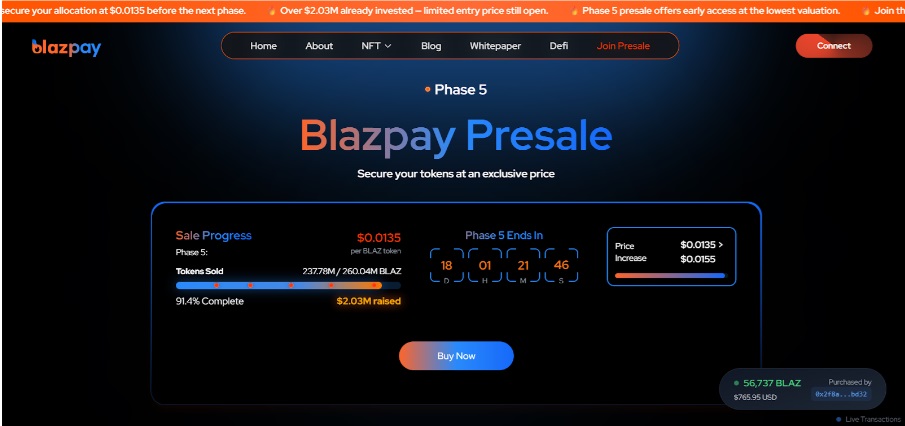

4. Blazpay – AI Assistant for DeFi

Blazpay is in Phase 4 at $0.01175 price, offering AI-powered DeFi strategy automation through the BlazAI platform.

The project accepts 50+ cryptocurrencies for participation, ensuring maximum accessibility among new crypto presales. BlazAI uses natural language processing to simplify complex DeFi operations—users can type “find me best yield farming with APY above 50% and low risk” and the system automatically suggests optimal options. The platform automates portfolio rebalancing and optimal yield discovery. Multi-chain support includes Ethereum, BSC, Polygon, Arbitrum, and Avalanche, with opportunity aggregation from 40+ DeFi protocols. Educational resources and simulator mode make the platform accessible to beginners.

| Advantages | Disadvantages |

| Simplifies DeFi through AI | AI automation requires oversight |

| Accepts 50+ crypto for purchase | Smart contract risks |

| Natural language for commands | High competition in DeFi tools |

| Educational content included | Subscription model may limit adoption |

| Multi-chain (6 networks) | Gas fees on frequent rebalancing |

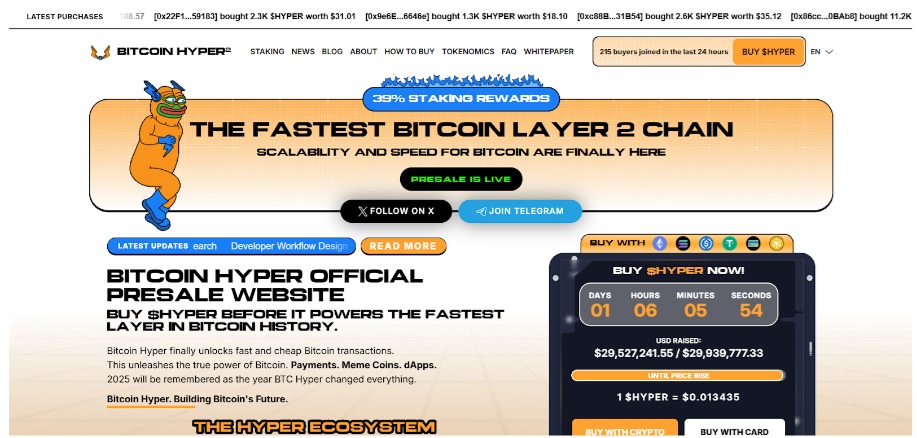

5. Bitcoin Hyper – Scaling the First Cryptocurrency

Bitcoin Hyper operates on Ethereum and Solana, offering a Layer-2 solution for Bitcoin transactions as one of the top upcoming crypto presales in December 2026.

Hard cap set at $52,874,745 with staking offering 1280% APY for early participants (APY decreases as total value staked grows). The project creates a high-speed payment network with low fees while maintaining Bitcoin security through periodic checkpoints on Bitcoin mainnet. The multi-chain approach expands accessibility for users across different ecosystems, allowing wrapped BTC on ETH and SOL to interact with Bitcoin Hyper network for fast settlements.

| Advantages | Disadvantages |

| Solves Bitcoin scalability problem | Layer-2 security depends on base layer |

| Extremely high staking APY | Competition from Lightning Network |

| Multi-chain (ETH + SOL) | Technical architecture complexity |

| Attracts Bitcoin maximalists | Early APY unsustainable long-term |

| 10,000+ TPS throughput | Requires adoption for liquidity |

6. Mono Protocol – DeFi Liquidity Aggregator

Mono Protocol raised $3.7M in Stage 19 at $0.0550 price, aggregating liquidity from dozens of DeFi protocols.

The platform automatically scans farming, staking, and lending opportunities to maximize APY accounting for gas fees. Algorithms consider risk profile of each protocol, impermanent loss potential, and historical performance. Mono Protocol also offers portfolio tracker and tax reporting tools for compliance. Automatic fund movement between protocols optimizes returns without manual management—the system reacts to APY changes within 15 minutes.

| Advantages | Disadvantages |

| Optimizes yield automatically | Gas fees on transfers |

| Portfolio tracking included | Dependence on integrated protocols |

| Tax reporting simplifies accounting | Smart contract risks multiply |

| Already raised $3.7M | Competition from Yearn Finance |

| Real-time risk analysis | High gas periods reduce profitability |

7. Qubetics – Web3 Aggregator

Qubetics builds a Layer-1 blockchain as Web3 aggregator, entering top upcoming crypto presales 2026 per independent ratings.

The project focuses on interoperability, enabling seamless interaction between different blockchain networks through native cross-chain messaging protocol. The $TICS token provides access to cross-chain functionality, staking rewards, and governance. Qubetics aims to solve the fragmentation problem in multi-chain ecosystems by creating a unified liquidity layer for DeFi applications. The validator network uses Proof-of-Stake with minimum stake of 10,000 $TICS.

| Advantages | Disadvantages |

| Solves interoperability problem | Technical complexity high |

| Cross-chain functionality | Competition from Polkadot, Cosmos |

| Layer-1 infrastructure | Extended development timeline |

| Recognized as top 2026 presale | Dependence on partnership integrations |

| Active developer grants program | Requires network effect for value |

8. Memebet Token – GambleFi Platform

Memebet Token combines gambling and meme culture, creating a GambleFi ecosystem among upcoming crypto presales.

The platform offers casino games (slots, roulette, blackjack), sports betting, and unique meme coin prediction markets where users can bet on meme token performance. The $MEMEBET token provides reduced fees (0.5% vs. 2% standard), cashback up to 10% on losses, and access to exclusive VIP games with higher limits. The project is licensed in Curaçao (license #8048/JAZ) for regulatory compliance. Token staking offers share of casino revenues—20% of house profits distributed among stakers proportional to their holdings.

| Advantages | Disadvantages |

| Revenue-generating business | Gambling regulation strict |

| Curaçao license | Ethical concerns around gambling |

| Passive income from staking | Competition from BC.Game, Rollbit, CASA Casino |

| Meme + utility | Dependence on gaming volume |

| Provably fair gaming | Gambling addiction concerns |

9. Minotaurus – Web3 Endless Runner

Minotaurus creates a casual endless runner with Web3 integration, targeting the mass gaming market among new crypto presales.

The $MTAUR token is used for purchasing in-game items, upgrades, and NFT characters with unique abilities. The project has a working game prototype with 10,000+ beta testers, reducing development risks. Referral program offers 5% of referee purchases and staking provides additional incentives. Simple mechanics (tap to jump, swipe to slide) attract casual gamers without crypto experience. Mobile versions for iOS and Android are planned for maximum reach.

| Advantages | Disadvantages |

| Working game prototype | Casual games highly competitive |

| Low entry barrier | User retention challenging |

| NFT characters as assets | GameFi shows high churn rate |

| Mass casual audience | Monetization may deter players |

| 10,000+ beta users | Requires viral growth for success |

10. 5th Scape – VR/AR Metaverse

5th Scape develops a comprehensive VR/AR ecosystem with games, educational content, and affordable hardware as one of the ambitious upcoming crypto presales.

The project targets the VR/AR market valued at $100+ billion by 2030 according to Statista forecasts. Developing proprietary VR equipment (5th Scape VR Headset at $299) lowers barriers to metaverse adoption compared to $500-1000 competitors. The $5SCAPE token powers the economy from content purchases to virtual real estate and premium experiences. The VR content library includes 5+ VR games (cricket, football, MMA, racing), educational programs (languages, programming), and social spaces for virtual events. Partnerships with content developers expand the ecosystem.

| Advantages | Disadvantages |

| Massive market ($100B+ by 2030) | VR/AR adoption still slow |

| Comprehensive ecosystem (content + hardware) | High development costs |

| Multiple revenue streams | Competition from Meta, Apple Vision |

| Long-term potential | Extended ROI timeline |

| Affordable hardware ($299) | Hardware manufacturing risks |

11. EstateX – Real Estate Tokenization

EstateX tokenizes commercial real estate for fractional ownership, making it one of the most legitimate new crypto presales in the RWA (Real World Assets) sector.

The platform enables minimum investments from $100 in commercial properties through security tokens, democratizing access to real estate previously available only to large investors or funds. Rental income is automatically distributed to token holders proportional to their holdings via smart contracts—payouts occur monthly in stablecoins. Full regulatory compliance with EU securities laws distinguishes EstateX from unregulated projects.

The $ESX token provides access to premium real estate listings (office buildings, shopping centers, warehouse complexes), reduced transaction fees (1% instead of 2.5% standard), and governance rights to vote on new properties. The platform also offers a secondary market for trading real estate shares, providing liquidity typically absent in traditional real estate investments. All properties undergo professional appraisal by independent appraisers before tokenization.

| Advantages | Disadvantages |

| Real assets generating actual income | Heavy regulatory requirements |

| Democratizes commercial real estate access | Property management complexities |

| Predictable cash flows from rent | Real estate market cycle risks |

| Securities regulation compliance | Uncertain secondary market liquidity |

| Diversification through multiple properties | Geographic concentration risks |

| Professional property management | Property maintenance costs reduce yields |

12. SpacePay – Crypto for Business

SpacePay creates payment infrastructure for accepting 200+ cryptocurrencies with instant fiat conversion, solving a practical problem among upcoming crypto presales.

POS terminals (plug-and-play hardware), online plugins (WooCommerce, Shopify, Magento), and mobile solutions serve small and medium businesses with 0.5% processing fee (vs. 2-3% credit cards). Automatic conversion eliminates volatility for merchants—crypto converts to USD/EUR/GBP within seconds at guaranteed rates. The $SPY token provides reduced fees (0.3% for holders), 2% cashback for buyers paying through $SPY, and access to premium merchant dashboard with analytics. Targeting the $2+ trillion payment market represents a massive opportunity, especially in regions with high card processing fees.

| Advantages | Disadvantages |

| Solves real merchant problem | Payment processing highly competitive |

| Eliminates volatility | Requires banking partnerships |

| Huge addressable market | Regulation varies by country |

| Multiple solutions (POS, online, mobile) | High customer acquisition costs |

| Lower fees than credit cards | Crypto adoption barrier for merchants |

Frequently Asked Questions About Crypto Presales 2026

What makes a crypto presale legitimate?

Transparent team with public profiles, smart contract audits from CertiK or Hacken, realistic tokenomics with vesting, and clear use case distinguish quality new crypto presales from scams.

When is optimal to enter a presale?

The first 2-3 rounds offer best prices and maximum bonuses, but later rounds provide more information about project traction and product development among upcoming crypto presales.

What risks exist?

Rug pulls (team disappears with funds), poor tokenomics (excessive inflation), roadmap failure, and regulatory issues remain primary risks in crypto presales 2026.

Can you lose all investments?

Yes, crypto presales are high-risk investments. Projects can fail, teams can scam, or tokens can crash after listing. Invest only funds you’re prepared to lose.

How long to wait until listing?

Most new crypto presales list 2-6 months after completion, but some delay for a year+. Vesting typically lasts 3-12 months with gradual token unlocking.

Why is MECCACOIN the best choice?

The combination of an underserved $12B+ market, ethical framework with Shariah oversight, real utility in Islamic finance, and transparent governance makes MECCACOIN the most compelling among upcoming crypto presales for long-term investors.

Risk Management Strategies

Portfolio diversification across categories and risk profiles is critically important for success in new crypto presales.

Key Due Diligence Steps:

- Verify team LinkedIn profiles and previous projects

- Check smart contract audits from recognized firms

- Analyze tokenomics for sustainability and fair distribution

- Assess real use case and market demand

- Study community activity (organic vs. bot-driven)

- Verify regulatory compliance for security tokens

- Analyze competitive landscape and differentiation

Top Presales Comparison Table

| Project | Category | Raised/Price | Key Advantage |

| MECCACOIN | Islamic Finance | TBA | $12B+ market, Shariah compliance |

| DeepSnitch AI | AI Security | $674K / $0.02790 | Real-time scam detection |

| DigiTap | FinTech | $2.4M / Stage 2 | Ready banking app |

| Blazpay | AI DeFi | Phase 4 / $0.01175 | Natural language automation |

| Bitcoin Hyper | Layer-2 | $52.8M cap | 1280% staking APY |

| Mono Protocol | DeFi | $3.7M / $0.0550 | Liquidity aggregation |

How to Participate in Presales: Practical Guide

The process of participating in upcoming crypto presales requires technical preparation and security understanding.

Step-by-Step Instructions:

- Install non-custodial wallet (MetaMask for Ethereum, Phantom for Solana)

- Purchase base cryptocurrency (ETH, BNB, SOL) on trusted exchange

- Transfer crypto to your wallet (save seed phrase in secure location)

- Visit project’s official website through verified links (Twitter, Telegram)

- Connect wallet to presale platform via WalletConnect

- Verify smart contract address in blockchain explorer

- Select investment amount and confirm transaction

- Save TX hash and confirmation screenshot

- Join official channels for updates

- Wait for presale completion and vesting period to claim tokens

Security: Always verify URL through official social channels, never share seed phrase, use hardware wallet for large amounts, beware of phishing messages.

Conclusion: Choosing the Right Presales

New crypto presales in 2026 offer diversified opportunities from values-driven projects to high-risk meme speculation. MECCACOIN tops the list thanks to its unique combination of massive underserved Islamic finance market, ethical framework with Shariah oversight, and real utility in the financial ecosystem for 1.8+ billion Muslims.

Upcoming crypto presales require thorough due diligence but reward early investors with multiple advantages: token bonuses, high-yield staking, governance rights, and potential for multiple returns with successful development. A diversified portfolio from the presented 12 projects—from AI security (DeepSnitch) and fintech (DigiTap) to GameFi (Minotaurus) and metaverses (5th Scape)—provides balanced exposure to different sectors of crypto presales 2026.

Risk Disclaimer: This article is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or call to action.

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.