Bitcoin’s sharp 20% pullback this week has pushed many investors to reassess where the next major crypto opportunity may come from. Large-caps often slow down after big runs, and it’s usually during these cooling phases that early buyers start searching for alternatives with stronger upside potential. One fast-moving DeFi token priced at $0.035 has now entered that conversation, with its demand growing so quickly that its allocation is close to selling out.

Bitcoin (BTC)

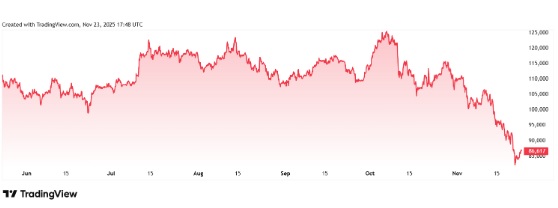

Bitcoin is still the market’s benchmark, but its recent behavior has raised concerns. BTC trades near $86,000, supported by a market cap around $1.7 trillion, yet strength hasn’t returned after the recent drop. Analysts point to heavy resistance zones around $95,700–$100,200, which have repeatedly rejected recoveries. Until BTC clears those levels, many believe sideways trading or another dip remains possible.

Long-term optimism around Bitcoin is common, but short-term projections aren’t as attractive. Some analysts expect only a modest 5–10% rebound in the near term unless a major catalyst appears. With large-caps moving slower and volatility cooling down, investors looking for meaningful crypto investment opportunities are now scanning mid-caps and early-stage tokens for higher upside.

Mutuum Finance (MUTM)

In contrast to Bitcoin’s slower pace, Mutuum Finance (MUTM) continues to attract significant early interest. The project is building a decentralized lending and borrowing platform designed around a dual-model system, allowing users to earn yield through mtTokens and open collateralized loan positions through smart contracts. It aims to offer a more efficient and transparent approach to borrowing and lending by removing intermediaries and automating risk management.

Mutuum Finance recently shared on its official X account that its V1 protocol is entering the final development stage, with a Sepolia testnet launch scheduled for Q4 2025. The first version includes the liquidity pool, mtTokens for yield, a debt-tracking token and the liquidator bot. ETH and USDT will be the initial supported assets. Investors see this as a key milestone, especially since the code is under formal analysis by Halborn Security.

Rapid Token Allocation Drive Early Buyer Interest

While BTC slows down, the MUTM presale remains one of the busiest of the year. The project has already crossed $18.85 million raised and attracted 18,100 holders, with 805 million tokens sold out of the total allocation. The current token price is $0.035, representing a 250% increase from the Phase 1 price of $0.01.

Phase 6 is now nearing a full sellout, with allocation levels moving rapidly as demand increases. According to early investors, part of this momentum comes from clear mathematics: with a confirmed $0.06 launch price, buyers entering at $0.035 stand to benefit from a strong upside once the token goes live. Some analysts even suggest that early buyers could see 200–300% growth once exchange listings push visibility higher.

The presale also includes features that keep activity high. The 24-hour leaderboard rewards the top contributor of the day with $500 in MUTM, creating consistent competition. At the same time, card payments with no purchase limits are now enabled, making entries smoother for new participants.

Oracle Infrastructure and Security Layers

What makes Mutuum Finance stand out to many analysts is the depth of its upcoming infrastructure. The team plans to launch a USD-pegged stablecoin tied to on-platform borrowing, designed so that interest generated flows into the protocol treasury. Many consider this an essential element for long-term ecosystem growth, as stablecoins often drive liquidity and user retention.

Oracle systems will also play a key role. Mutuum Finance intends to rely on Chainlink feeds along with fallback and aggregated oracle models. This ensures accurate price data during volatile periods, leading to fairer liquidations and safer borrowing conditions. For a lending protocol, this is crucial.

Security has also been reinforced. The project completed its CertiK audit with a 90/100 Token Scan score, while Halborn’s independent audit is ongoing. In addition, a $50k bug bounty is active for identifying code vulnerabilities, which increases confidence among users participating early.

These fundamentals are especially important when comparing MUTM to meme-coins or high-volatility assets. Investors searching for the best crypto to buy now often gravitate toward tokens with strong utility and a clear product roadmap, and Mutuum Finance fits this narrative.

Why Investors Are Moving Quickly

The combination of BTC’s slower momentum and Mutuum Finance’s accelerating demand is shaping a clear sentiment shift. Many investors who previously focused on large-caps are now rotating into smaller, utility-driven tokens ahead of potential market recovery. With Phase 6 nearly sold out, the remaining allocation is shrinking rapidly, and whales have reportedly begun accumulating larger positions at this stage.

In a market where timing can dramatically influence returns, the early window for MUTM is closing fast. With V1 development progressing, stablecoin plans in motion, a strong audit record and a fast-moving presale, many analysts believe MUTM could become one of the top cryptocurrencies to watch going into Q1 2026.

If the current buying pace continues, Phase 6 could reach 100% allocation sooner than expected — making now one of the final opportunities for early-stage entry before the token edges closer to its launch price.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.