The crypto market is buzzing as Binance Coin (BNB) surges past the psychological $1,000 milestone, an achievement that signals renewed strength in the sector. Yet for many retail investors, BNB’s lofty valuation feels out of reach. Buying a single unit already requires a four-figure commitment, limiting accumulation for smaller portfolios. This reality is turning attention toward Mutuum Finance (MUTM), a DeFi project still in presale at just $0.035 and increasingly seen as a low-entry, high-upside opportunity.

BNB’s $1,000 Milestone

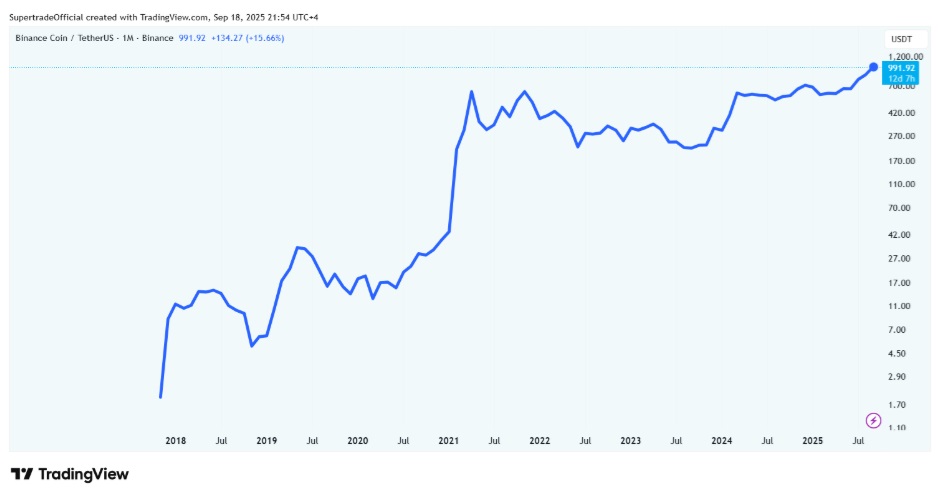

Binance Coin (BNB) achieved a historic milestone by surpassing $1,000 for the first time on September 18, 2025, trading at approximately $1,012 amid widespread market euphoria. This breakthrough, marking a 191% yearly gain from its starting price of around $350 in January 2025, propelled BNB’s market cap above $145 billion, solidifying its position as the fifth-largest cryptocurrency. The surge was catalyzed by the BNB Chain’s Maxwell upgrade, which reduced transaction costs by 20% and boosted daily transactions to over 4 million, alongside institutional inflows including a $108 million purchase and a $500 million treasury allocation by key players.

Technical indicators show BNB breaking through $962 resistance, with RSI at 72 indicating overbought conditions but strong momentum, support at $950, and potential resistance at $1,100. Social media buzz reflects investor excitement over Binance’s regulatory progress and DeFi TVL surge to $7.8 billion, though macro pressures like U.S. tariffs could trigger pullbacks. Analysts project a $1,200 target if $1,050 holds, but a drop below $950 risks $900.

Mutuum Finance (MUTM): A More Accessible DeFi Model Built for Long-Term Growth

What separates Mutuum Finance (MUTM) from high-priced alternatives is not just the entry point but its ecosystem design. The platform will operate two distinct lending frameworks: peer-to-contract (P2C) pools and peer-to-peer (P2P) arrangements. P2C pools will cover established tokens like ETH, BTC, SOL, and stablecoins, providing predictable liquidity for borrowers. P2P will allow isolated agreements for riskier tokens, protecting the system from instability while still rewarding lenders willing to engage in higher-yield contracts.

Users who supply liquidity will receive mtTokens representing their deposit share. These mtTokens can be staked for MUTM rewards or even used as collateral themselves, adding a second layer of utility. Revenues generated from borrowing activity will fund ongoing MUTM buybacks, with the acquired tokens redistributed directly to mtToken stakers. This creates a continuous cycle where platform growth directly benefits active participants.

In comparison to large-cap assets, this model positions MUTM as a platform where everyday investors can engage meaningfully without requiring the scale of capital that accumulating BNB now demands. For those looking at crypto investment through the lens of accessibility, this dual-revenue model stands out as a forward-thinking approach that strengthens user incentives over time.

Why Analysts Are Targeting 300% Gains for MUTM

The presale momentum further validates interest. Mutuum Finance (MUTM) is now in Phase 6, having already generated $16 million with more than 16,450 holders onboard. At the current $0.035 price, nearly half of this stage’s allocation is already sold. Once Phase 7 begins, the cost per token will rise to $0.040 — a 15% increase overnight. Hesitation simply means paying more later, which is why analysts are encouraging early positioning before the remaining stages close.

When projecting returns, the framework is equally compelling. At today’s price, reaching $0.14 by 2026 would deliver a 300% return on entry. For context, an investment of $3,500 at this presale rate secures 100,000 MUTM tokens, translating into $14,000 at the targeted exchange valuation. Unlike BNB, which required years to scale and now delivers slower multiples due to its size, MUTM benefits from its smaller starting point and expanding roadmap.

That roadmap includes a testnet demo launch, full exchange listings, multi-chain expansion, and institutional partnerships, all of which are designed to strengthen adoption. Unlike passively holding a crypto ETF, investing in crypto through a token like MUTM means exposure to both the growth of decentralized lending activity and the revenue cycle that redistributes value to its participants.

Security and community trust also anchor the project’s credibility. A CertiK audit has already reviewed its framework, supported by a $50,000 bug bounty program that rewards ethical disclosures up to $2,000 for critical findings. Alongside this, Mutuum Finance (MUTM) is running a $100,000 giveaway that further builds engagement across its growing community of more than 12,000 Twitter followers. These safeguards and initiatives show a clear commitment to transparency and long-term viability.

For investors who missed earlier waves in projects like BNB, the story of Mutuum Finance (MUTM) offers a rare opportunity to start from the ground floor. With a presale price of just $0.035, a clear utility framework, and strong safeguards in place, it represents a project aligned with where the next cycle of investing in crypto is heading. By 2026, the expectation of 300% returns does not appear speculative but firmly rooted in the way the ecosystem has been structured.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

Disclaimer: This is a sponsored press release for informational purposes only. It does not reflect the views of Times Tabloid, nor is it intended to be used as legal, tax, investment, or financial advice. Times Tabloid is not responsible for any financial losses.