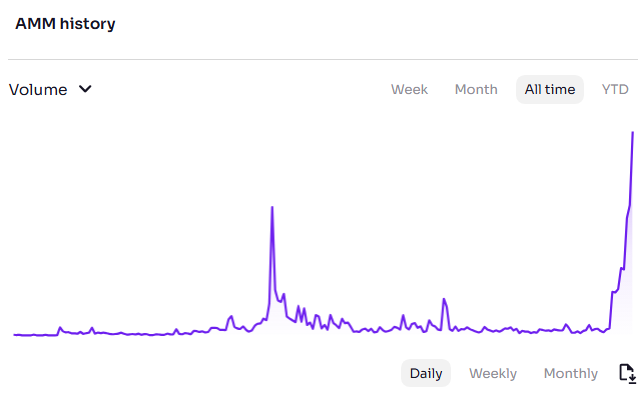

The automated market maker (AMM) on the XRP Ledger (XRPL) has experienced a surge in daily transaction volumes, which now exceed levels seen just a week ago by 40x.

This rapid growth signals a significant increase in activity, with many attributing this to new liquidity and trading opportunities introduced by the AMM feature on XRPL.

Crypto analyst Blockchain Backer (@BCBacker), an influential figure in the cryptocurrency community, highlighted this trend, noting the sharp spike in AMM volumes.

Ripple’s Automated Market Market

The AMM launched as part of Ripple’s XRPL and is designed to enable decentralized, permissionless trading, allowing users to provide liquidity for various assets on the network. This functionality appears to be attracting substantial interest from both retail and institutional users.

Before its launch, Ripple’s Chief Technology Officer (CTO) David Schwartz revealed that he was personally excited about its launch, and since then, the XRPL has seen a marked uptick in AMM-related transactions and overall DEX (decentralized exchange) activity.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Increased Activity on the XRPL

A recent report from CryptoQuant indicates that XRPL’s DEX volume alone has risen by approximately 17.6% over the past month, further reflecting heightened user engagement across the platform.

The XRPL also saw a 62.35% increase in AMMDeposit activity, while AMMCreate spiked by 143.10%, reflecting a notable rise in liquidity contributions from users. Governance engagement also increased, with AMMVote activity up by 65.22%.

The increase in AMM volume reflects broader trends within the XRPL ecosystem, as more users and liquidity providers engage with the new tools offered by Ripple’s blockchain.

Despite some declines in total transaction volume and payments, the rise in DEX and AMM volumes highlights a shift in how users interact with the platform, favoring decentralized trading and liquidity pools over traditional payments.

This surge in volume might be linked to several factors, including the AMM’s ability to accommodate various trading strategies and incentivize liquidity provision through yield-earning opportunities. The increased liquidity and flexibility of the XRPL AMM could attract more participants, particularly those seeking decentralized alternatives to centralized exchanges.

Ripple is also working on other significant projects like the upcoming RLUSD stablecoin, and the success of the AMM could be a sign that the company is on the right track and provides quality services to the crypto community.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News