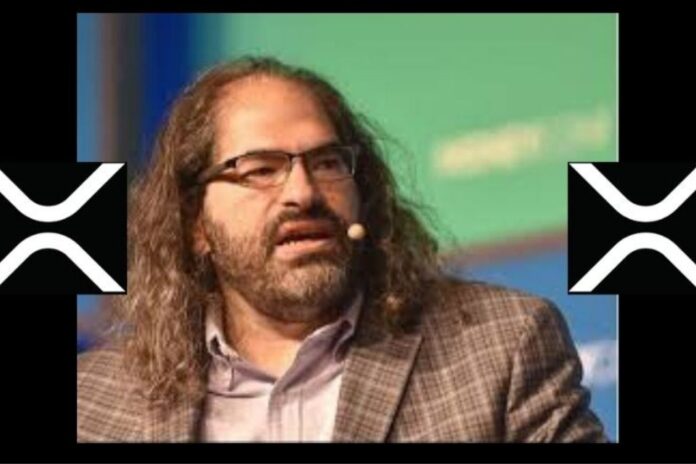

David Schwartz, Chief Technology Officer (CTO) of Ripple, recently illustrated the practical utility of XRP in cross-border payments in a video shared on X by the pseudonymous researcher XRP Daily (@XRPXLMVERSE).

Schwartz’s example sheds light on how XRP facilitates remittance payments from the United States to Mexico, transforming the traditional remittance landscape.

Schwartz gave an example where a customer in the United States wanted to send funds to a relative in Mexico. Typically, this process involves intermediaries, significant delays, and high fees.

However, by leveraging XRP, the process becomes remarkably streamlined. The customer can purchase XRP on a U.S. exchange, transfer it via the XRP Ledger to a Mexican exchange, and convert it to Mexican pesos. This entire transaction can be completed in approximately 60 to 80 seconds, dramatically reducing the time and cost.

This rapid transaction capability of XRP offers a corridor for payments that is always open and circumvents the restrictions of traditional banking hours and holidays. This ensures that the transfer can take place at any time, providing unparalleled flexibility for users.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

What About XRP’s Volatility?

A common concern with digital assets is their inherent volatility. However, Schwartz pointed out that the brief holding period of XRP, typically no more than 80 seconds, mitigates this risk.

Schwartz explained, “If you think about the volatility of XRP over 80 seconds and you compare it to like holding Mexican pesos through the weekend, even though XRP is more volatile than Mexican pesos, XRP in two minutes is not more volatile than Mexican pesos over a holiday weekend.”

Its speed makes it a viable option for remittances, and the digital asset is already being used by companies like SBI Holdings for remittance.

Another significant benefit of using XRP is the reduction in the need for pre-funding. Traditional cross-border payments often require institutions to maintain reserves of various currencies in different locations, which ties up capital inefficiently.

Schwartz emphasized that with XRP, financial institutions can hold their funds in a single currency, such as U.S. dollars, and convert them to the required foreign currency on demand.

“You can have them in less than a minute, anytime, day or night, holiday,” he noted. This flexibility reduces cost and enhances liquidity management for businesses.

Furthermore, Ripple’s strategy extends beyond just payment facilitation. By integrating XRP into their systems, institutions gain access to a suite of decentralized finance (DeFi) products and services.

These include lending products, real-world asset tokenization, and other financial innovations that are poised to meet future regulatory standards. Schwartz referred to this as a “distribution channel for enterprise DeFi.”

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News