The collaboration between SWIFT and R3 has garnered significant attention within the blockchain and cryptocurrency communities, particularly due to its potential implications for the digital token XRP.

A recent tweet by a cryptocurrency enthusiast, XRP Avengers, highlighted a proof of concept involving SWIFT’s global payments innovation (gpi) and R3’s distributed ledger technology (DLT) platform Corda, in which XRP could play a role as a settlement option.

This development has reignited discussions surrounding the potential adoption of digital assets like XRP within traditional financial infrastructures.

SWIFT and R3 Collaboration Overview

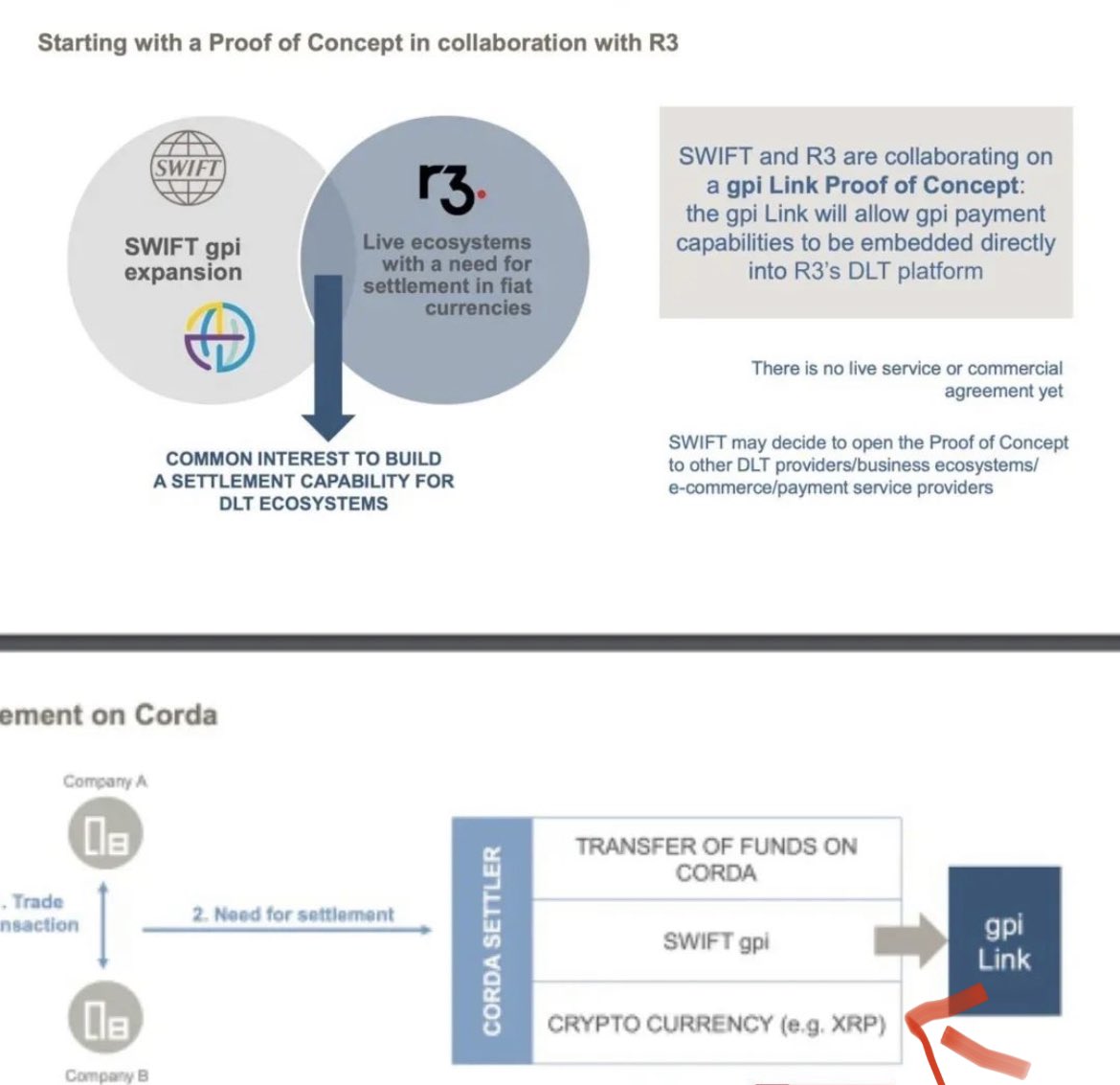

According to the images shared in the tweet, SWIFT, a well-established leader in financial messaging and cross-border payment systems, is working with R3, a blockchain consortium, to explore new settlement capabilities.

The partnership aims to integrate SWIFT’s gpi into R3’s Corda platform, a distributed ledger technology primarily used by financial institutions. This integration is part of a broader proof of concept intended to create a more efficient settlement layer for DLT-based ecosystems.

The focus of the collaboration is to enable the SWIFT gpi to function directly within R3’s Corda platform, allowing for cross-border transactions that settle in fiat currencies. This represents an important step towards improving interoperability between traditional financial systems and blockchain networks.

The images indicate that both organizations share a common interest in building settlement capabilities for DLT ecosystems, however, it is noted that the proof of concept is not yet a commercialized service.

XRP’s Potential Role

A key point that has captured attention is the potential use of XRP as a settlement asset in this system. XRP is highlighted in the images as a possible currency for the Corda settler, the mechanism by which funds would be transferred.

Specifically, the diagram shows the option to settle transactions through SWIFT gpi or cryptocurrencies, with XRP explicitly mentioned as an example. This suggests that XRP could be used as an intermediary to facilitate liquidity between different fiat currencies on the Corda platform.

The mention of XRP in this context is significant for several reasons. First, it validates the potential for digital assets to play a meaningful role in cross-border payments, particularly in conjunction with established financial networks.

Second, it brings the token to the forefront of discussions regarding the institutional adoption of cryptocurrencies, which has been a topic of speculation for years. For the XRP community, this is seen as a positive signal, as it represents potential mainstream usage of the digital asset in a system that already processes large volumes of transactions globally through SWIFT.

No Commercial Agreement Yet

Despite the excitement surrounding this development, it is important to emphasize that this collaboration is still in its early stages. The images clearly state that there is “no live service or commercial agreement yet.”

SWIFT has indicated that this proof of concept may eventually be opened to other DLT providers and business ecosystems, meaning that the solution could expand beyond just R3 and involve other participants in the future.

This openness reflects a broader trend within the financial services industry toward exploring multiple blockchain solutions in search of the most effective and scalable technologies.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Broader Implications for Cross-Border Payments

The integration of SWIFT’s gpi with DLT platforms like Corda represents a significant step towards enhancing cross-border payment infrastructures. SWIFT gpi already offers faster and more transparent cross-border payments for banks and financial institutions, and adding a DLT-based settlement layer could further improve the efficiency, speed, and cost-effectiveness of these transactions.

XRP, if implemented as part of the solution, could serve as a bridge currency to facilitate faster and less expensive cross-border transfers, leveraging its liquidity and speed to settle transactions in real-time.

For XRP proponents, this development aligns with Ripple’s vision of positioning XRP as a critical asset for global payments, particularly in areas where traditional financial systems are slow or inefficient.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News