Per the latest report from Matrixport, a top crypto trading platform, Bitcoin (BTC) is on the brink of attaining an unprecedented price high as it began its fifth bull market season on June 22, 2023.

The revelation above seemed to elicit surprises among crypto enthusiasts, due to the instability of the crypto market. So, not many people expect a big rally that could push Bitcoin beyond its price all-time high of $69,000.

Nevertheless, the crypto trading platform seemed confident in its observation. Part of the report read, “This bull market officially commenced on June 22, 2023, when Bitcoin reached a new one-year high for the first time in a year.”

Read Also: BitMEX Co-Founder Shares 3 Reasons Why Bitcoin (BTC) Is Rising, Not ETF

Bitcoin Projected To $125,000 – Timeline.

Citing increased adoption rates, Matrixport projected XRP to ascend to a remarkable $125,000, a worth almost doubling the digital asset’s ATH attained in November 2021.

According to the report, Bitcoin’s unique characteristics made it comparable with conventional valued assets like gold and other low-risk assets such as treasury bonds. This makes the token an attractive option for financial institutions that seek diversification.

Driving its point further on BTC’s uniqueness, an extract from the report noted, “It is not a coincidence that Bitcoin is surging at a time when the United States’ debt-to-GDP ratio is reaching unsustainable levels.”

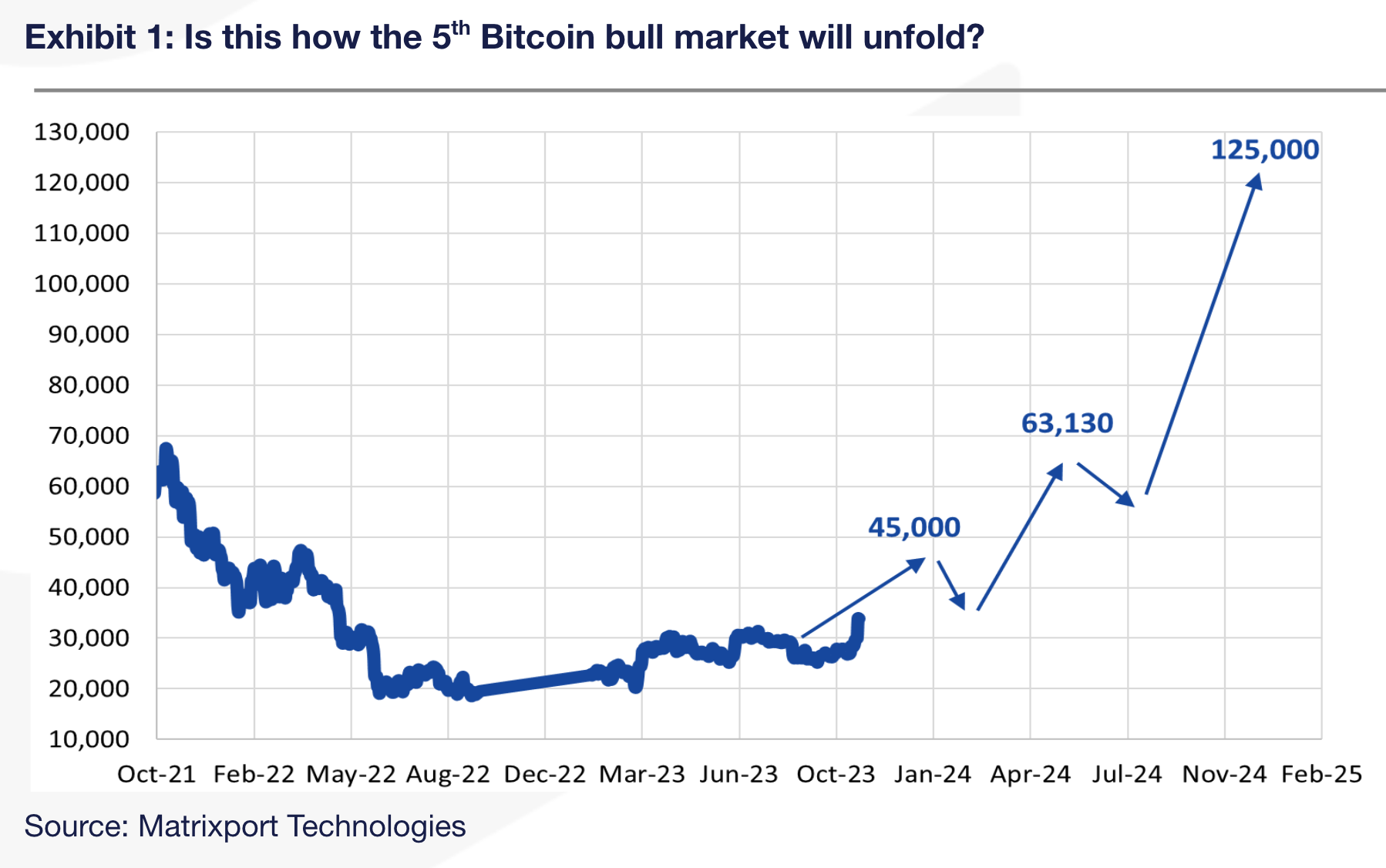

Worthy of mention is the attached chart displaying Bitcoin’s price movement and likely timelines. According to what we could pick from the chart, BTC’s price ascent will be exponential.

The digital asset would first ascend to a $45,000 price level between December 2023 and January 2024, after which it would register a slight decline before gathering momentum for another rally, which would see it achieve a price high of $63,130.

Like the retracement that accompanied the surge to $45,000, BTC is expected to drop slightly again after attaining the $63,130 price mark to muster the momentum that would catapult it to the $125,000 price level between November 2024 and early months of 2025.

Based on the BTC’s current selling price of approximately $34,110, increments to $45,000, $63,130, and $125,000 would imply spikes of about 31.9%, 85.1%, and 266.5%, respectively.

The report suggested a safe period for purchasing Bitcoin to be 14-16 months before the next halving event. The next halving event is expected to play out in April 2024. This implies that October 2022 would have been the best entry point for accumulating BTC. Notably, BTC was changing hands at about $17,000 in October 2022.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Read Also: BitMex Co-founder Says Crypto Holders Are About to See Biggest Bull Market In History. Here’s why

Bitcoin (BTC) Previous Bull Cycles And Their Propellers

According to the report, Bitcoin’s previous rallies were orchestrated by unique drivers, which the trading firm highlighted in the publication. Per the report, BTC’s first rally played out in 2011, elicited by Bitcoin’s emergence as a reliable payment option as of then.

The second bull season was evoked by China, following Bitcoin’s recognition as a money analogue. BTC’s third rally came about in the wake of rising initial coin offerings (ICOs) as a means of funding companies and establishments.

Finally, the fourth bull season was due to the crypto space trends such as DeFi summer and the Non-Fungible-Tokens (NFT) minting.

While the predictions above remain to be seen in the future, crypto enthusiasts are encouraged to take the predictions half-heartedly. The place for research in crypto investments remains crucial.

Follow us on Twitter, Facebook, Telegram, and Google News