With Bitcoin (BTC) remaining relatively stuck below the psychologically crucial $30,000 resistance level, the bearish trend might persist longer than expected as BTC has been projected to decline further in the coming weeks.

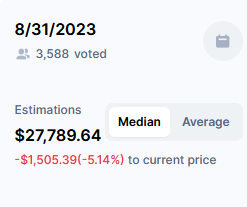

Per votes collated from the CoinMarketCap community, a dedicated crypto authority platform, BTC might plunge to at least $27,789. Should the community’s price projection stand, it implies that Bitcoin will drop by about 6% from its current selling price.

For the past six months, the mean historical accuracy from the community, especially regarding BTC price predictions, has amounted to 84.46%, a percentage well above several other price prediction tools and platforms renowned for consulting insights from Artificial Intelligence (AI) algorithms.

Analyzing BTC’s Price Movements And Market Indices

According to Bitcoin’s data on CoinGecko, the Decentralized Finance (DeFi) asset, as of the time of compiling this news article, was selling for $29,287.40. BTC is up by 0.3%, with a market cap valued at an estimated 569 Billion from a circulating supply of 19,442,262.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Despite the prices and indices described above, showing all shades of a bearish market, Bitcoin’s real-time Technical Analysis (TA) gauges seem to indicate otherwise. Notably, the one-month summary of these gauges read “buy signal” at 9, based on moving averages (MA), pointing at a “strong buy” at 8 and oscillators in the “neutral” at 9.

Meanwhile, based on Bitcoin’s historical data, the digital asset could be set for tough times ahead, especially as we approach the third quarter of 2023; this has been a regular pattern in BTC’s price movement and might as well corroborate the CoinCapMarket community assertions on BTC’s price trends.

Finally, this should not serve as an investment but rather a guide that could be incorporated while contemplating investment options.

Follow us on Twitter, Facebook, Telegram, and Google News