The latest documents released in the ongoing lawsuit involving Ripple and the United States Securities and Exchange Commission (SEC) have caused a commotion in the crypto community, resulting in a clarifying response from the CTO David Schwartz.

Per the released court documents, Ripple is said to have entered into six partnerships with different trading platforms to get XRP listed. The document also showed that the San Francisco-based blockchain company paid the sum of $1 million and $5 million to two popular crypto exchanges based in the United States to list XRP. “In 2017 alone, Ripple entered into six agreements with platforms and also offered two U.S.-based crypto trading platforms $1 million and $5 million, respectively, to list XRP.

Read Also: Ripple Lawyer Moves to Withdraw as Counsel in XRP Lawsuit, But No Cause for Alarm. Here’s why

Furthermore, the unveiled court documents claimed that Ripple targeted the largest US-based exchange Coinbase for years to get XRP listed on the trading platform. According to the report, the cross-border payment engaged in these activities to give XRP more exposure.

The report said, “Ripple targeted one particular U.S.-based trading platform-Coinbase-for years to increase speculative trading volume in XRP, engaged in an online campaign to petition that platform to list XRP. Ripple noted internally that “investors are interested” in exchange listings because “they want to see a price increase by getting XRP more exposed on major exchanges.”

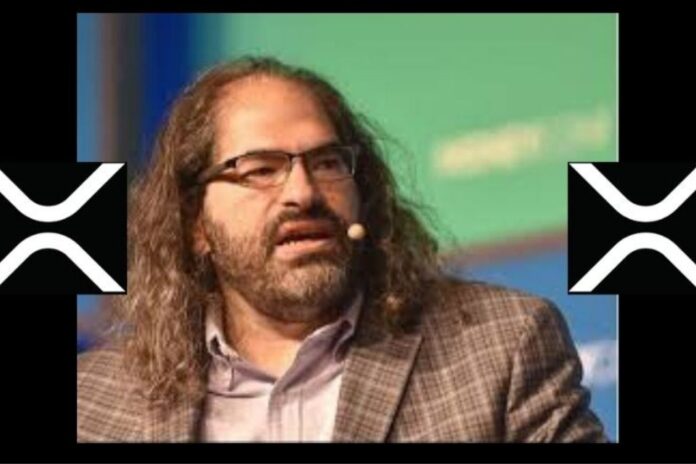

David Schwartz Reacts to Allegations

An anonymous Twitter user “Scam Detective” emphasized these allegations in a thread that prompted a quick response from Schwartz. According to Ripple CTO, the tweet from Scam Detective about Ripple arranging for six exchanges to list XRP, and paying between $1-$5 million in 2017 misrepresents allegations as facts.

This tweet misrepresents allegations as facts https://t.co/twJ1CjUGLq

— David "JoelKatz" Schwartz (@JoelKatz) June 14, 2023

While Schwartz did or did not outrightly say that Ripple made no dollar payments to trading platforms, he stated that the “characterization is an allegation and the facts are complicated.”

Read Also: Ripple CTO and John Deaton Share Views On Coinbase Leveraging Hinman Emails As Public Release Nears

To clarify the issue, Ripple CTO David Schwartz gave an ideal analysis that was not based on facts. According to his hypothetical expression, if Ripple entered into any agreement with a company or made payments to any crypto exchange, it was to advance the company’s On-Demand Liquidity (ODL) services. “Generally, a litigation adversary will put the worst spin that is not inconsistent with the facts in their allegations. Repeating them as if the allegations were facts is not fair,” he remarked.

Let me give you a completely made up hypothetical. It's not based on actual facts, but it's just to give you the idea.

Say there was an exchange that contacted Ripple and demanded $1 million to list XRP. We explain that they have their own business reasons, they refuse.

Then, a…

— David "JoelKatz" Schwartz (@JoelKatz) June 14, 2023

Follow us on Twitter, Facebook, Telegram, and Google News