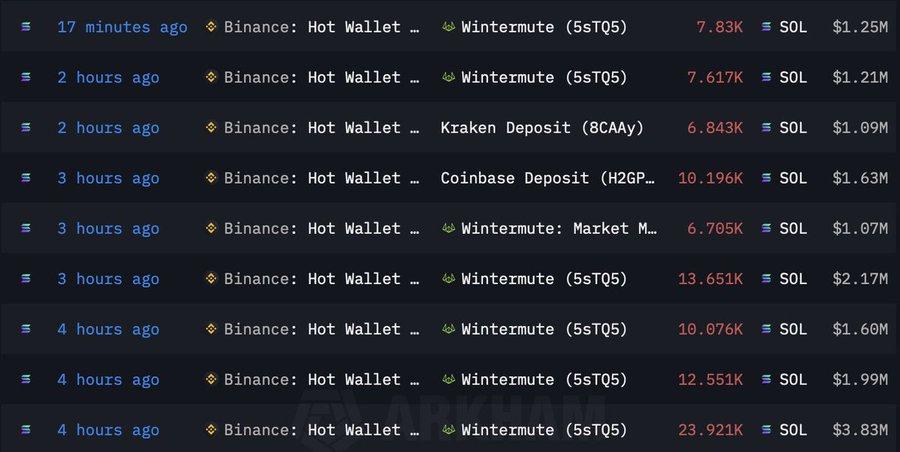

The cryptocurrency market is witnessing heightened speculation with an emerging report that Binance has been offloading significant amounts of Solana (SOL) in the last four hours through market maker Wintermute. This large-scale sell-off has sparked widespread concern among investors and traders, leading to questions about whether Binance possesses insider knowledge of an impending market shift or regulatory development.

The Role of Binance and Wintermute in Market Liquidity

The timing of this sell-off is particularly noteworthy given the broader market conditions. Solana has been one of the standout performers in the altcoin space, recovering strongly from previous downturns and attracting significant institutional interest. However, large transactions by major exchanges like Binance often send signals that influence market sentiment, leading to increased volatility and speculation about the motivations behind such moves.

Wintermute, a well-known market maker is important in maintaining liquidity across various trading platforms. Their involvement in this rapid sell-off suggests a strategic operation rather than an organic market-driven event. When a major entity like Binance engages in high-volume sales, it can indicate a shift in strategy, profit-taking, or even concerns about Solana’s future performance. The lack of an official statement from Binance only adds to the uncertainty, fueling further speculation among market participants.

Possible Reasons Behind Binance’s Massive SOL Sell-Off

One possible reason for Binance’s large-scale SOL dump could be regulatory concerns. Global crypto regulations have been tightening, and Binance has been under increased scrutiny in multiple jurisdictions. If Binance anticipates future restrictions that could influence Solana’s utility or adoption, the exchange might adjust its holdings accordingly.

An alternative explanation suggests that Binance is reallocating its capital to other assets or positioning itself for a significant liquidity influx. Given the exchange’s dominance in the crypto market, such moves are always closely monitored, as they can trigger cascading effects across the entire industry. Additionally, the possibility of internal risk management strategies cannot be ignored, as exchanges frequently rebalance portfolios to optimize operational stability.

Impact on Solana and Market Reactions

Despite the concerns, Solana’s fundamentals remain strong. The network boasts high-speed transactions, growing developer activity, and an expanding DeFi ecosystem. However, if Binance’s sell-off persists, it could lead to short-term price declines, shaking investor confidence. Large dumps often create a ripple effect, prompting smaller holders to sell in panic, which could accelerate downward pressure on SOL’s price.

We are on twitter, follow us to connect with us :- @TimesTabloid1

— TimesTabloid (@TimesTabloid1) July 15, 2023

Market participants will closely watch on-chain data and order book movements to gauge whether this is a temporary event or the beginning of a larger trend. Traders and investors will also look for signs of accumulation by other large players, which could indicate a potential reversal in sentiment.

What Comes Next for SOL Investors?

Without clear communication from Binance, traders should exercise caution and conduct thorough research before making investment decisions. The crypto market is highly reactive to major sell-offs, and understanding the underlying motivations behind such actions is crucial.

Whether Binance’s move is an isolated event or a precursor to broader market movements remains to be seen. It undoubtedly adds another layer of intrigue to the ever-evolving cryptocurrency landscape. As developments unfold, market analysts and investors will continue to assess the implications of this significant sell-off on Solana’s long-term trajectory.

Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are urged to do in-depth research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses.

Follow us on Twitter, Facebook, Telegram, and Google News